Fx’ent is now offering a new set of indicators, which will enable you to access and compare more comprehensive, accurate and consistent data related to your portfolio and exposures.

The values and data associated to these indicators are collected and processed in a single, extremely powerful analysis tool, which allows you to assess your situation either according to personalised templates or through dedicated analysis views focussed on different items.

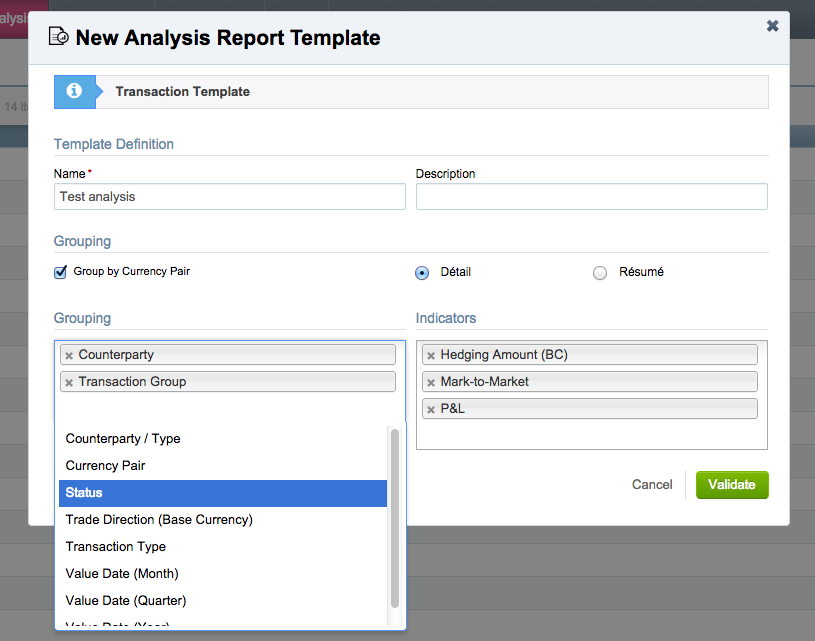

On the one hand, by clicking on the “More” menu, you will be able to create and customise your own analysis report templates either on exposures or traded transactions. For each template, Fx’ent will allow you to set specific grouping patterns (counterparties, transaction types, currency pairs, etc.), and to select all the relevant indicators (available amounts, hedging rate, Mark-to-Market, etc.); you will then be able to apply default and custom filters to determine which data must be taken into account in the analysis.

On the other hand, Fx’ent gives you the opportunity to make use of dedicated analysis views that enable to focus on a particular dimension of your position. For example, the “Commitment by bank” section allows you to assess your committed amounts by bank counterparty: you will just have to choose a view (mapping or pie chart) to access a cross-sectional overview of your commitments, complemented by the detailed breakdowns by bank and currency pair. Moreover, a set of default or custom filters is available to define which transactions you wish to include in the analysis.

What does this new analysis tool bring to your foreign exchange risk management? It enables to centralise and enhance the consistency of data and calculation, since all the indicators are jointly assessed in the same section. This clearly results in improved support to your monitoring activities.