An FX collar in Fairways FX is a security combining the purchase/sale of an FX cap and the sale/purchase of an FX floor to specify a range in which an FX rate can fluctuate.

Log In to Fairways FX

- Log in to your Fairways FX account.

- Select an account.

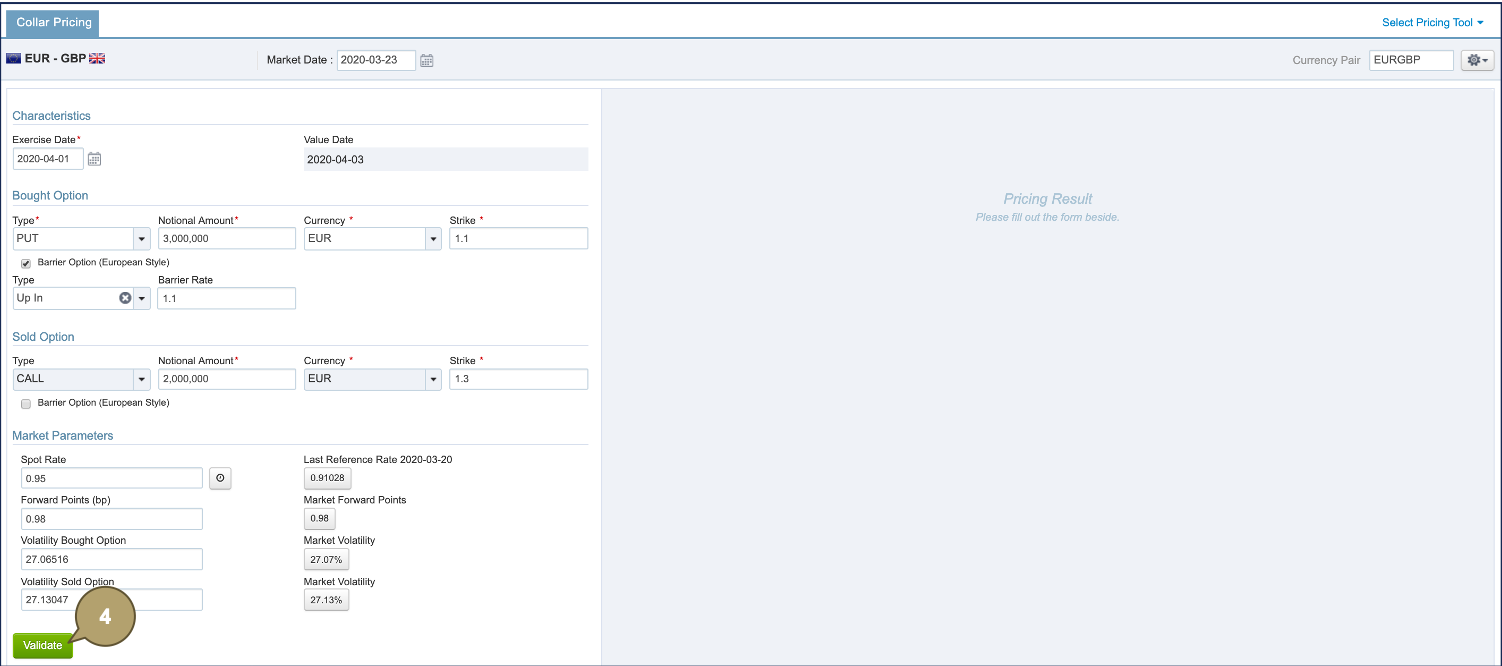

Price a Collar

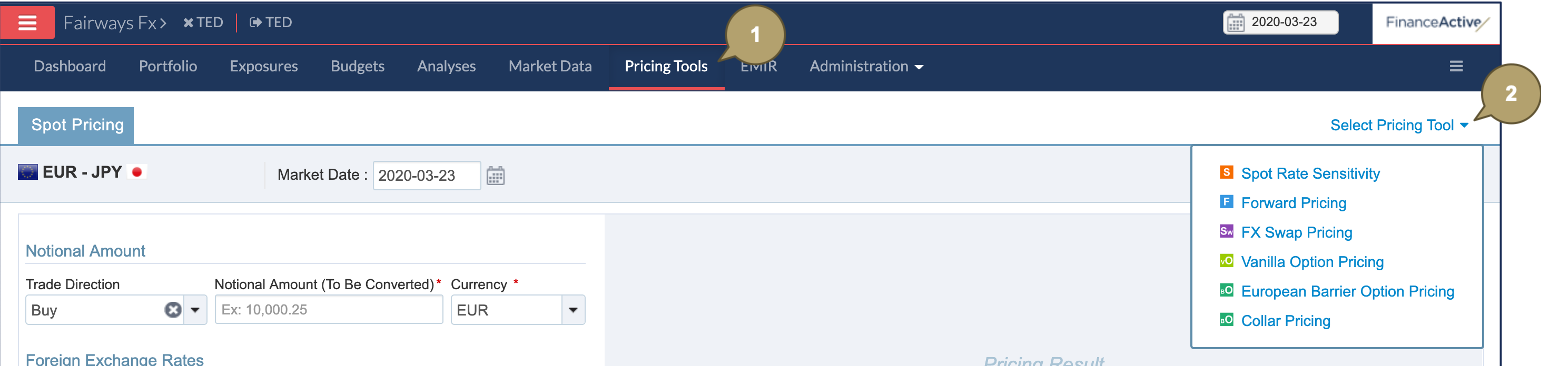

- Navigate to Pricing Tools.

- Click Select Pricing Tools > Collar Pricing.

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

Market Date |

Date on which the collar is priced. |

|

Currency Pair |

Currencies to buy (for a call) or to sell (for a put). |

|

Field |

Description |

|---|---|

|

Exercise Date |

Start date of the transaction. |

|

Value Date |

2 calendar days later than the exercise date. |

|

Field |

Description |

|---|---|

|

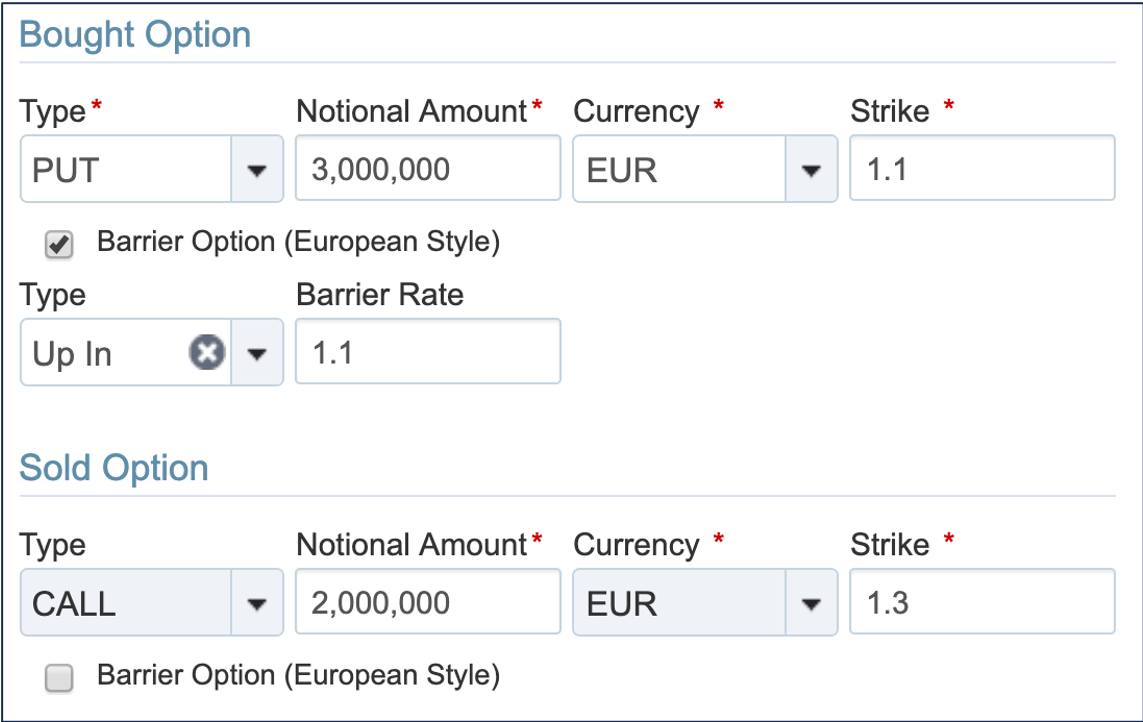

Type |

Direction of the option:

|

|

Notional Amount |

Nominal amount invested in the option. |

|

Currency |

Currency to buy (for a call) or to sell (for a put). |

|

Strike |

Exchange rate level at which the option can be exercised. This rate is usually compared to the spot rate to determine the moneyness of the option. |

|

Barrier Option (European Style) |

Includes/excludes a European barrier option. |

|

Barrier Option Type |

Note: This field only displays if the barrier option is included. Behavior between the spot price and the barrier level:

|

|

Barrier Rate |

Note: This field only displays if the barrier option is included. Value of the barrier. |

|

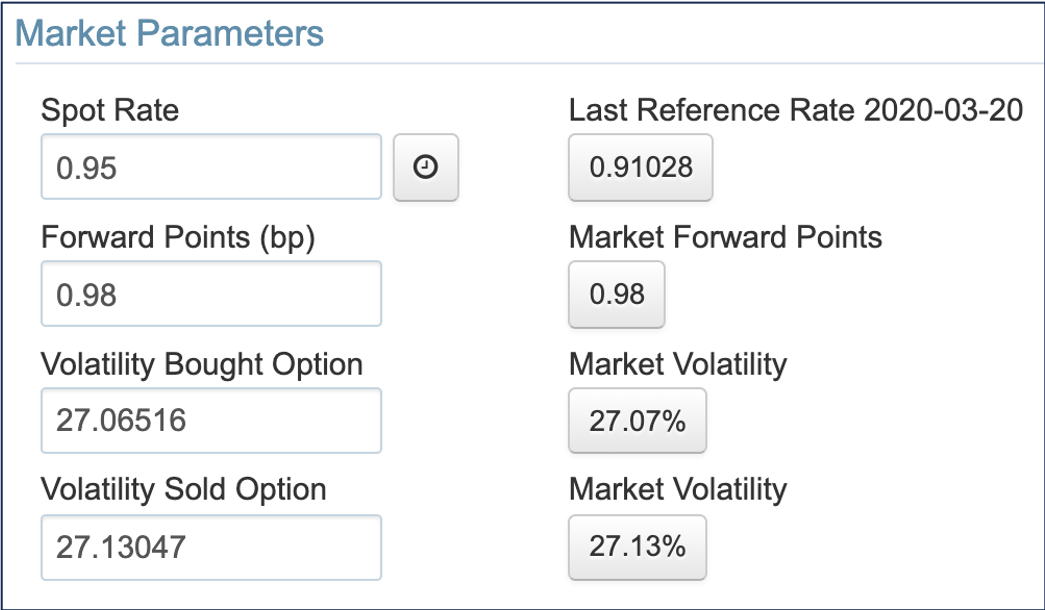

Field |

Description |

|---|---|

|

Spot Rate |

Specific rates to price the collar. |

|

Forward Points (bp) |

|

|

Volatility Bought Option |

|

|

Volatility Sold Option |

Note: Click the clock  to use real-time rates or click the adjacent last referenced rates in the application to use them.

to use real-time rates or click the adjacent last referenced rates in the application to use them.

- Click Validate to price the collar.

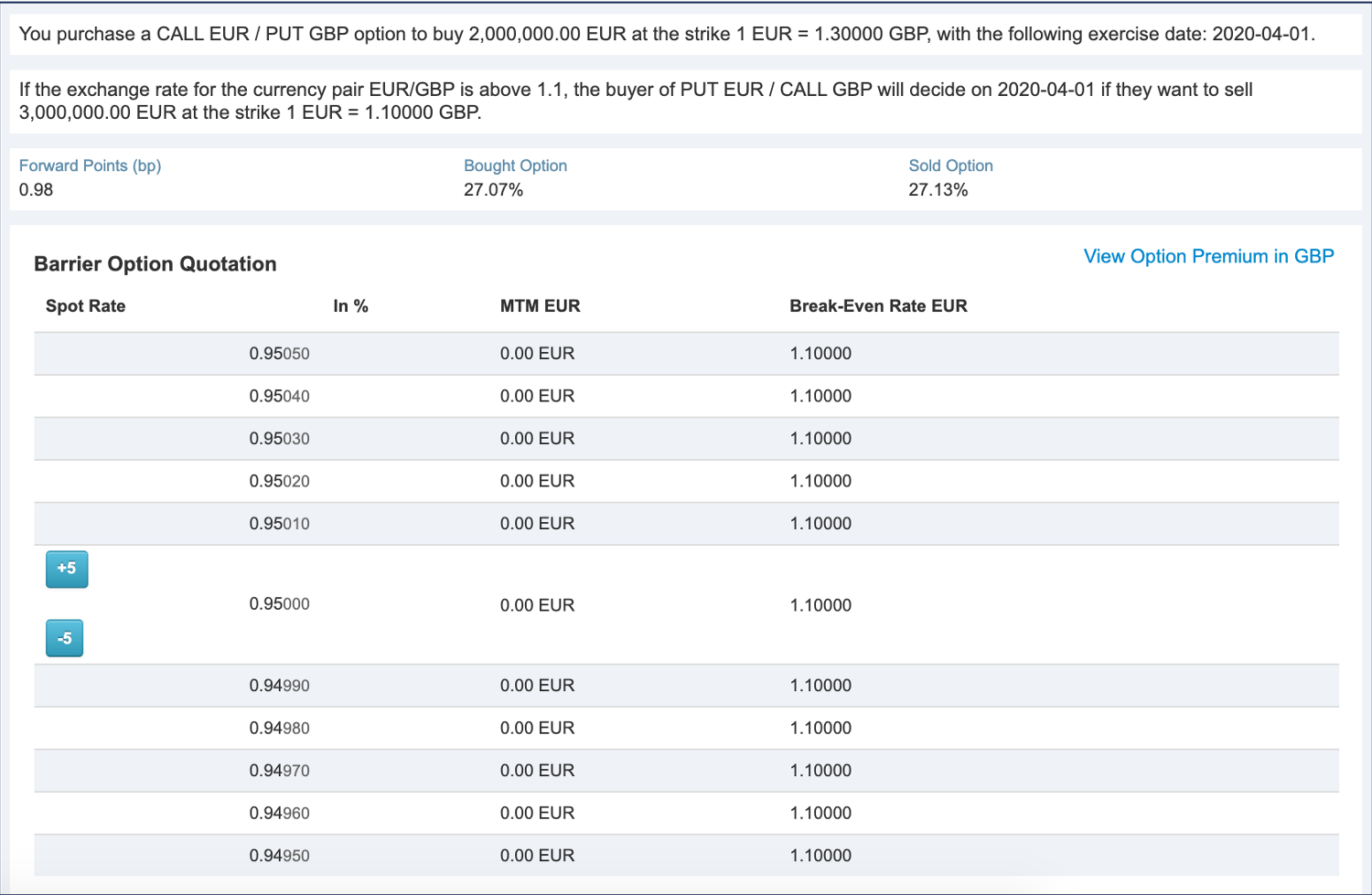

The pricing results display.

Note: Click +/-5 to simulate different results.