Vanilla European calls or puts for foreign exchange in Fairways FX are options to buy or sell a foreign currency at a predetermined strike price (exchange rate).

Log In to Fairways FX

- Log in to your Fairways FX account.

- Select an account.

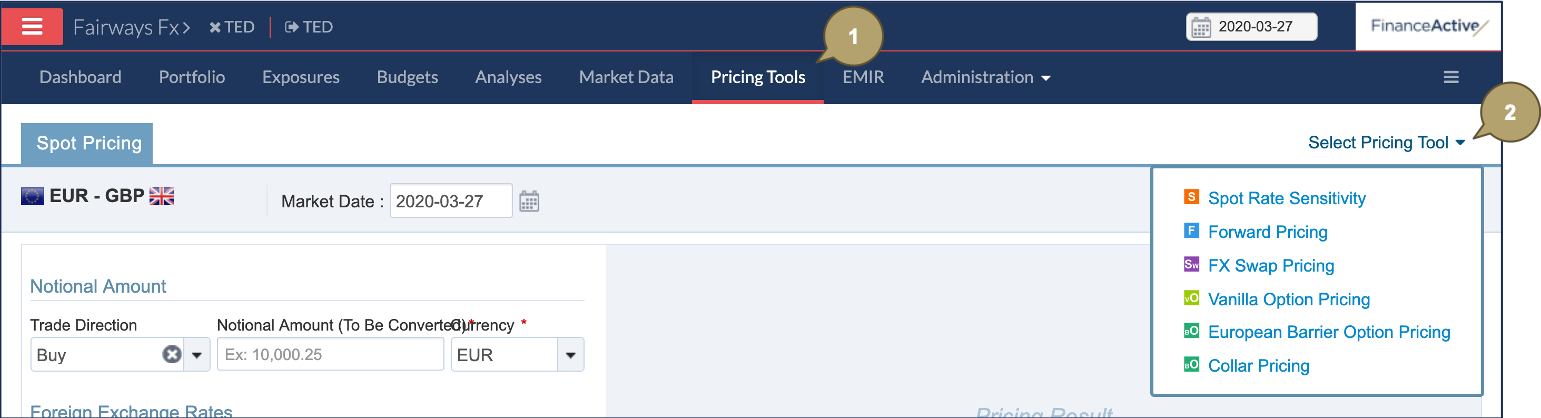

Price a Vanilla Option

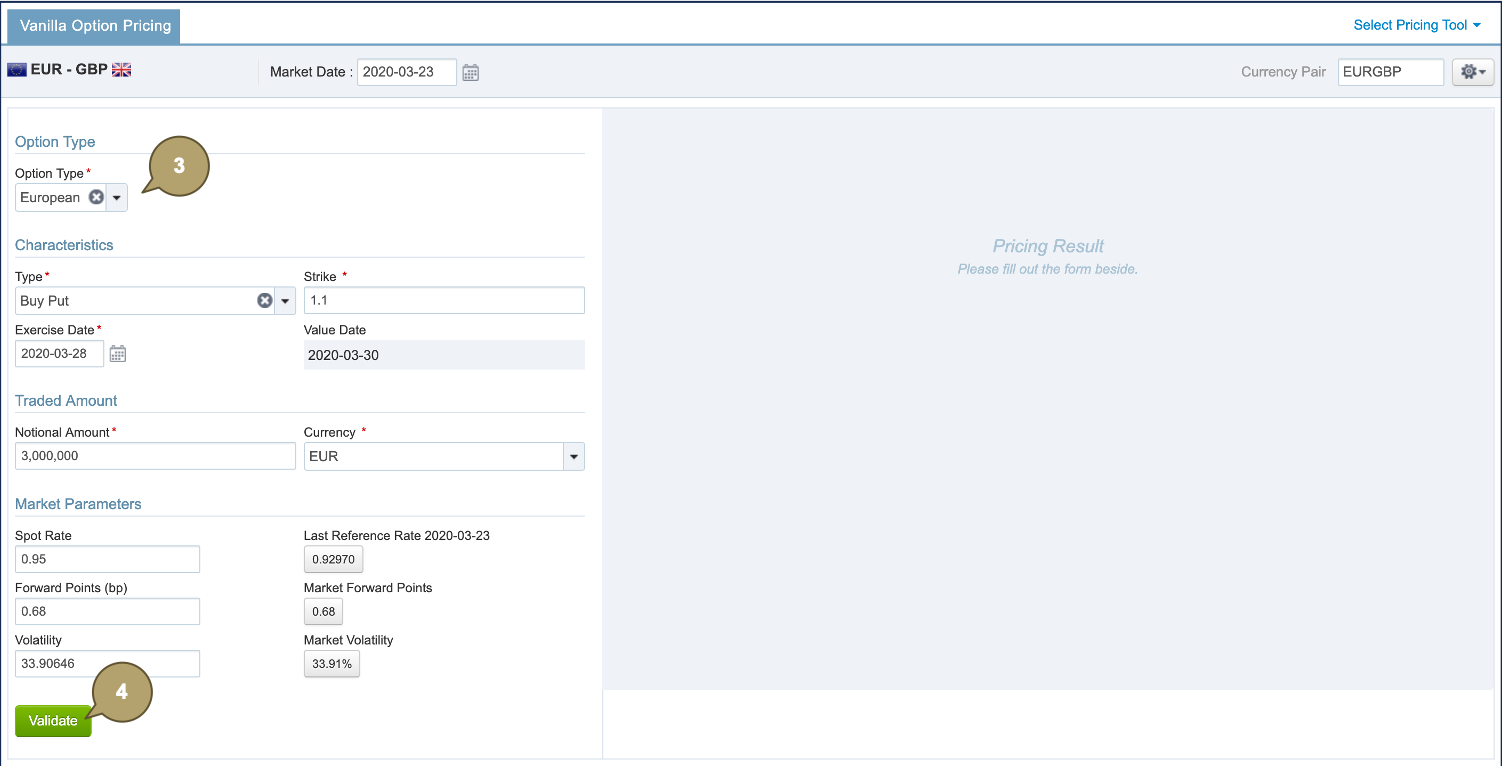

- Navigate to Pricing Tools.

- Click Select Pricing Tools > Vanilla Option Pricing.

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

Market Date |

Date on which the option is priced. |

|

Currency Pair |

Currencies to buy (for a call) or to sell (for a put). |

|

Field |

Description |

|---|---|

|

Option Type |

Type of the option to price. Note: Additional fields display depending on the selection. |

|

Observation Start Date |

Note: These fields are only available for Asian options. |

|

Observation Frequency |

|

Field |

Description |

|---|---|

|

Type |

Direction of the option. |

|

Strike |

Exchange rate level at which the option can be exercised. This rate is usually compared to the spot rate to determine the moneyness of the option. |

|

Exercise Date |

Start date of the option. |

|

Value Date |

2 calendar days later than the exercise date. |

|

Field |

Description |

|---|---|

|

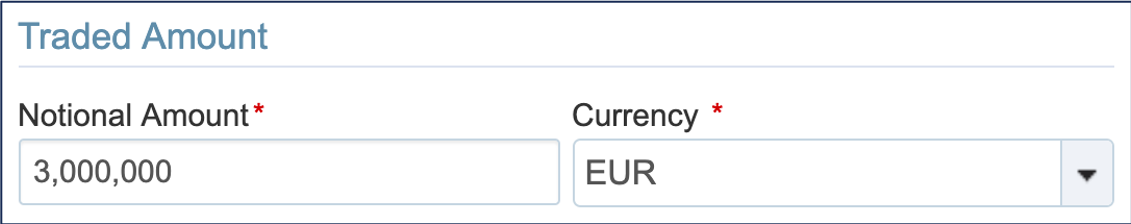

Notional Amount |

Nominal amount invested in the option. |

|

Currency |

Currency of the notional. The premium is paid or received in this currency. |

|

Field |

Description |

|---|---|

|

Spot Rate |

Specific rates to price the option. |

|

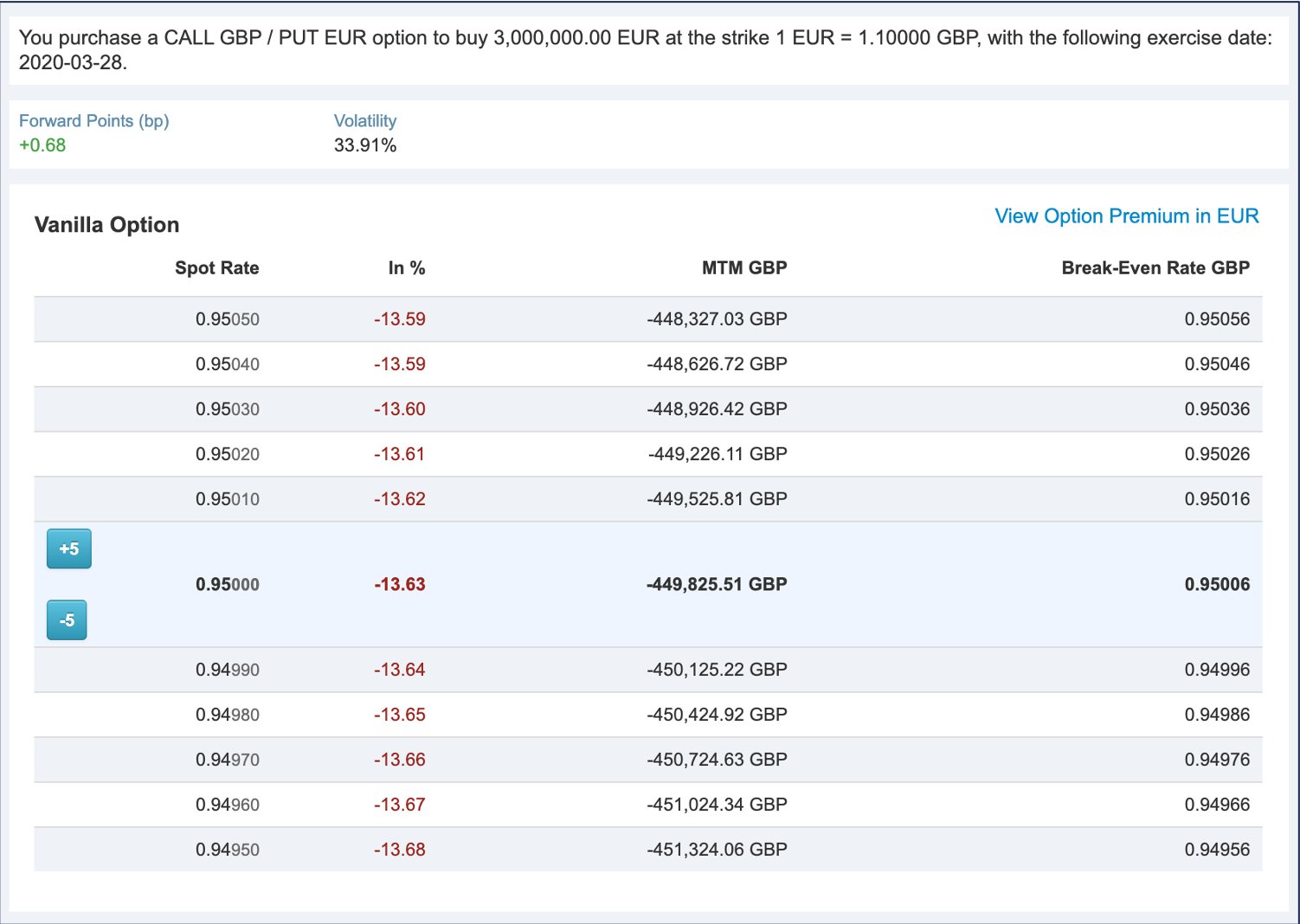

Forward Points (bp) |

|

|

Volatility |

Note: Click the adjacent last referenced rates in the application to use them.

- Click Validate to price the option.

The pricing results display.

Note: Click +/-5 to simulate different results.