A loan guarantee in Fairways Debt ensures a guarantor assumes the debt obligation of a borrower in case of failure. Such a guarantee can be limited or unlimited, so that the guarantor might be liable for the entire debt or only for a part.

Transaction types associable with guarantees are:

- Loans

- Derivatives

- Bonds

- Issuing programs

- Credit facilities

- Municipal commercial paper (CP) programs

- Leases

Prerequisite

- Enable the Guarantee transaction type (contact your Finance Active consultant)

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Debt & Derivatives.

Create a Guarantee

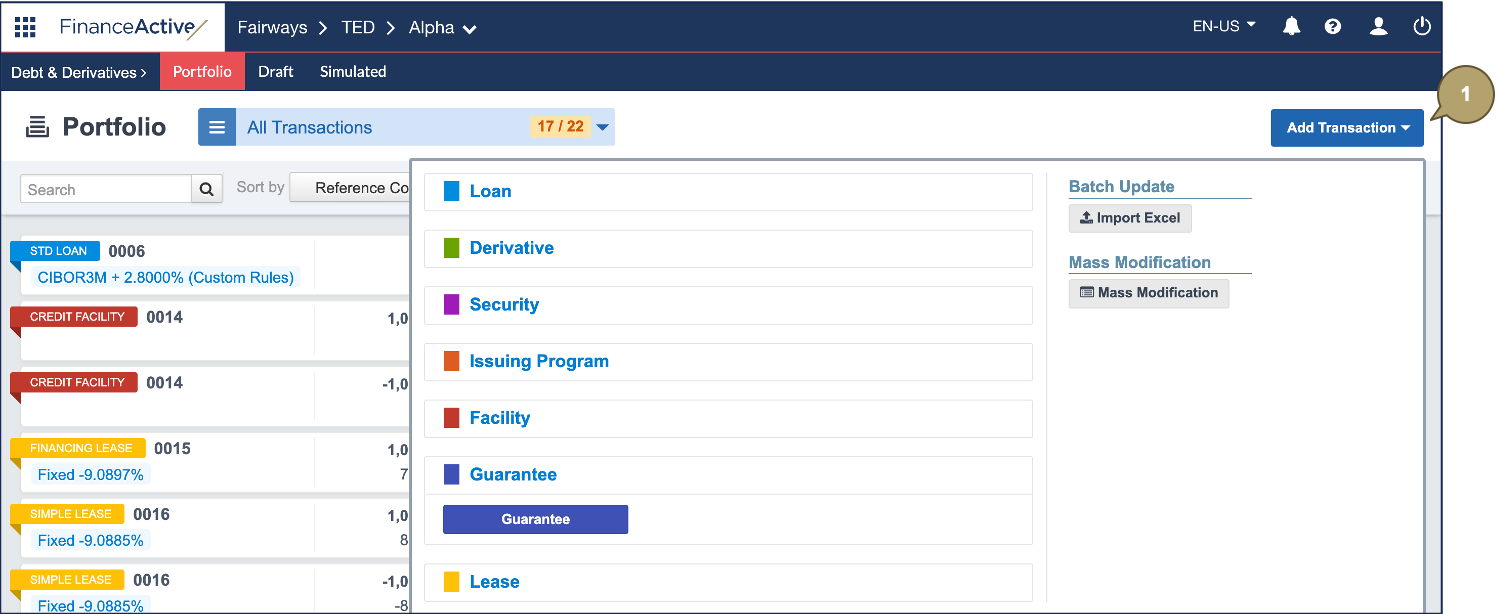

- Click Add Transaction > Guarantee > Guarantee.

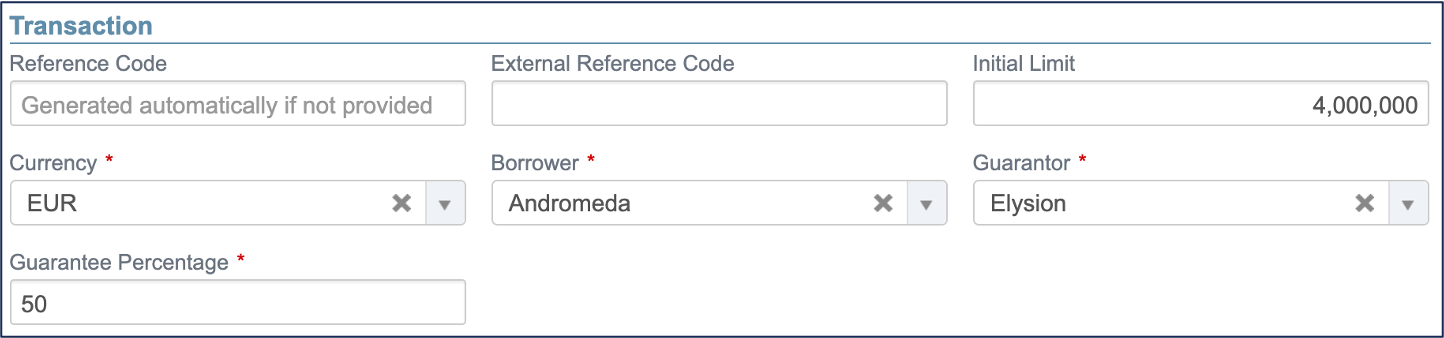

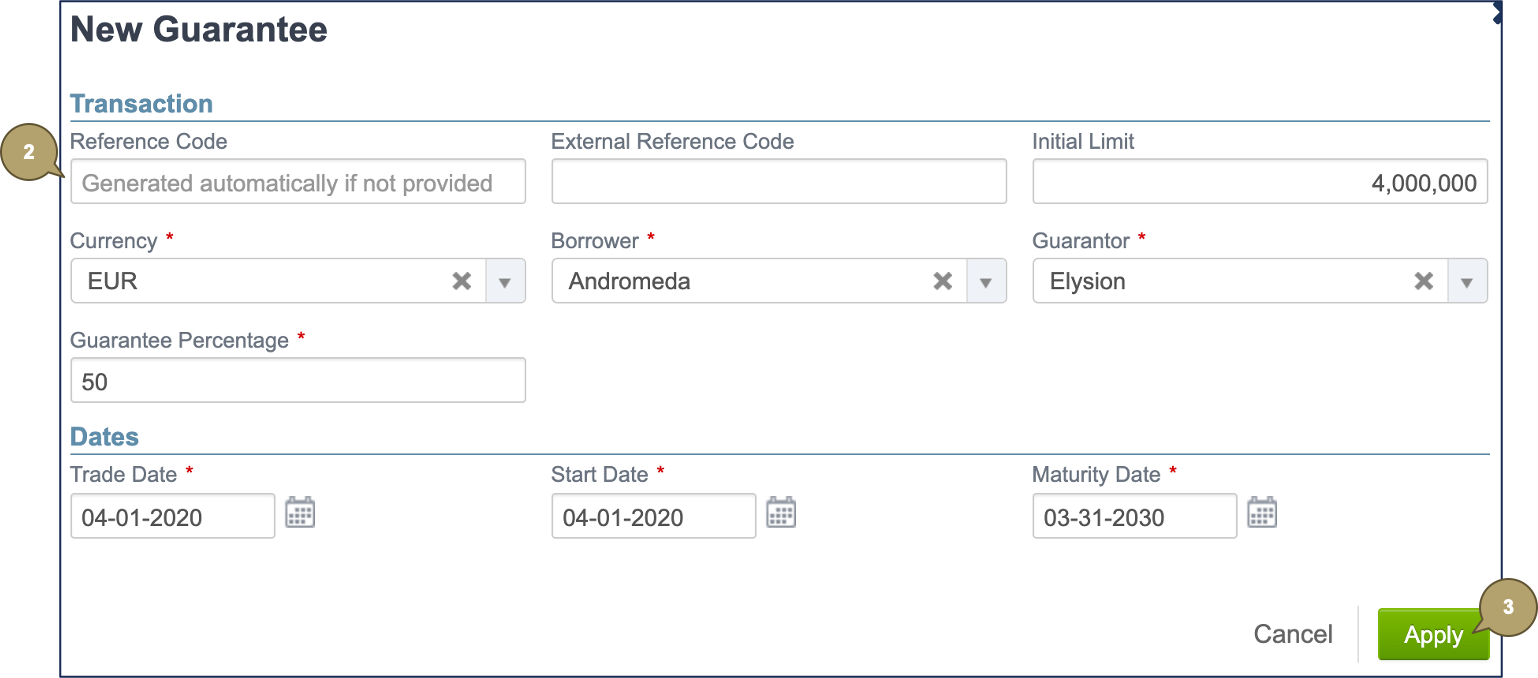

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

Reference Code |

Unique reference of the transaction. Identifies the transaction in the portfolio. Note: The reference must be unique among all the entities managed in the account. |

|

External Reference Code |

Used by external systems to identify the transaction. Used when transactions are imported from or exported to another system. |

|

Initial Limit |

Maximum allowed amount. |

|

Currency |

Currency of the guarantee amount. |

|

Borrower |

Borrowing entity in the system. |

|

Guarantor |

Entity assuming the debt obligation for the borrower. |

|

Guarantee Percentage |

Part of the loan guaranteed in percentage. |

|

Field |

Description |

|---|---|

|

Trade Date |

Date at which the transaction has been traded. From that date, the system takes the transaction into account as an item of the portfolio. |

|

Start Date |

Unadjusted start date of the transaction. |

|

Maturity Date |

Unadjusted maturity date of the transaction. |

Enter the required custom attributes, if any.

- Click Apply.

The new guarantee displays in the draft portfolio.