The new Fall Release is coming for Fairways Debt. Have a look below and discover our new features and developments.

New Features

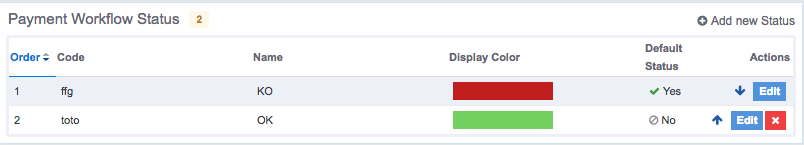

Checkbox for Payments

Users will now be able to create a status process for all payment flows. This feature must be managed from the features administration page.

Users will now be able to change the payment status in the schedule of each deal. A status indicator has been created on the cash flow report.

Transaction Management

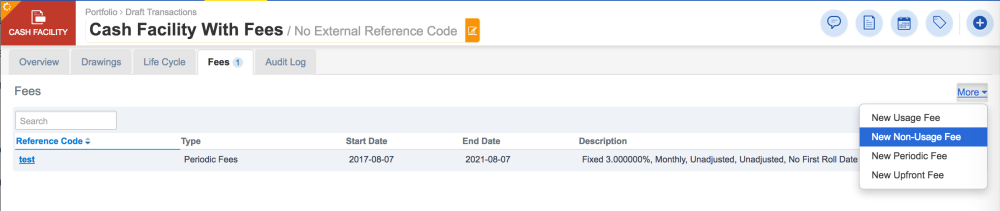

Fees on Cash Facility

Fairways Debt can now support additional fees on Cash Facilities, such as periodic Fees and non usage fees.

To enter these fees, click the ‘Fees’ tab on the Cash Facility page.

The additional fees on Cash Facilities are taken into account in the relevant indicators computation in the reporting and analysis sections.

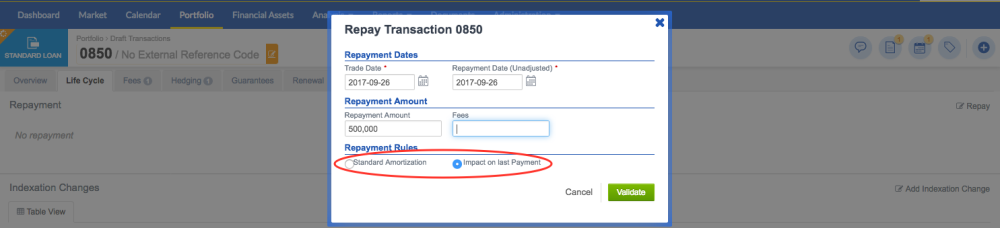

Repayment: Two Choices Available for Straight Line and Custom Amortization Profiles

For Standard Loans, an enhancement is now available on the ‘Repayment’ lifecycle action.

When entering a partial repayment, users can now specify how the principal flows that occur after the repayment action will be impacted.

When a user makes a partial repayment on a straight line (or custom) amortization loan, he can either:

- Choose the ‘Standard Amortization’ method. The system automatically recalculates all the next payments based on the new principal amount.

- Or choose the ‘Impact on last Payment’ method. The system will not impact the followings payment (same amounts as before the partial repayment). However, the last payment is reduced by the principal repayment amount.

This feature is available for ‘Straightline’ and ‘Custom’ amortization profiles.

This feature is not supported for ‘Constant annuity’, and does not make sense for ‘Bullet’ amortization profiles.

New Transactions

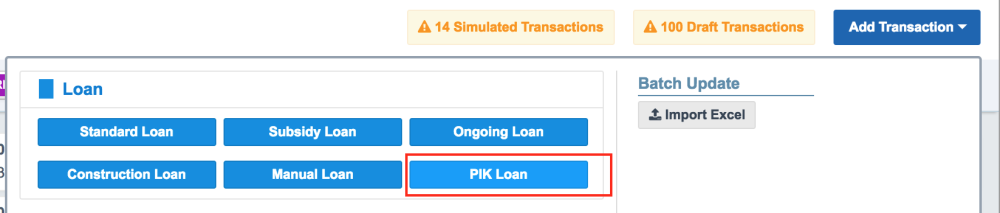

PIK Loans

A new feature of PIK loans has been deployed on Fairways Debt to integrate one computation method: PIK interest= PIK Rate * PIK Balance * Base and PIK Balance= Last PIK Nominal + Interest unpaid + Last PIK Interest

On the portfolio page, click “new product” and add a new PIK Loan

A PIK loan can also include multiple drawings (you don’t need to withdraw all the principal amount from the start). Interests are capitalized and paid at the maturity date.

Fees are managed on the drawn and/or undrawn amount: add “usage” and “non usage” fees on PIK loans to update the schedule.

PIK loans are well known to be risky loans because cash flows are only capitalized and not paid at the IPD date. Nevertheless, it is possible to go on the loans’s page, called “lifecycle”, and use the “Pay interest” action. The user can pay cash interests and decrease the PIK balance whenever he wants!

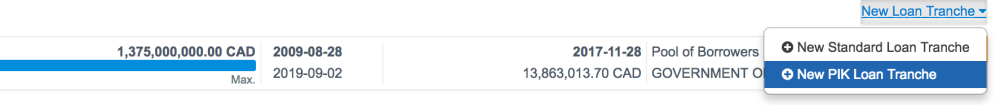

Quite often PIK loans are part of a bigger financial envelope. For this reason we have integrated them as a tranche of a facility agreement.

Go to a facility agreement product and add a new tranche called “New PIK Loan Tranche”. Of course the payment advices template also contains dedicated variables for PIK participations in facility agreement.

Financial Lease

Regarding the Lease project, we have added the Lease Downpayment feature. Users will now be able to create a lease, add a downpayment and follow the schedules of the deal.

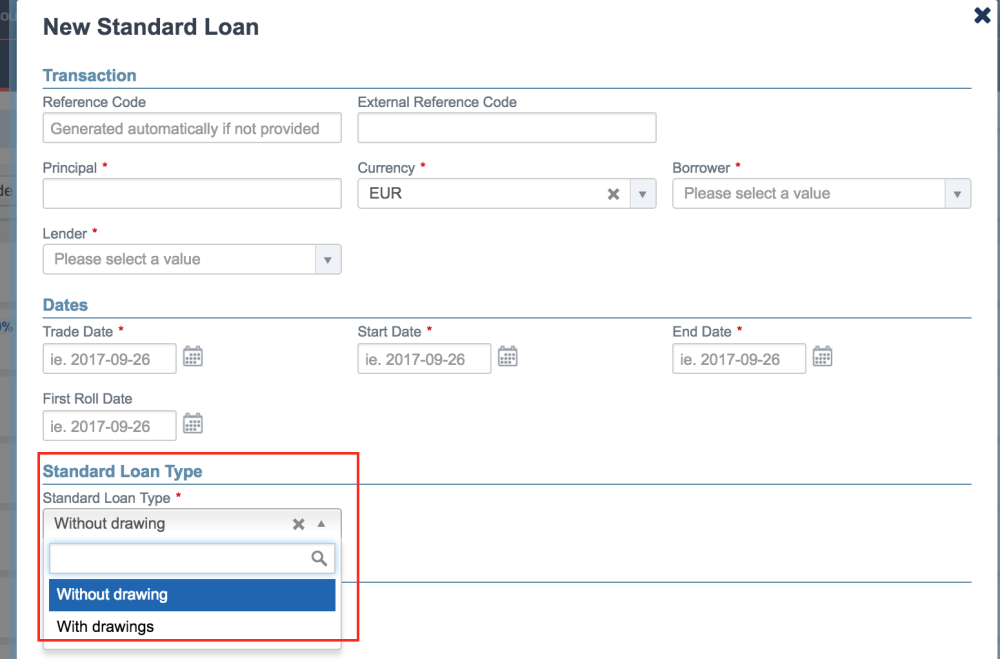

Loan with Multiple Drawings

Available as a beta feature, the system now supports 2 types of standard loans. When selecting “New Standard Loan” in his/her portfolio, the user can now has 2 options :

- Withdrawing the principal at the start date (select “without drawing”) or

- Deciding to make drawings (max the amount of principal) during a dedicated period of time (select “with drawings”).

The consolidation phase corresponds to the amortization period: the user has done, or almost done, the withdrawing part of the loan.

Life cycle has quite a few new features:

- Make drawings

- Change principal: the user has contractually decided that the borrowed amount has increased or decreased

- Last drawing date change: shift the last drawing date so that the user keeps withdrawing while the capital is amortized

- Add a repayment

- Change the index of the loan

And of course, we have included the fundamental usage and non usage fees computed on drawn and undrawn amounts.

…and Much More!

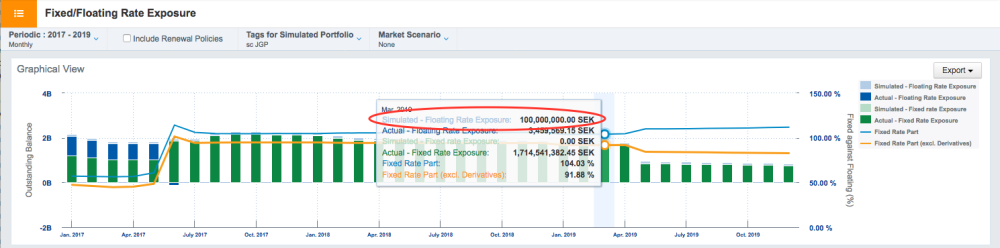

Improvement of Analysis Qcreens: Visualize the Effect of Simulated Deals

Fairways Debt offers an even better way of analysing and simulating your portfolio. The impact of simulated deals are now immediately visible on the relevant analysis screens.

Below is an example of the Fixed Floating Rate exposure analysis screen.

Display "Fixing" Event on the Calendar Page

Fixing events on deals are now displayed on the Calendar page

You can also apply a filter on the calendar page to set up the event types to be displayed on the Calendar page.

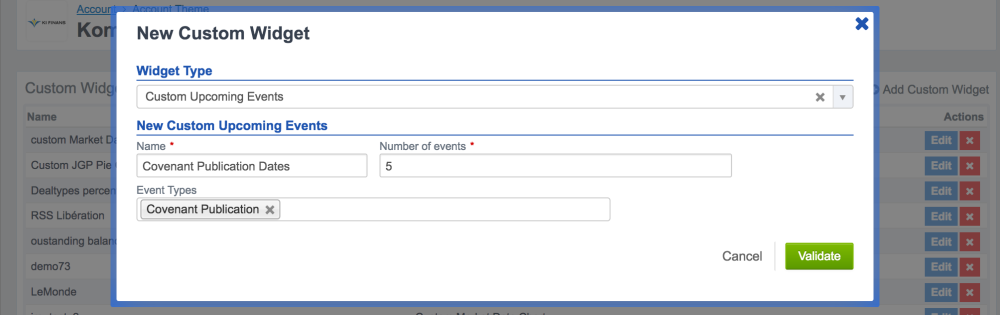

New "Upcoming Events" Custom Widget

In order to improve the configuration of your dashboard, a new widget is available. this widget allows you to display a specific Event Type, such as a Collateral Revision Date or a Covenant Publication date.

Administrators can configure a new ‘Upcoming Events’ widget in the Account Theme administration menu.

Improve Export Functions through APIs

Analysis and Reports results can be exported through internal APIs. The perimeter of these APIs has been extended, such as: expose the results of a Schedule Report, or choose to expose swaps as a single product, or as two separate legs.

Coming Soon…

We are currently working on new outstanding features, such as:

- More features on Lease: Creation of the consolidated schedule for the lease downpayment and new Interest calculation method added (Outstanding – Rent)

- Loan with embedded cap/floor: Users will be able to manually set the strike for cap and/or floor

- New transaction: support for ‘Emprunt CdC’ (French social housing sector): Creation of a new kind of deal: CDC Loans

- And a completely new user experience on the platform. The navigation through different modules (Portfolio, Calendar, Analysis, etc.) will be improved. The goal is to extend the Fairways Debt platform into a new modular platform. More information will be available in the next release: the Winter 2018 Release.