The new Fall Release is live for Fairways Debt. Have a look below and discover our new features and developments.

Debt & Derivatives

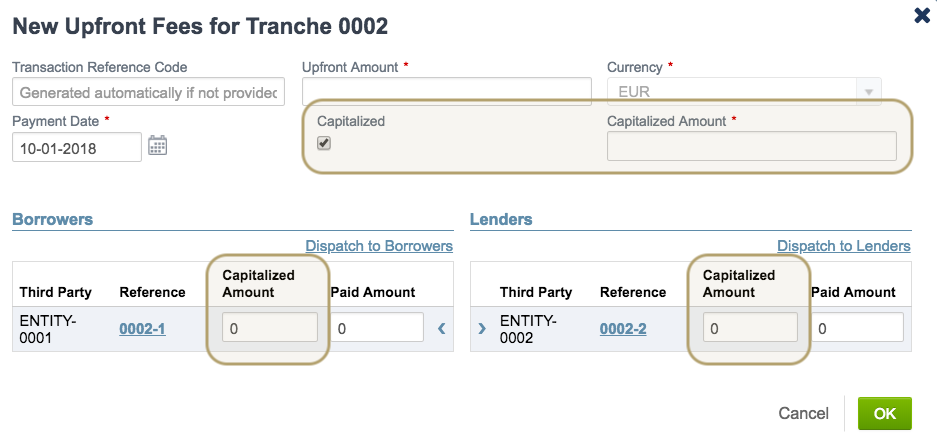

Capitalize Upfront Fees of Facility Agreements

Add capitalized amounts in addition to paid amounts for upfront fees.

- Open a facility agreement.

- Open a tranche.

- Navigate to Fees.

- Click More > New Upfront Fee.

- Enable Capitalize to add capitalized amounts.

Automatically Calculate Paid Amounts for Upfront Fees of Facility Agreements

If a tranche has multiple borrowers/lenders associated, enter the paid amounts for the first third parties and automatically display the last paid amount.

1. Open a facility agreement.

2. Open a tranche.

3. Navigate to Fees.

4. Click More > New Upfront Fee.

5. Enter an upfront amount.

6. Enter the paid amounts of the first borrowers/lenders.

7. Click > / < beside a blank paid amount to automatically calculate that paid amount.

Formula: Paid amount = Upfront amount – Sum of paid amounts already entered

In this example:

- Borrowers: 1000 – 300 – 200 = 500

- Lenders: 1000 – 900 = 100

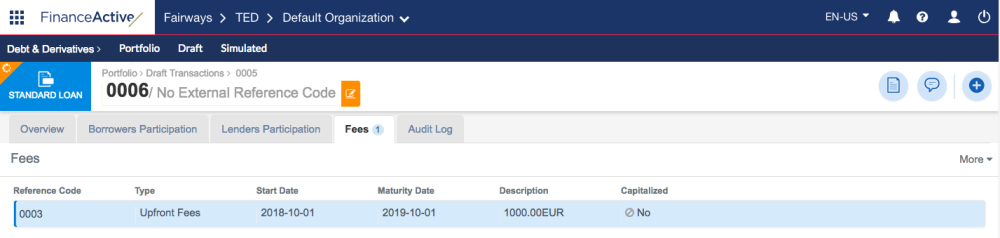

Delete Upfront Fee Details

Click the relevant fee to display its details.

The upfront fee details display.

Click Delete to delete the entire fee.

Create Non-Usage Fees

- Open a transaction.

- Open a tranche.

- Navigate to Fees.

- Click More > New Non-Usage Fee.

- Enable Capitalized in the New Non-Usage Fees panel to capitalize non-usage fees.

- Select a mode to calculate non-usage fees:

— Undrawn Amount: Default mode. Formula: Limit amount – (Sum of drawings + Sum of capitalized fees + Sum of capital interest)

— Undrawn Amount exc. Capitalized Flows: Capitalized fees and capital interest are ignored. Formula: Limit amount – Sum of drawings Note this calculation only impacts the fee calculation. - Non-usage fees display in the borrower and in the lender participations.

- A deleted non-usage fee in a:

- participation remains existing in a tranche.

- tranche is also deleted in the participations.

Apply a Fee to All Transactions

You can now apply the same fees to multiple transactions.

- Open a transaction.

- Open a tranche.

- Navigate to Fees.

- Click Add > Apply to All Transactions.

Import Multiple Balances for Cash Facilities

You can simultaneously import multiple balances for cash facilities using two ways:

- Within a specific cash facility

- In the account administration

Within a Specific Cash Facility

- Open a cash facility.

- Navigate to Balance.

- Click Manage Balances > Excel Export to download the template.

- Complete the template.

- Click Manage Balances > Excel Import to upload the template.

The balances display in the Balances list.

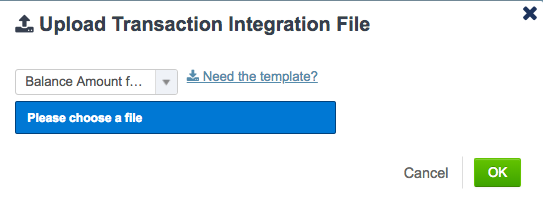

In the Account Administration

- Navigate to Account Administration > Administration > Batch Update.

- Click Upload Transaction Integration File.

- Select Balance Amount for Cash Facilities.

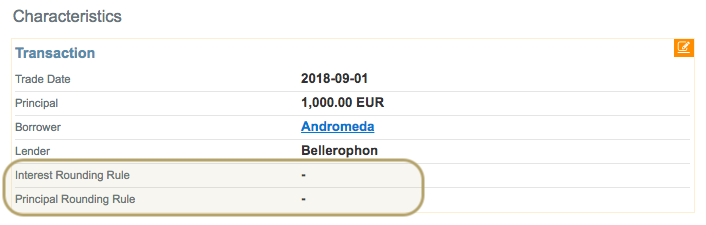

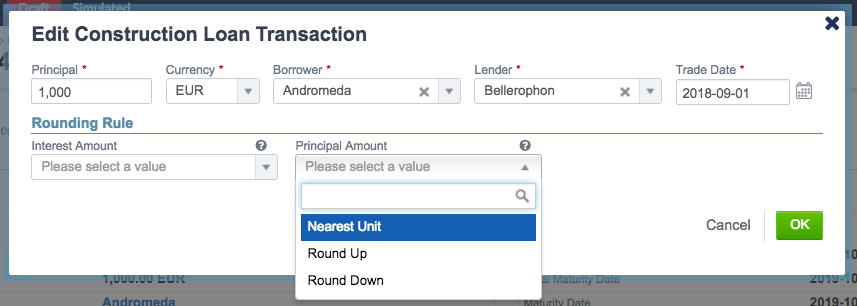

Rounding Rules for Interest and Principal Amounts

Apply a different rounding rule for the interest amount and the principal amount, when editing a transaction.

1. Open a draft transaction.

2. Click Edit in the Characteristics section.

3. Select a rounding rule for the interest and principal amounts.

| Rounding Rule | Description |

|---|---|

| Nearest Unit | Nearest superior or inferior unit |

| Rounding Up | Nearest superior unit, no decimals |

| Rounding Down | Nearest inferior unit, no decimals |

Note: Leave the selection blank to apply the default rule: nearest cent.

Example

| No Rounding Rule | Nearest Unit | Round Up | Round Down |

|---|---|---|---|

| 0,13 | 0 | 1 | 0 |

Analysis & Reporting

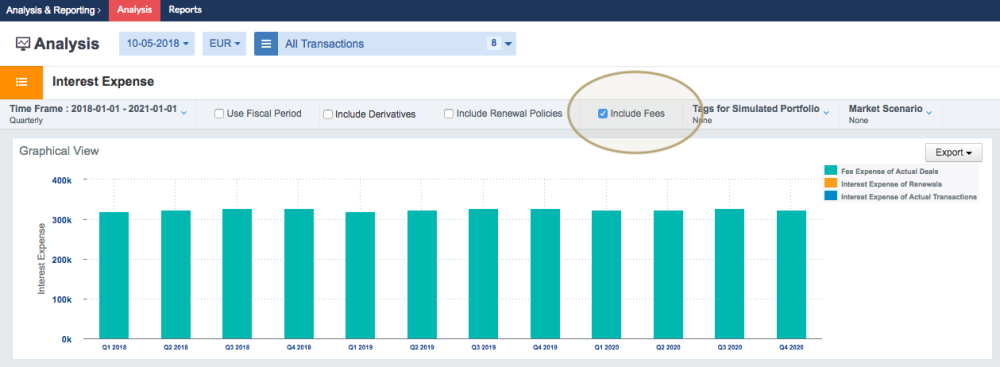

Include Fees in Analyses

Include fees in two analyses:

- Debt Maturity Profile

- Interest Expense

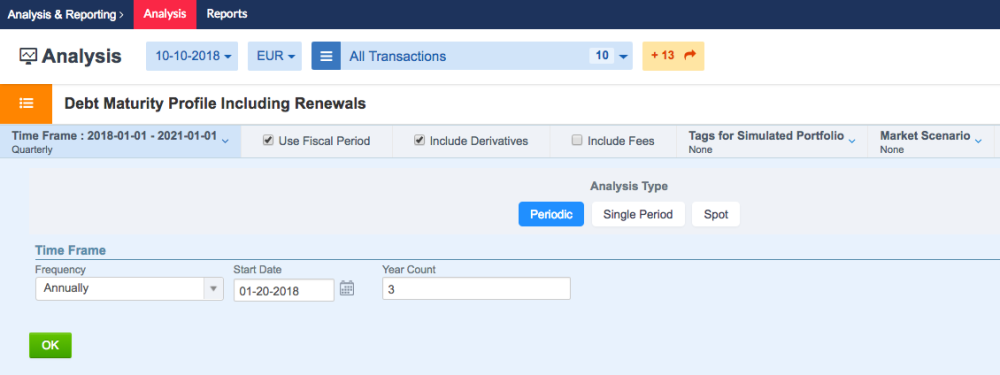

Enter Accurate Dates for an Analysis Period

Three fields now replace the time frame of the Analysis Type so you can select a period more accurately and easily, using the combination of a:

- Frequency

- Start date

- Year count

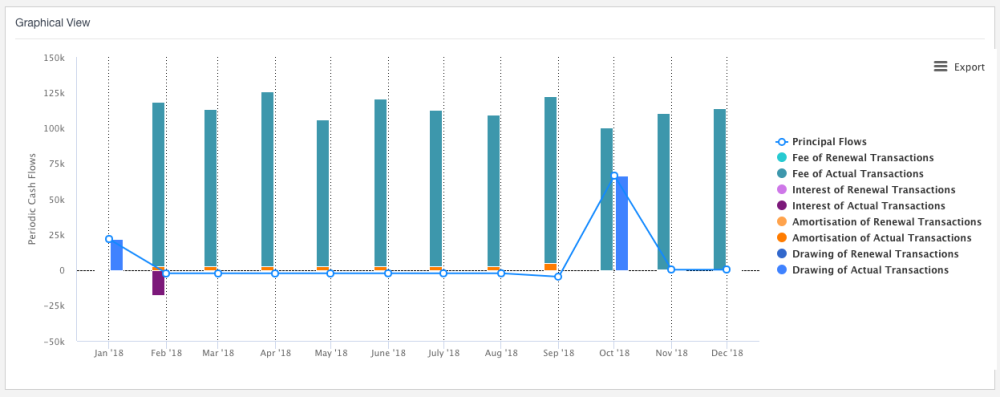

New Design for “Periodic Cash Flows” Analysis

Financial Calendar

New:

- Geneva

Coming Soon!

- Group FX Rate: use custom FX rate for analyses and reporting

- A new connector for Habitat Social, in partnership with Salvia