Finance Active’s team is happy to announce the immediate availability of the final release of Fairways Debt 2.0.!

This new release includes more than 20 new exiting features and 150 minor enhancements and fixes. See below for the most noticeable changes.

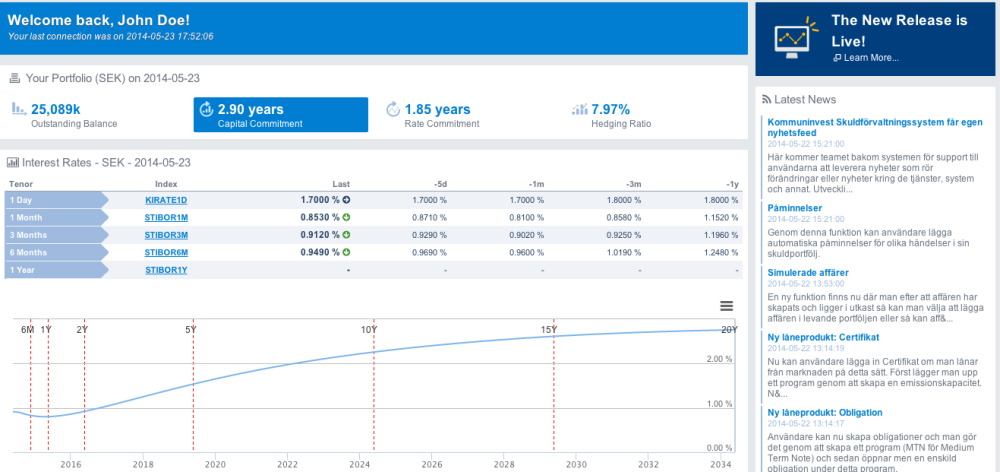

New Home Page

The Home Page of your organization has been redesigned to offer a quick look on what’s happening :

- Main indicators on your consolidated portfolio

- Last fixing for your currency indexes

- Current yield curve on your currency

- News feed on your area

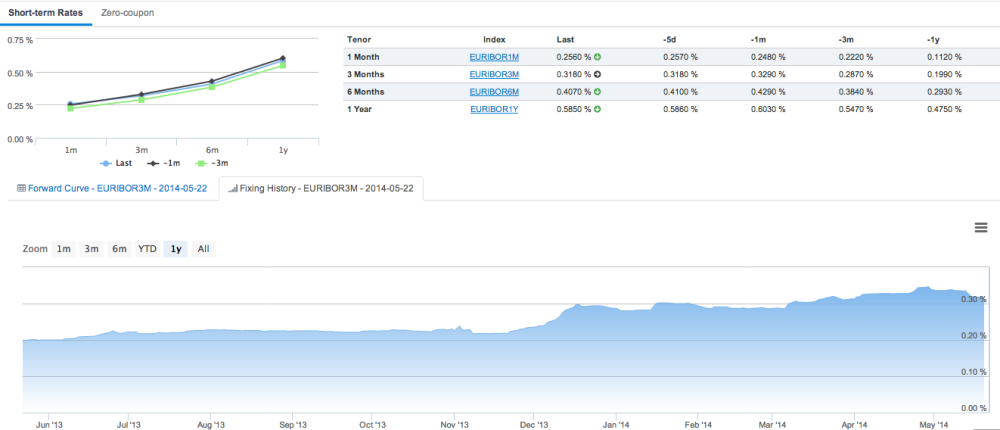

New Market Area

The market area has been completely re-written to offer a powerful and extensible design.

This release contains 2 brand-new market screens – and more are yet to come!

- Historic fixing and forward values for all short-term (ibor) indexes in the 6 main currencies (EUR,USD,GBP,JPY,SEK,NOK)

- Yield curves in the 6 main currencies (EUR,USD,GBP,JPY,SEK,NOK)

- All charts can be exported as images and their data can be downloaded to Excel

New Product Support

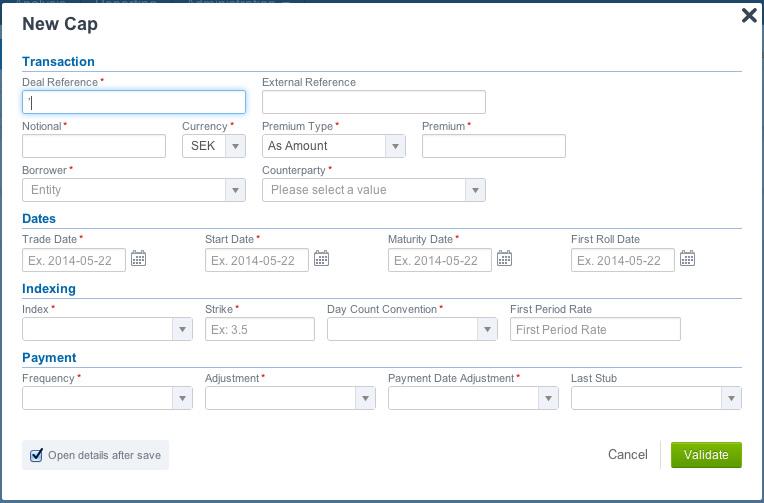

Vanilla Interest Rate Options

You can now book and manage vanilla caps, floors and collars in the system.

You can immediately see the impact of your interest rates derivatives in all your historic and forward analysis.

Bonds

You can book fixed and floating-rate long term bonds using the new ‘Bond’ feature.

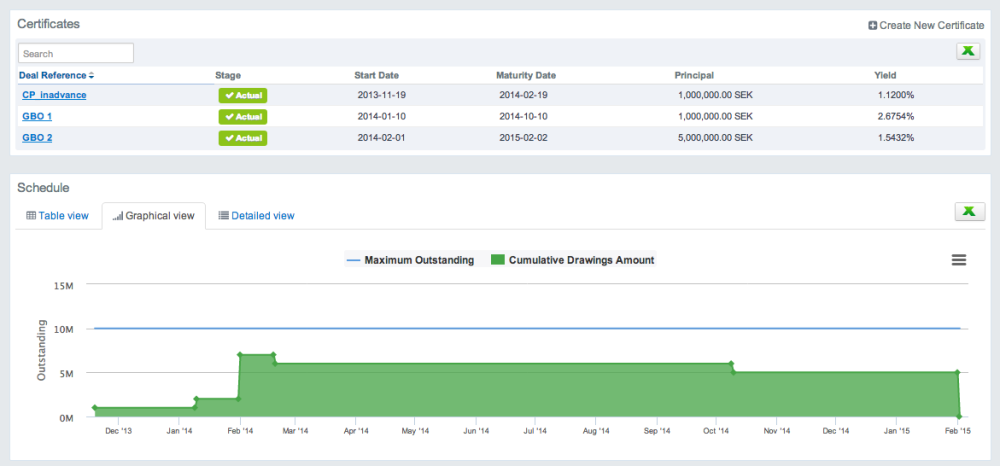

Certificates and Issuing Programs

Fairways Debt also manage short-term zero-coupon bonds, using the ‘Certificates’ feature.

Certificates are booked, analyzed and consolidated through an issuing program.

Amortized Swaps

You can now configure the amortization profile of your swaps.

New Analysis Screens

Interest Expense

Interest expense is a historical and forward analysis of interest expense over a period.

You can analyze how your refinancing strategy impact the forward looking interest expense of your consolidated portfolio.

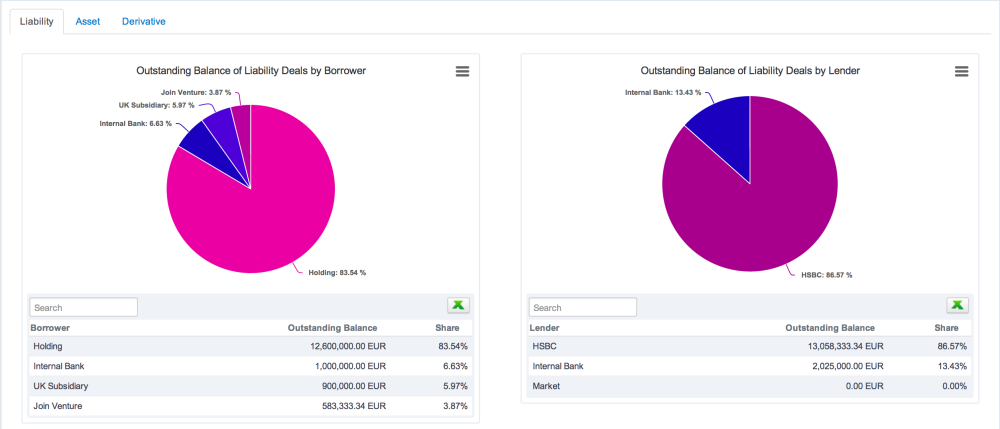

Balance Distribution by Lender & Borrower

Through this new screen, you can easily review your exposure by Party or Counterparty.

And much more…

Global Renewal Policies

Renewal Policy can be set on each entity. This renewal policy is applied to all deals related to this entity.

Deal Simulations

New deals can now be booked into the Simulated Deals portfolio rather than the Actual Dealsportfolio. You can then use the new tagging system to include some of the simulated deals into all the historical or forward analysis.

Tagging System

You can now add custom tags to all your deals (including the simulated ones) to design specific portfolios for use into the analysis and reporting areas.

Notification Center

Use the notification center to configure get notified (by mail) when deals mature or when a payment will occur.

Enhanced Life-Cycle Management on Live Deals

You can now perform partial repayment on any loan, as well as early terminations on derivatives.

Spread/index changes, as well as rescheduling are to come soon.