March 2015 – Finance Active’s team is pleased to welcome the spring with a new release full of exceptional features and advanced management solutions!

As usual, we strive to improve our service by enhancing the existing tools while adding, at the same time, new facilities to meet specific financial needs. So have a look below and discover what’s new this time!

New Features

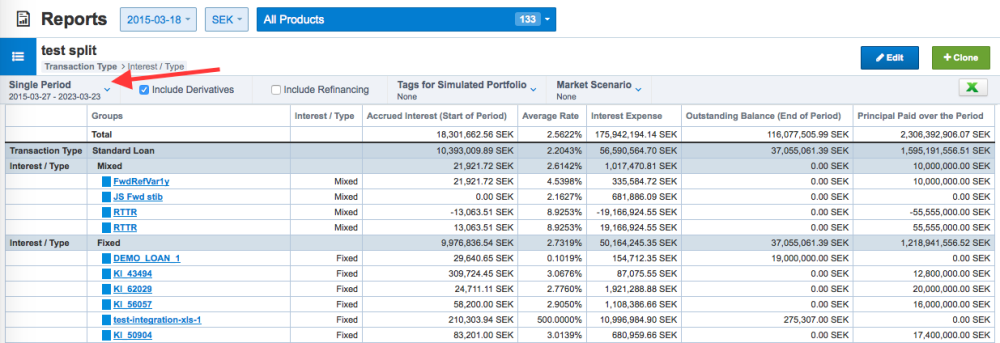

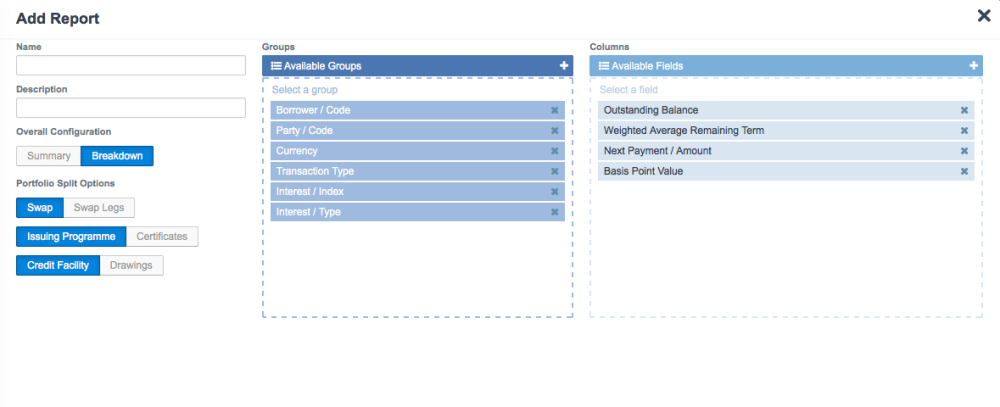

Improved Reporting Tool

The “Reports” section shows up in a new version, with a redesigned layout and several additional features.

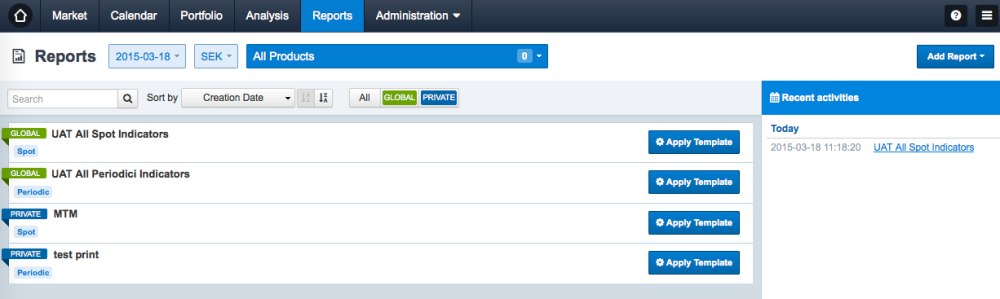

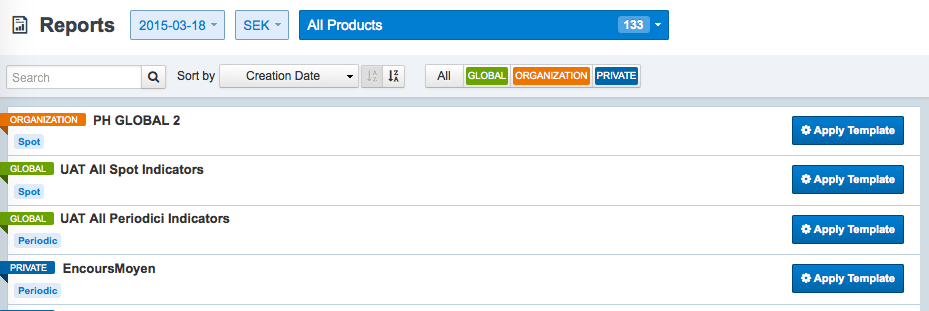

Differences will first be noticed in the section home page, where you directly access the list of the available templates (left side of the page), as well as the recently used reports on the right side of the screen. Quite a practical design!

Another concept introduced in this release concerns the rights related to templates’ visibility. Three levels are provided in order to define the scope of each report template: global (all the account users can see and use the template), organization (only the members of the organization are allowed to see and use it) and private (only the user who created the template has the right to see and make use of it). Please note, however, that users are not authorized to edit the templates and that only administrators have the rights to delete them.

When it comes to adding a new report, two main improvements were introduced to make template configuration more flexible and customizable. In detail, it is now possible to order the field columns according to specific needs and there are no more limits to the number of groups that can be set in the template (the limit was previously 3 groups).

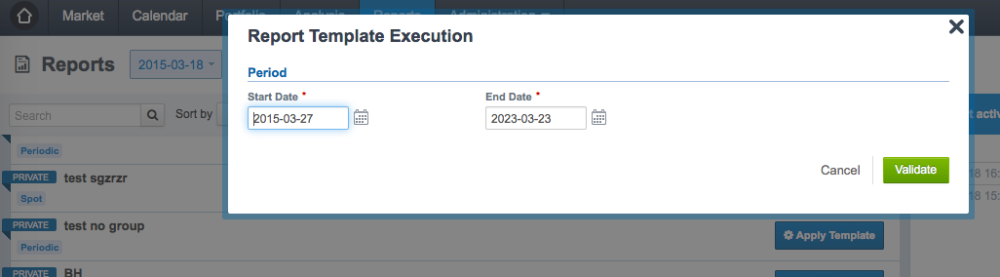

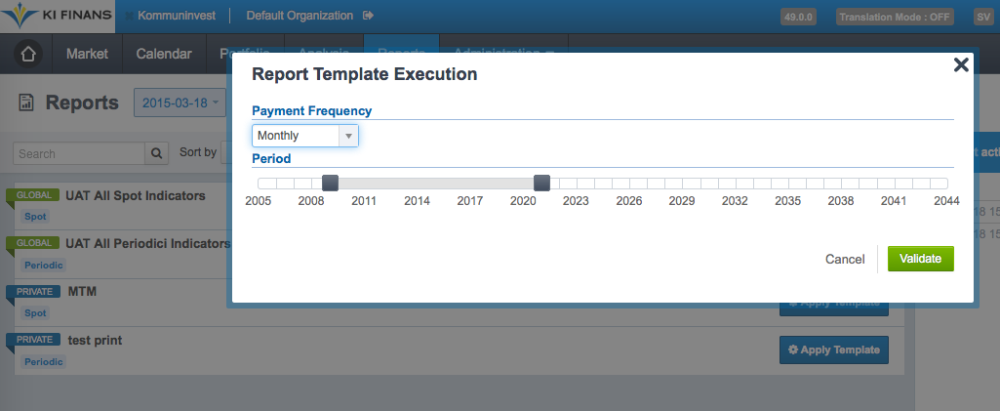

Always with a view to providing the most flexible solution, the system now allows to apply the same report template to different analysis periods: all you have to do is to choose a periodic or single-period template in the list, click on “Apply Template”, then set the desired period and frequency (if applicable) in the “Report Template Execution” window (the system retrieves by default the last settings).

Moreover, even once the report is generated, it is possible to modify these period settings directly from the report view: just click on the relevant field at the top left of the section and the input box will be displayed again. It couldn’t be easier!

(Extended) Cash Flow Report

A new entry in the “Portfolio” section, this feature enables to export as an Excel file all the cash flows incurred between two specific dates. Two versions are made available in this release: a basic report and an extended version (the difference lies in the number of fields displayed in the Excel file). Yet another tool to meet your reporting needs!

New Transactions

Swaption

A swaption is an option which grants the right to enter into a swap.

There are two types of swaption contracts:

- Payer swaption: it grants the owner the right to enter into a swap in which they will pay the fixed leg, and receive the floating leg.

- Receiver swaption: it grants the owner the right to enter into a swap in which they will receive the fixed leg, and pay the floating leg.

To add a swaption to your portfolio, just follow the standard transaction workflow and fill in the specific fields: payer/receiver, strike, underlying swap transaction, underlying swap fixed and floating legs, etc.

Payment in Kind Loan

A PIK (Payment-in-Kind) loan is a specialized instrument with no interest or principal payments until maturity. This type of transaction is mainly used in the UK real estate market.

The most common PIK loan structure (the one which is supported by Fairways Debt) is composed of a PIK interest payment, besides periodic interest payments.

In Fairways Debt, PIK loans are therefore configured with 2 different interest flows:

- Cash-Pay Interest, which is paid periodically according to the schedule;

- PIK Interest, which is capitalized and paid at the maturity of the loan.

Transaction Management

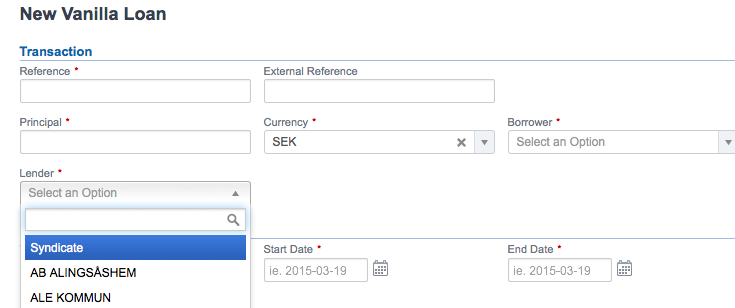

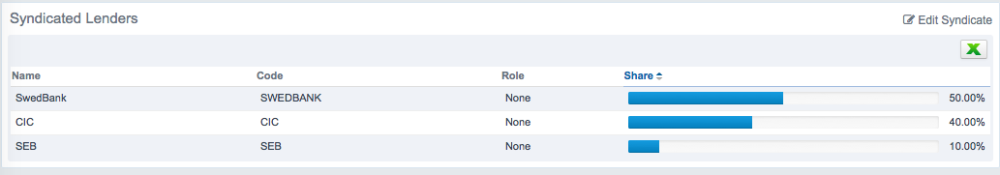

Pool of Lenders

Fairways Debt can now support pools of lenders, with several lenders involved in a single loan with specific shares.

To add a syndicated loan, just select “Pool” in the “Lender” field of the new loan. Once the draft transaction is created, you will be able to choose the “Pool members” from the list.

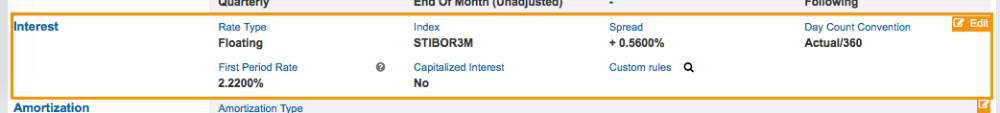

Custom Rules for Interest Rate Computation

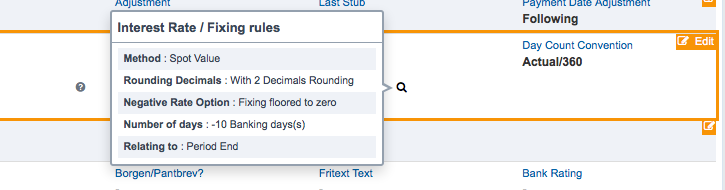

In floating-rate transactions, it is now possible to custom rate computation and fixing rules. All you have to do is to access the draft transaction to which you wish to apply the rule, then thick the “Advanced” box when editing interest details. Therefore, you will be able to set the following parameters:

- Method: You can choose how to calculate the interest rate: spot value, average, weekly average

- Rounding: You can define the interest rate rounding precision

- Negative rate option: You can decide how to handle negative interest rates: “Fixing floored at zero” means that the fixing value is floored at zero, and the spread is applied; “Never Negative” means that (fixing value + spread) is floored at zero.

- Number of days: Indicates the number of days to compute the fixing date with regard to the reference period.

- Day Type: Indicates which type of day is used for the day count convention

- Relating to: Indicates if the day count applies from the start or the end of the period

And Much More…

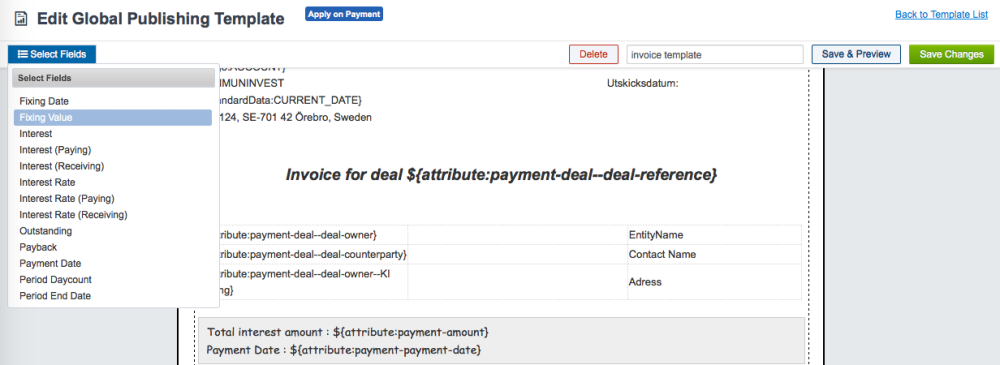

Interest Computation Details in Invoice Publishing Templates

In “Payment” templates (global settings), it is now possible to display information related to the interest rate computation: period start date, period end date, day count convention, fixing, interest rate, etc. To get an overview of all the relevant data, without having to look through thousands of documents!

Batch Update for Repayment Actions

The batch update via XML is now supported for loan repayment actions.

Ratios with Two Parameters

You can now add ratios with two parameters when configuring entity compliance policies. For instance, it is possible to set a ratio with the part of rate commitment being between X and Y years.

Coming Soon…

Cancelable and Extendable Swaps

Two new transactions are expected to be supported by the system: cancelable and extendable swaps.

A cancelable swap is a vanilla swap in which one of the counterparties has the right, but not the obligation, to terminate the swap on one or more specified dates during the swap’s term to maturity.

An extendable swap is a vanilla swap where one of the counterparties has the right, but not the obligation, to enter into a new swap extending the term of the initial swap.

In other words, cancelable and extendable swaps are structured instruments that embed a vanilla swap and a swaption.