Fairways Debt enables you to create CDC (Caisse des Dépôts et Consignations) loans.

Prerequisite

- Add the CDC loan type to your customer account (contact your Finance Active consultant)

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account, if relevant.

- Navigate to Applications

> Debt & Derivatives.

> Debt & Derivatives.

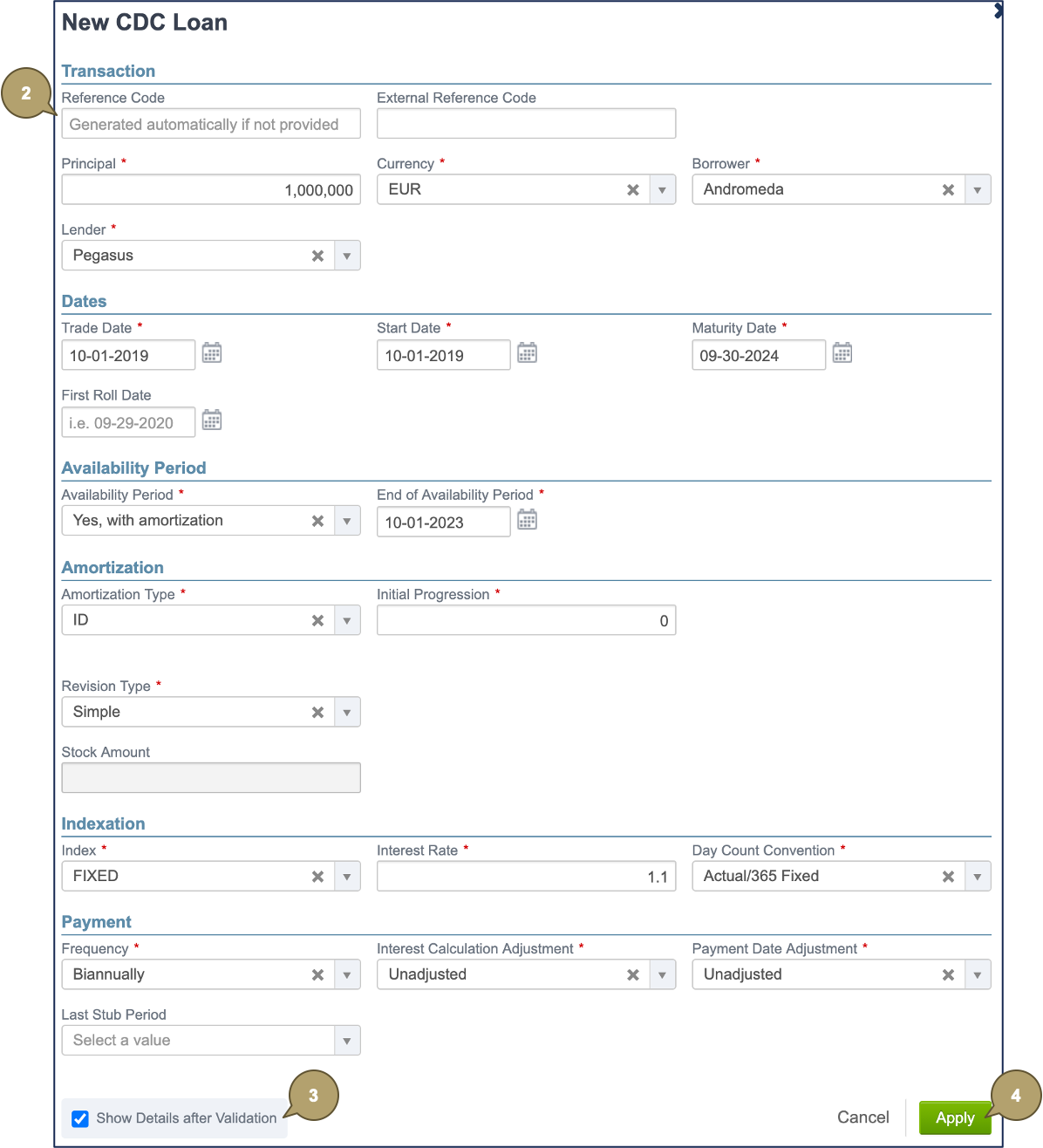

Create a CDC Loan

- Click Add Transaction > Loan > CDC Loan.

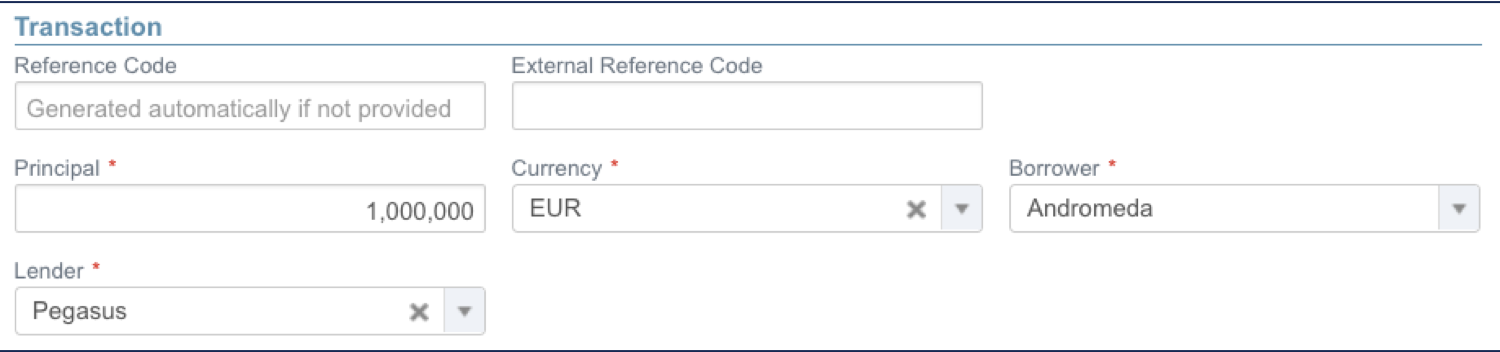

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

Reference Code |

Unique reference of the transaction. Identifies the transaction in the portfolio. Note: The reference must be unique among all the entities managed in the account. |

|

External Reference Code |

Used by external systems to identify the transaction. Used when transactions are imported from or exported to another system. |

|

Principal |

Principal amount of the loan. |

|

Currency |

Currency of the principal amount. |

|

Borrower |

Borrowing entity in the system. |

|

Lender |

Can be either internal (an entity in the system) or external (a commercial bank). |

|

Field |

Description |

|---|---|

|

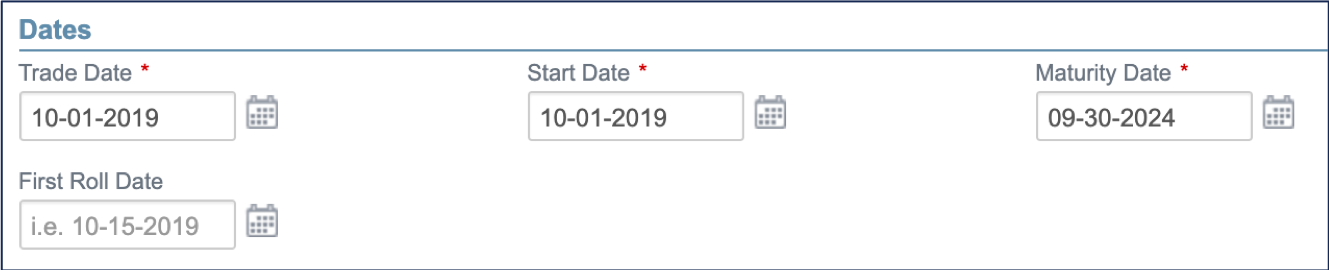

Trade Date |

Date at which the transaction has been traded. From that date, the system takes the transaction into account as an item of the portfolio. |

|

Start Date |

Unadjusted start date of the transaction. |

|

Maturity Date |

Unadjusted maturity date of the transaction. |

|

First Roll Date |

Unadjusted date of the first payment (useful when the first period is a long or short stub). |

|

Field |

Description |

|---|---|

|

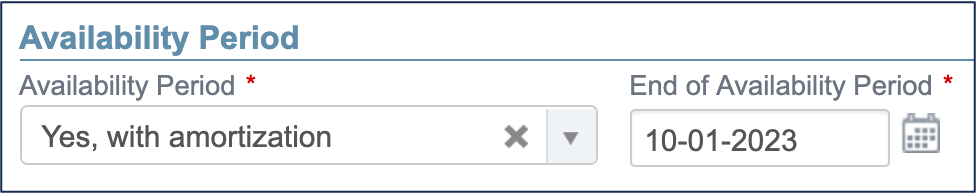

Availability Period |

Indicates if the loan includes drawings and amortization:

Notes:

|

|

End of Availability Period |

Note: This field displays if the availability period is enabled. Indicates the last date at which drawings can be made. |

|

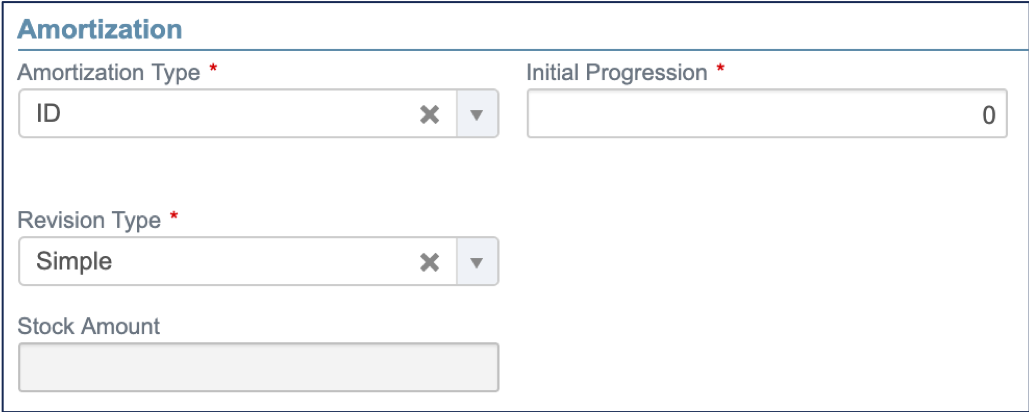

Field |

Description |

|---|---|

|

Amortization Type |

Amortization mode. Notes:

|

| Initial Progression |

|

|

Construction Rate |

Note: This field only displays for the DA amortization type. |

|

Progress Type |

Note: This field only displays for the DA amortization type. |

|

Revision Type |

Note: This field only displays for the ID, ICO, and IP amortization types. |

|

Revision Floor |

Note: This field only displays for the Double Limited revision type. |

|

Stock Amount |

Note: This field only displays for the Double and Double Limited revision types. |

|

Amortization Progression |

Note: This field only displays for the ICO amortization type. |

|

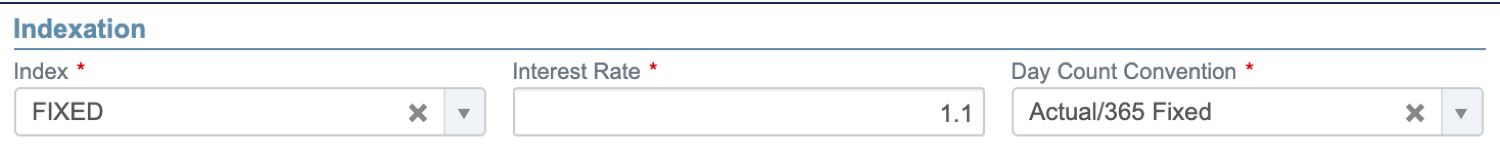

Field |

Description |

|---|---|

|

Index |

Name of the index used to calculate the rate value, e.g. FIXED for a fixed rate. Note: The field beside displays depending on the index selected. |

|

Interest Rate |

Fixed rate value in percentage. Note: This field displays depending on the index selected. |

|

Initial Interest Rate |

Initial rate of the custom index. Note: This field displays depending on the index selected. |

|

Spread |

Spread (or margin) value in percentage. Note: This field displays depending on the index selected. |

|

Used to compute the day fraction of an interest accrual period. |

|

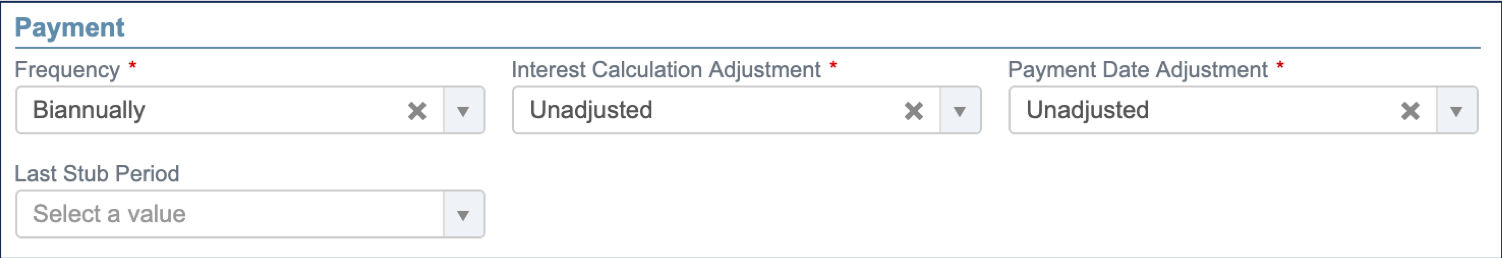

Field |

Description |

|---|---|

|

Frequency |

Frequency of the payments. |

|

Adjustment mode for the interest calculation. The nominal start and end dates of the accrual period will be adjusted accordingly before computing the interest amount. |

|

|

Adjustment mode for the payment date. |

|

|

Last Stub Period |

Defines whether the last period should be a short or long stub when it does not match the selected frequency:

Note: If neither stub is selected, the short stub applies by default. |

Enter the required custom attributes, if any.

- Enable Show Details after Validation to automatically open the new CDC loan profile once created.

- Click Apply.

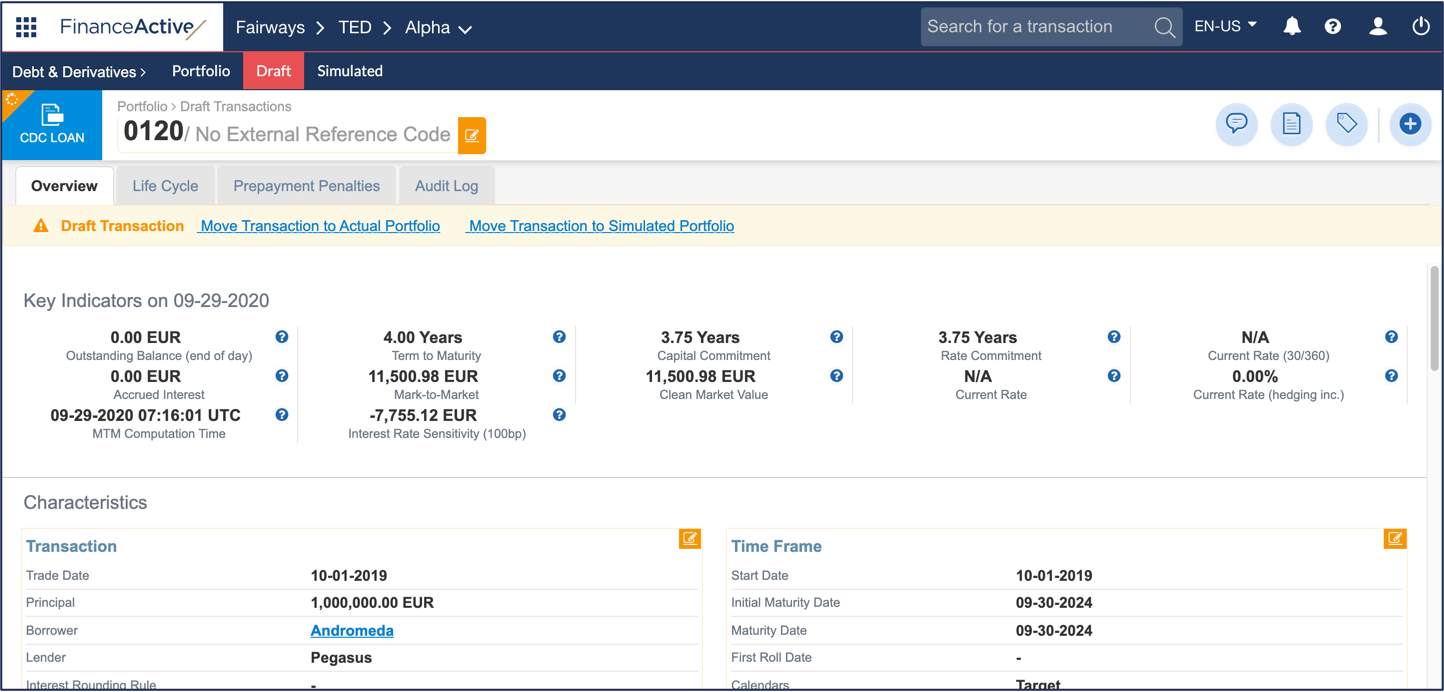

The new CDC loan displays in the draft portfolio.