A bond is a debt issued by a party to the market. It is evidenced by a note specifying: the principal amount, the interest rate, the repayment date, etc.

In terms of schedule and interest computation, a bond is similar to a standard loan.

In Fairways Debt, the bond counterparty is a generic counterparty called MARKET.

Prerequisite

- Enable the Bond transaction type (contact your Finance Active consultant)

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Debt & Derivatives.

Create a Bond

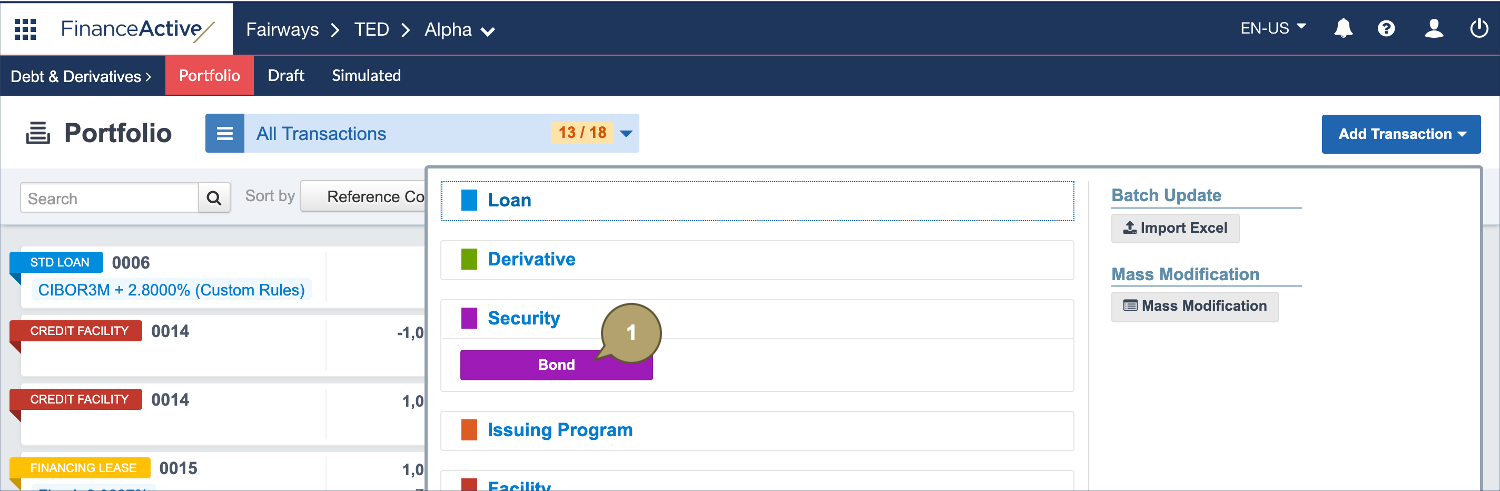

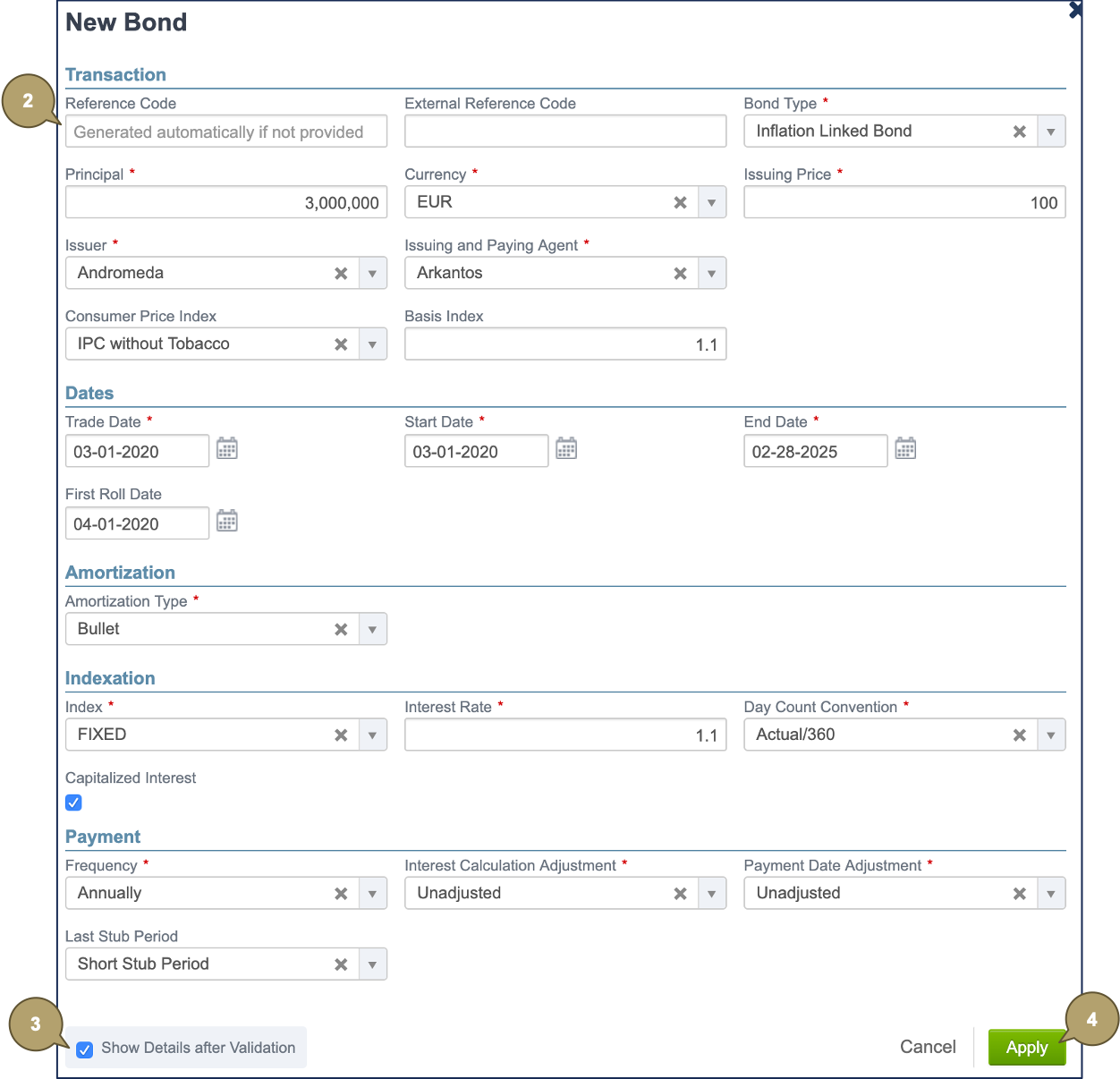

- Click Add Transaction > Security > Bond.

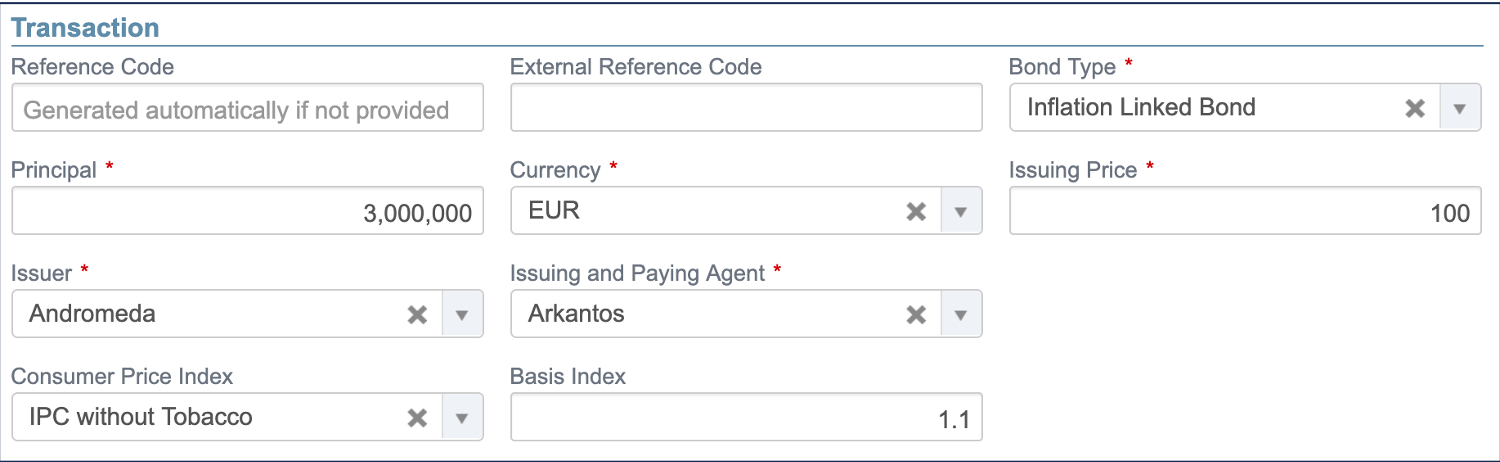

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

Reference Code |

Identifies the transaction in the portfolio. Note: The reference must be unique among all the entities managed in the account. |

|

External Reference Code |

Used by external systems to identify the transaction. Used when transactions are imported from or exported to another system. |

|

Bond Type |

Type of the bond. |

|

Principal |

Principal amount of the transaction. |

|

Currency |

Currency of the principal amount. |

|

Issuing Price |

Computes the initial bond premium. An issuing price of 100% means that there is no initial bond premium. |

|

Issuer |

Issuer entity in the system. |

|

Issuing and Paying Agent |

A third party, usually a commercial bank, which accepts the payments from the issuer and then distributes the related amount to the holders of the bond. |

|

Consumer Price Index |

Note: These fields are only available for inflation linked bonds. Measures the weighted average of prices of a basket of consumer goods and services. |

|

Basis Index |

|

Field |

Description |

|---|---|

|

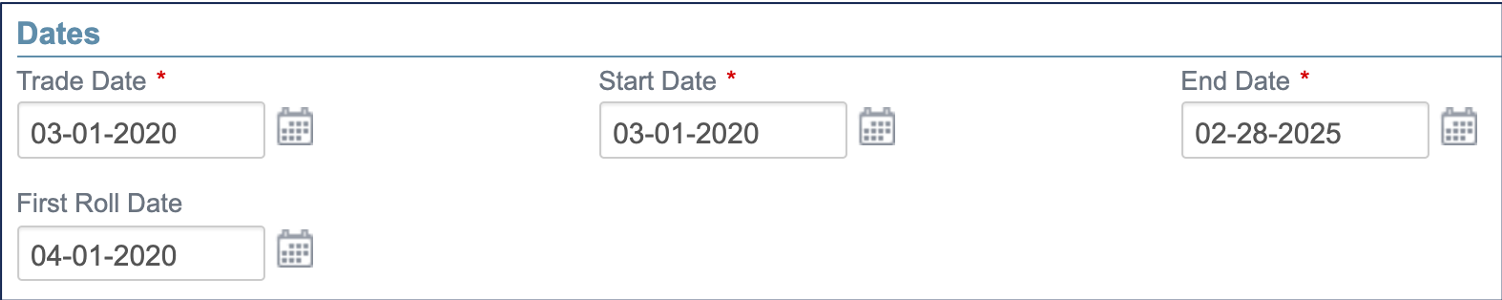

Trade Date |

Date at which the transaction has been traded. From that date, the system takes the transaction into account as an item of the portfolio. |

|

Start Date |

Unadjusted start date of the transaction. |

|

End Date |

Unadjusted end date of the transaction. |

|

First Roll Date |

Unadjusted date of the first payment (useful when the first period is a long or short stub). |

|

Field |

Description |

|---|---|

|

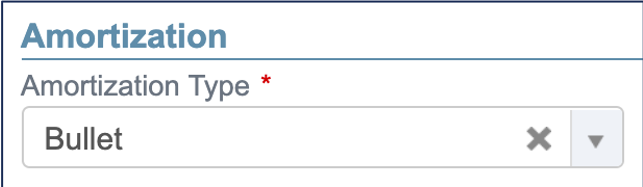

Amortization Type |

Amortization mode. |

|

Extended Constant Annuity Date |

Note: This field displays if extended constant annuities are selected as amortization type. Indicates the date until which constant annuities will be computed (a transaction with a maturity date corresponding to the extended constant annuity date would amortize to zero at this date). |

|

Field |

Description |

|---|---|

|

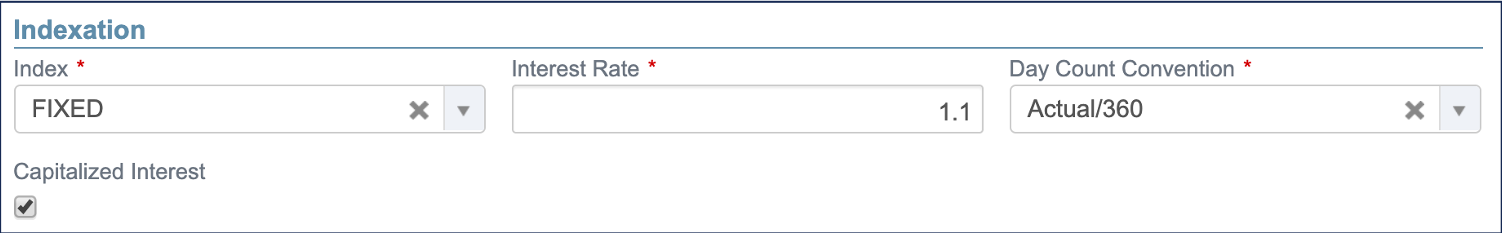

Index |

Name of the index used to calculate the rate value, e.g. FIXED for a fixed rate. Note: The field beside displays depending on the index selected. Only a fixed index can be defined if constant annuities or extended constant annuities are selected as the amortization type. |

|

Interest Rate |

Fixed rate value in percentage. Note: This field displays depending on the index selected. |

|

Initial Interest Rate |

Initial rate of the custom index. Note: This field displays depending on the index selected. |

|

Spread |

Spread (or margin) value in percentage. Note: This field displays depending on the index selected. |

|

Day Count Convention |

Used to compute the day fraction of an interest accrual period. |

|

Capitalized Interest |

Defines whether the interest amount should be paid at the payment date, or added to the principal (and included in the outstanding balance for the following periods). |

|

Field |

Description |

|---|---|

|

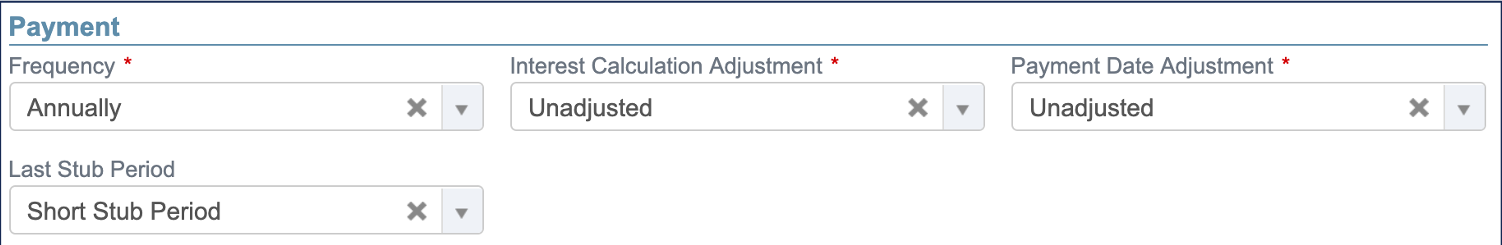

Frequency |

Frequency of the payments. |

|

Adjustment mode for the interest calculation. The nominal start and end dates of the accrual period will be adjusted accordingly before computing the interest amount. |

|

|

Adjustment mode for the payment date. |

|

|

Last Stub Period |

Defines whether the last period should be a short or long stub when it does not match the selected frequency:

Note: If neither stub is selected, the short stub applies by default. |

Enter the required custom attributes, if any.

- Enable Show Details after Validation to automatically open the new transaction profile once created.

- Click Apply to create the bond.

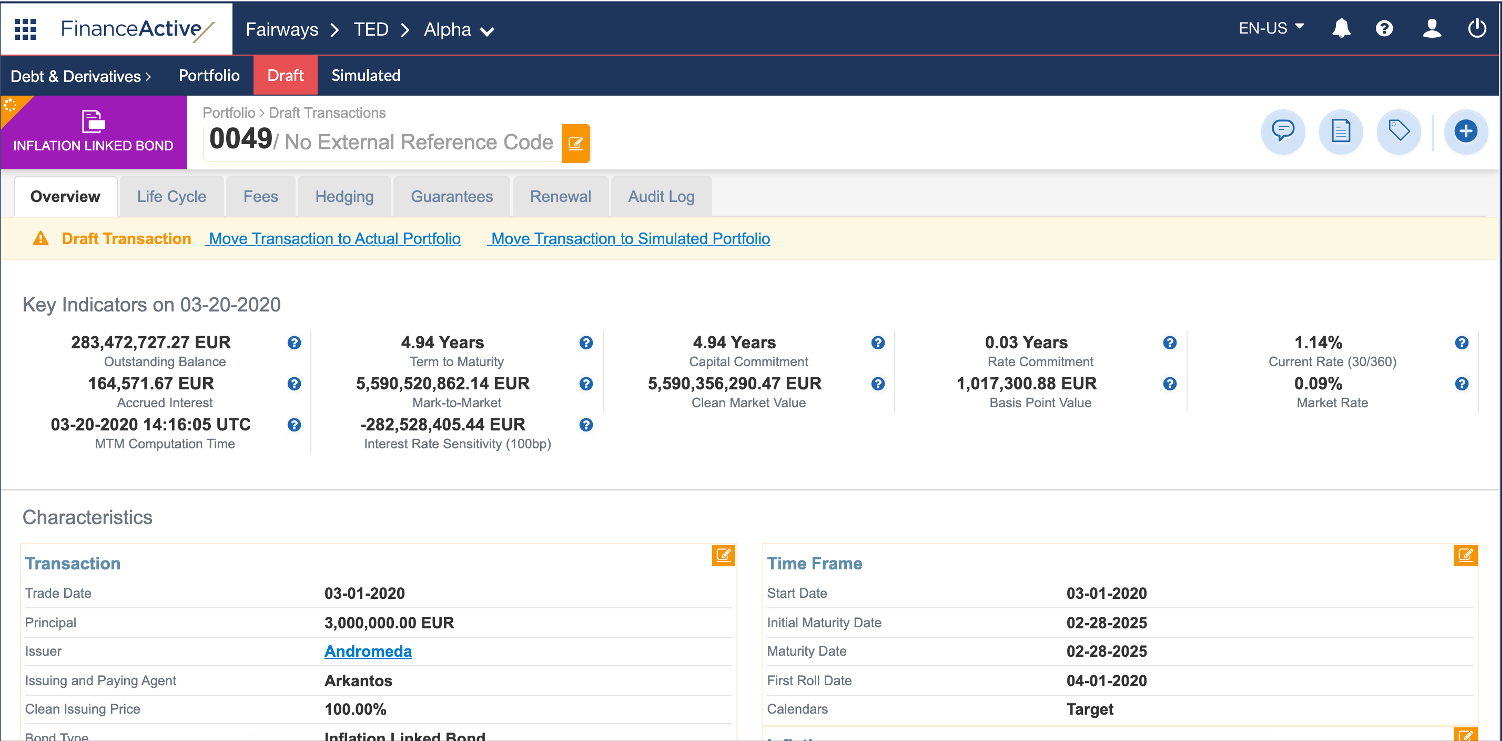

The new bond displays in the draft portfolio.

Adjustment

Adjustment modes define how the system rolls dates in case of holidays in the calendar.

|

Field |

Description |

|---|---|

|

Unadjusted |

Not rolled. |

|

Preceding |

Rolled to the previous business day. |

|

Following |

Rolled to the next business day. |

|

Modified Preceding |

Rolled to the previous business day, only if that day occurs in the same month. Otherwise, rolled to the next business day. |

|

Modified Following |

Rolled to the next business day, only if that day occurs in the same month. Otherwise, rolled to the previous business day. |

|

End of Month (unadjusted) |

Rolled to the last day of the month. |

|

End of Month (preceding) |

Rolled to the last day of the month, then adjusted to the previous business day. |

|

Modified Following (year) |

Rolled to the next business day, only if that day occurs in the same year. Otherwise, rolled to the previous business day. |