Periodic fees in Fairways Debt are paid at defined periods and computed using the maximum outstanding amount of the transaction.

Prerequisite

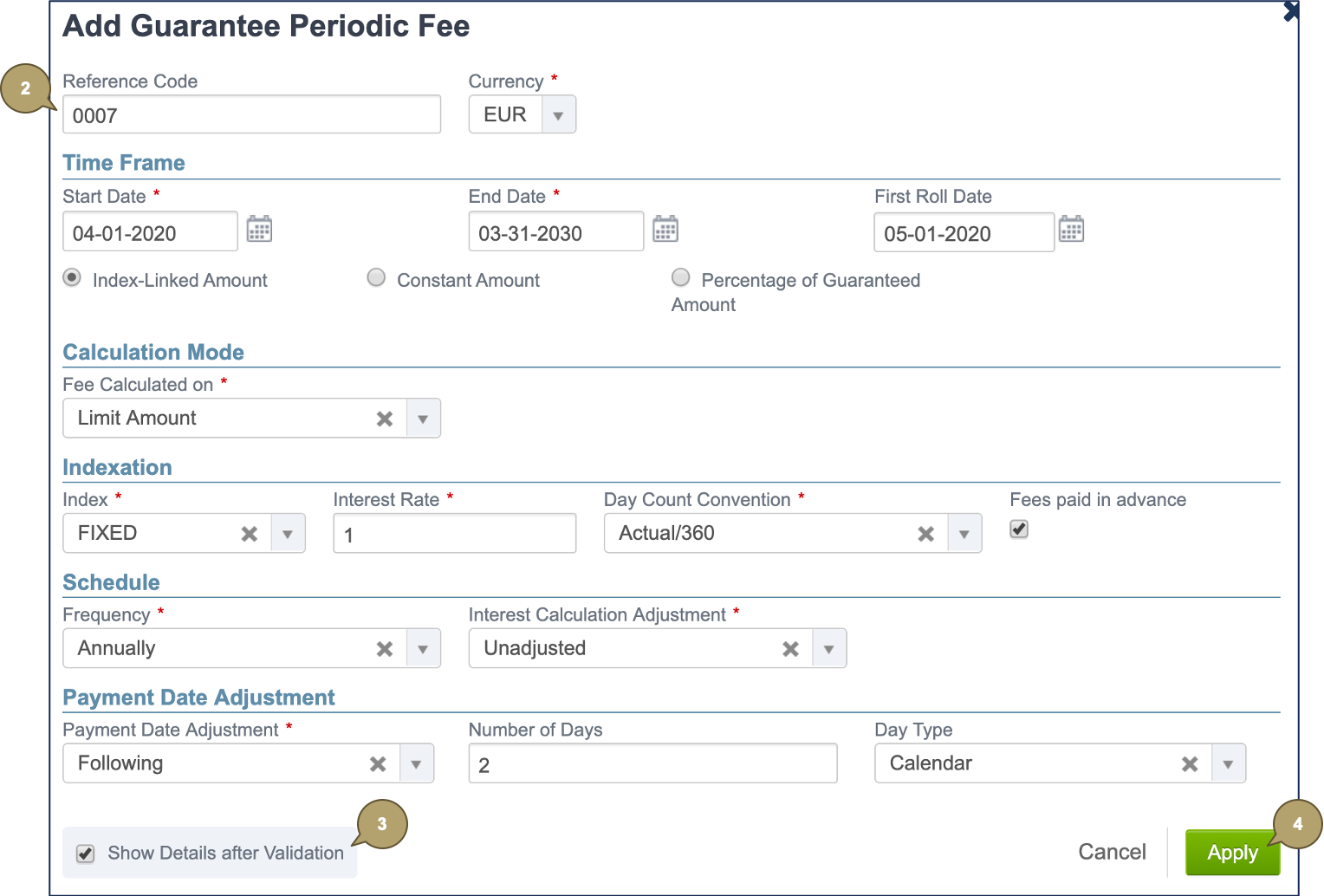

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Debt & Derivatives.

Navigate to the Fees Tab

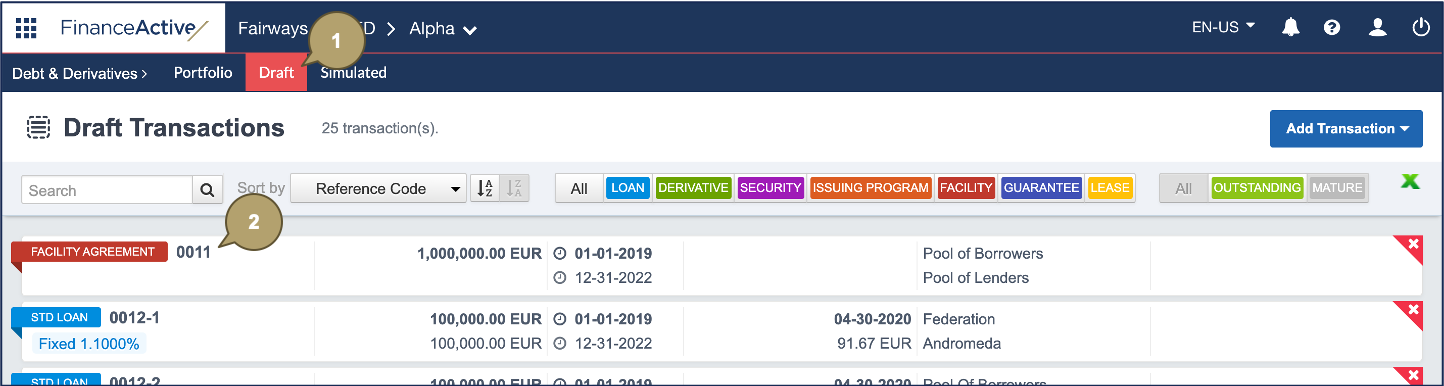

- Navigate to Draft.

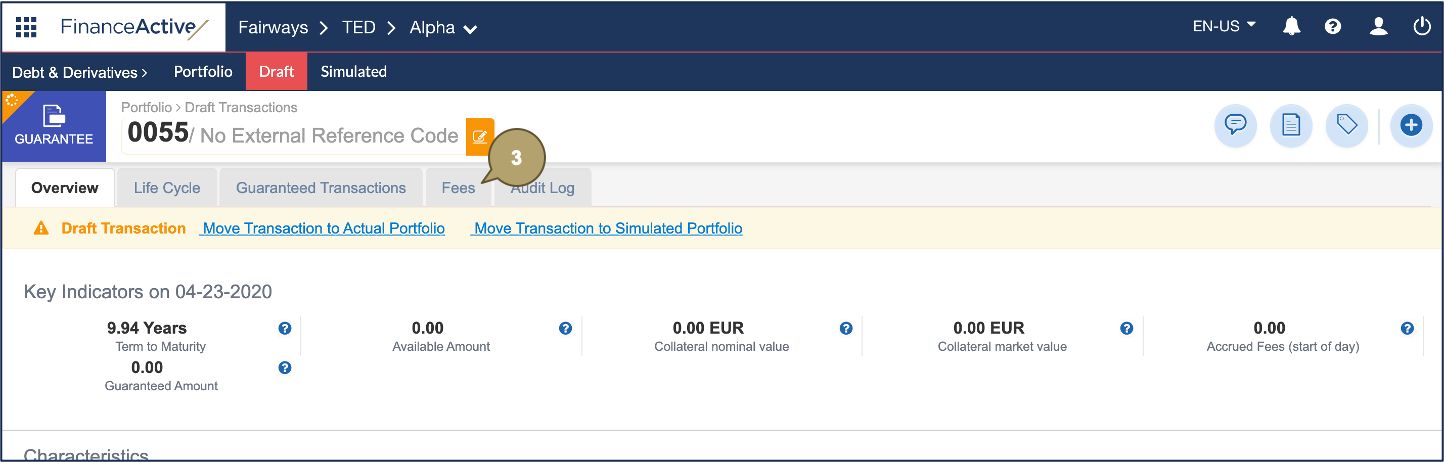

- Click the relevant transaction to open its profile.

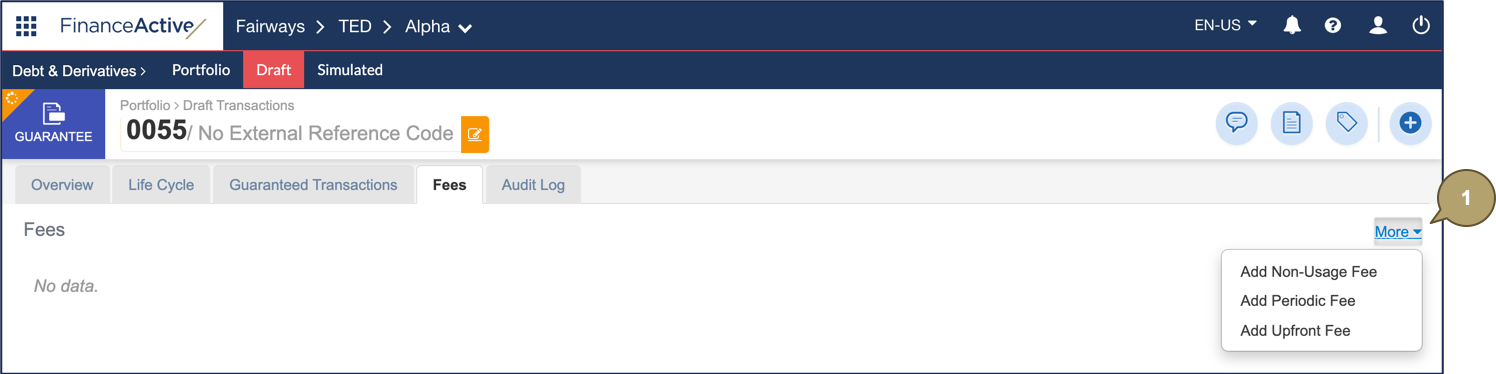

- Navigate to Fees.

Add a Periodic Fee

- Click More > Add Periodic Fee.

- Complete the form with all relevant details.

Notes:

- Fields marked with an asterisk * are mandatory.

- Different fields and layouts display depending on the parent transaction.

|

Field |

Description |

|---|---|

|

Reference Code |

Unique reference of the fee. |

|

Currency |

Currency of the fee. |

|

Field |

Description |

|---|---|

|

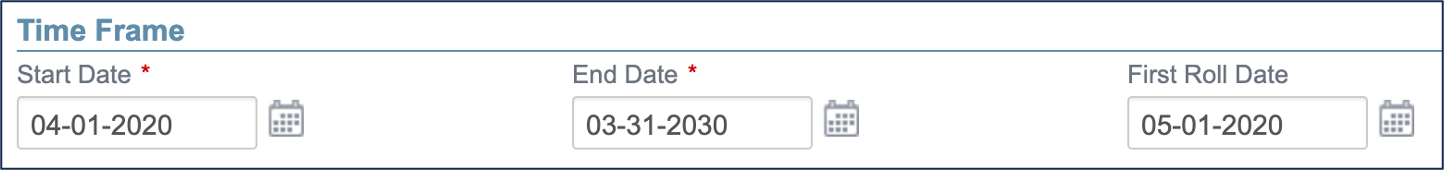

Start Date |

Unadjusted start date of the fee. |

|

Maturity Date |

Unadjusted maturity date of the fee. |

|

First Roll Date |

Unadjusted date of the first payment . |

|

Field |

Description |

|---|---|

|

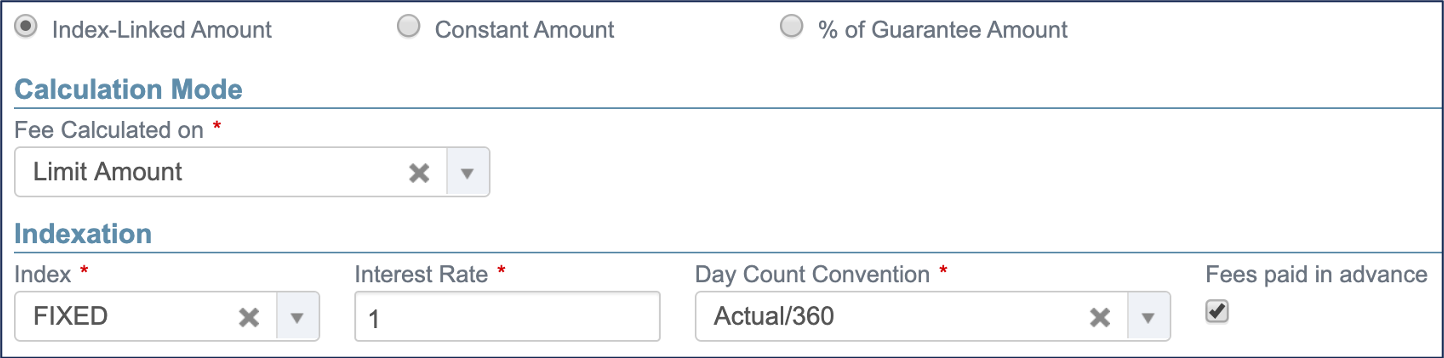

Fee Type |

How the fee payment is calculated and paid. Note: Additional fields display depending on the selected. |

|

Fee Calculated On |

Note: This field only displays for index-linked amounts. Amount used for calculating the fees. |

|

Index |

Note: This field only displays for index-linked amounts. Name of the index used to calculate the rate value. |

|

Interest Rate |

Note: This field only displays for fixed indexes. Fixed rate value in percentage. |

|

Initial Interest Rate |

Note: This field only displays for custom indexes. Initial rate of the custom index. |

|

Spread |

Note: This field only displays for floating indexes. Spread (or margin) value in percentage. |

|

Day Count Convention |

Note: This field only displays for index-linked amounts. Used to compute the day fraction of an interest accrual period. |

|

Fees Paid in Advance |

Note: This field only displays for index-linked and percentage-guaranteed amounts. Defines whether the fees should be paid at the start of the period. |

|

Constant Amount |

Note: This field only displays for constant amounts. Fixed amount. |

|

Percentage of Guaranteed Amount |

Note: This field only displays for percentage-guaranteed amounts. Amount based on a percentage of the guaranteed amount. |

|

Percentage of Outstanding |

Note: This field only displays for caps and floors using the Percentage of Outstanding type. Amount based on a percentage of the outstanding notional amount. |

|

Field |

Description |

|---|---|

|

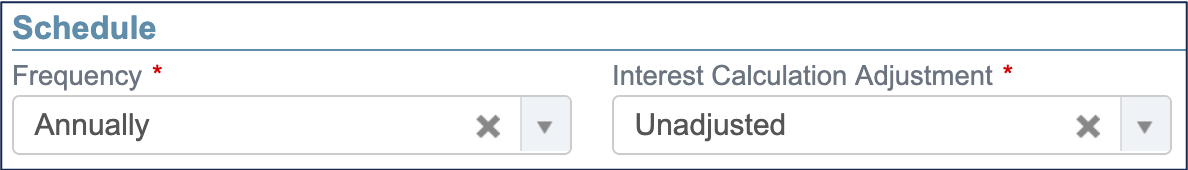

Frequency |

Frequency of the payments. |

|

Adjustment mode for the interest calculation. The nominal start and end dates of the accrual period will be adjusted accordingly before computing the interest amount. |

|

Field |

Description |

|---|---|

|

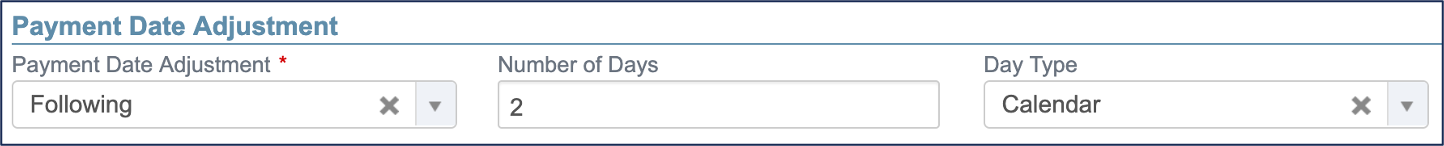

Adjustment mode for the payment date. |

|

|

Number of Days |

Number of days to move from the payment date mode selected, can be earlier or later, e.g.:

|

|

Day Type |

|

- Enable Show Details after Validation to automatically open the new fee profile once created.

- Click Apply.

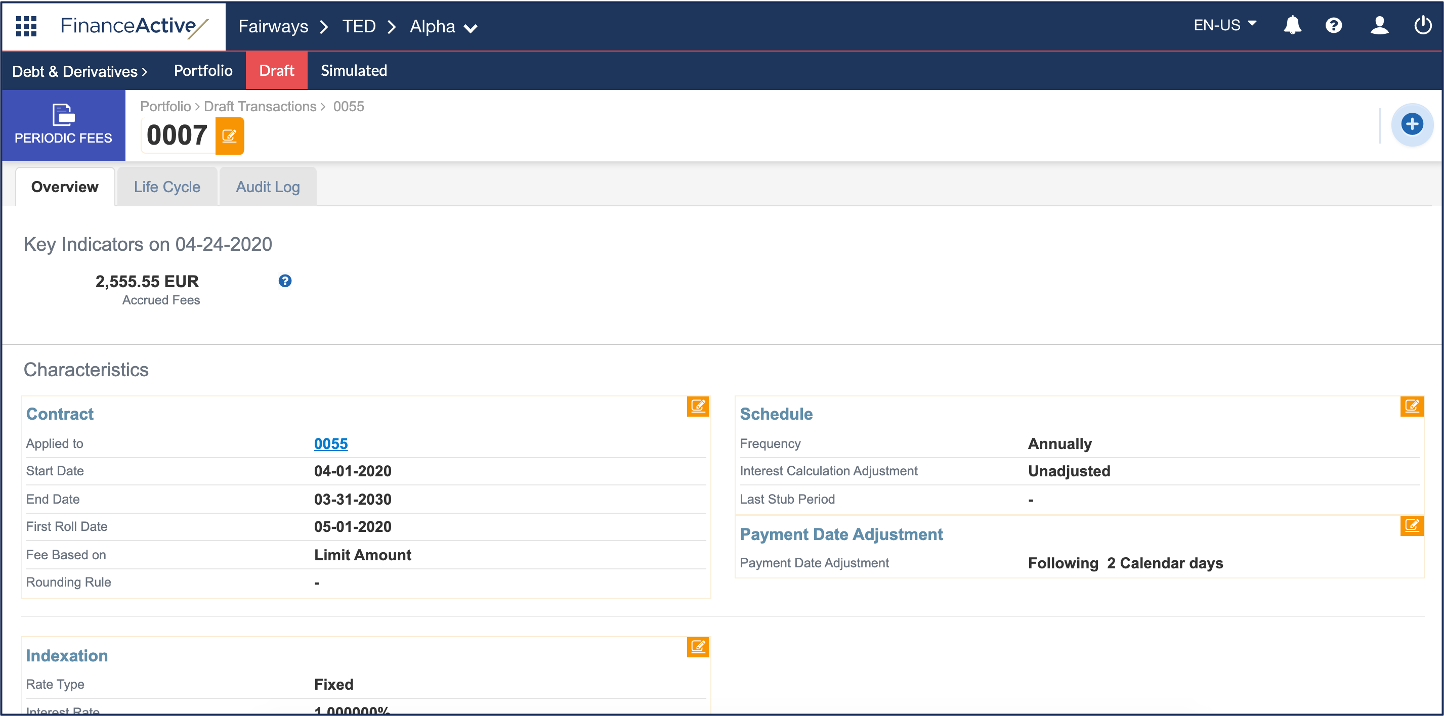

The new periodic fee displays.