A facility agreement in Fairways Debt is an envelope involving different tranches subject to specific legal conditions (standard loans), which can be shared among pools of different lenders and borrowers. Third parties are not necessarily involved in all tranches. This type of financing transaction is widely used in the real estate sector.

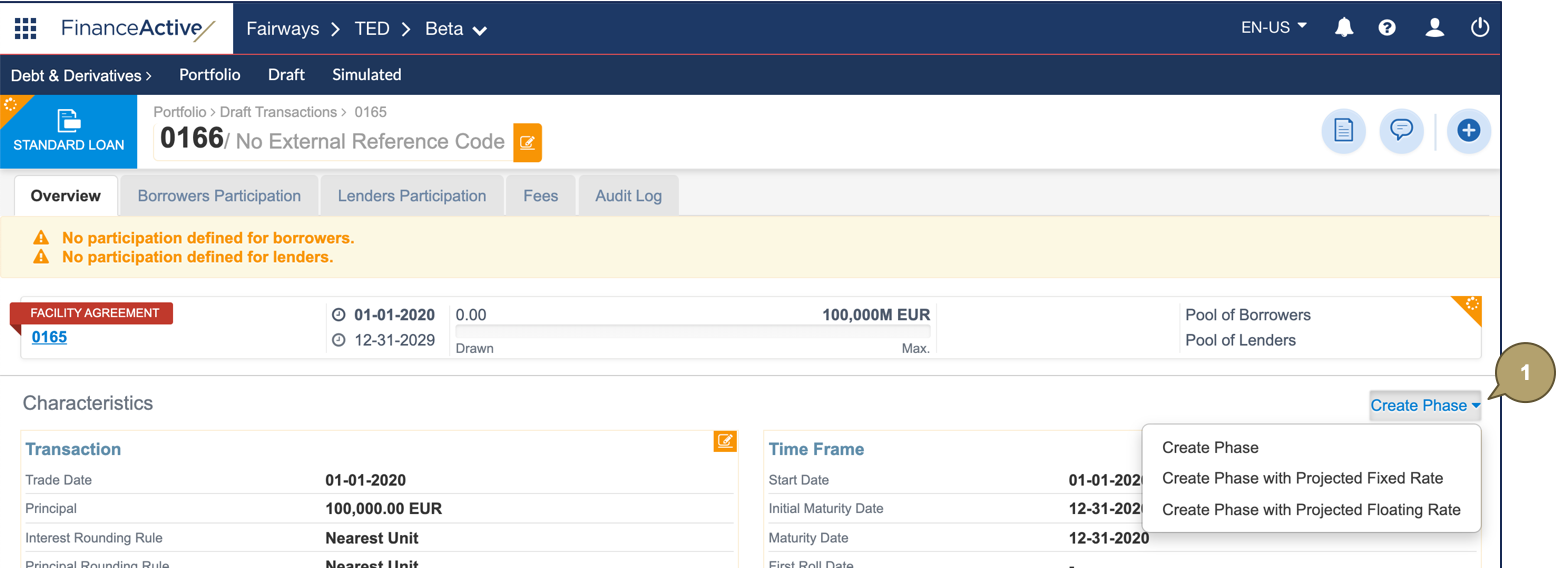

Create:

- Standard phases to add a fixed/floating rate change confirmed in the contract.

- Phases with projected fixed rates to estimate the future fixed rate, based on the swap rate and a spread, and to create an event that will notify you when the rate will be fixed.

- Phases with projected floating rates to create an event that will notify you when the new index is determined.

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Debt & Derivatives.

Open a Facility Agreement Tranche

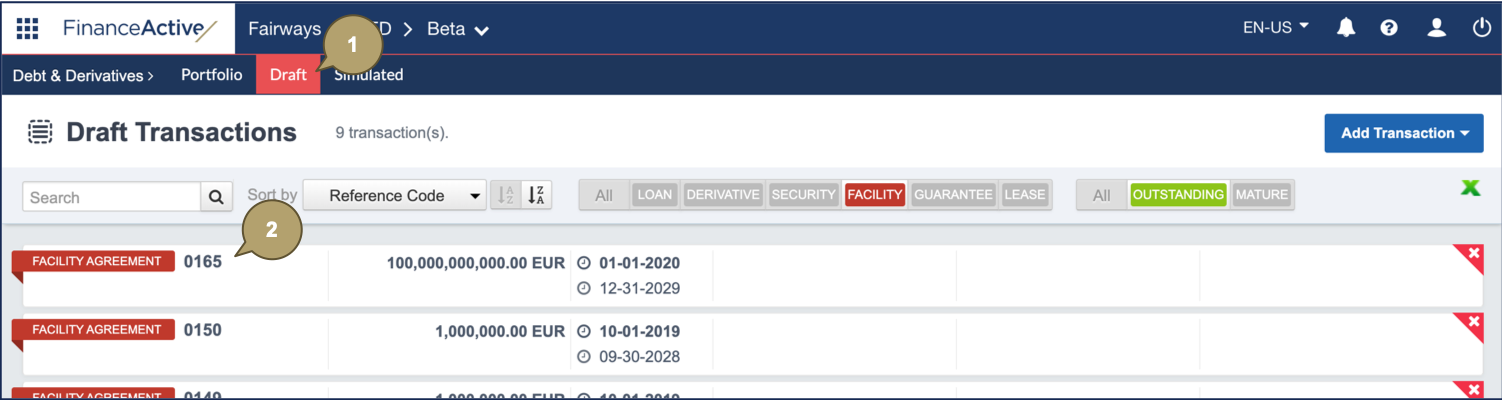

- Navigate to Draft.

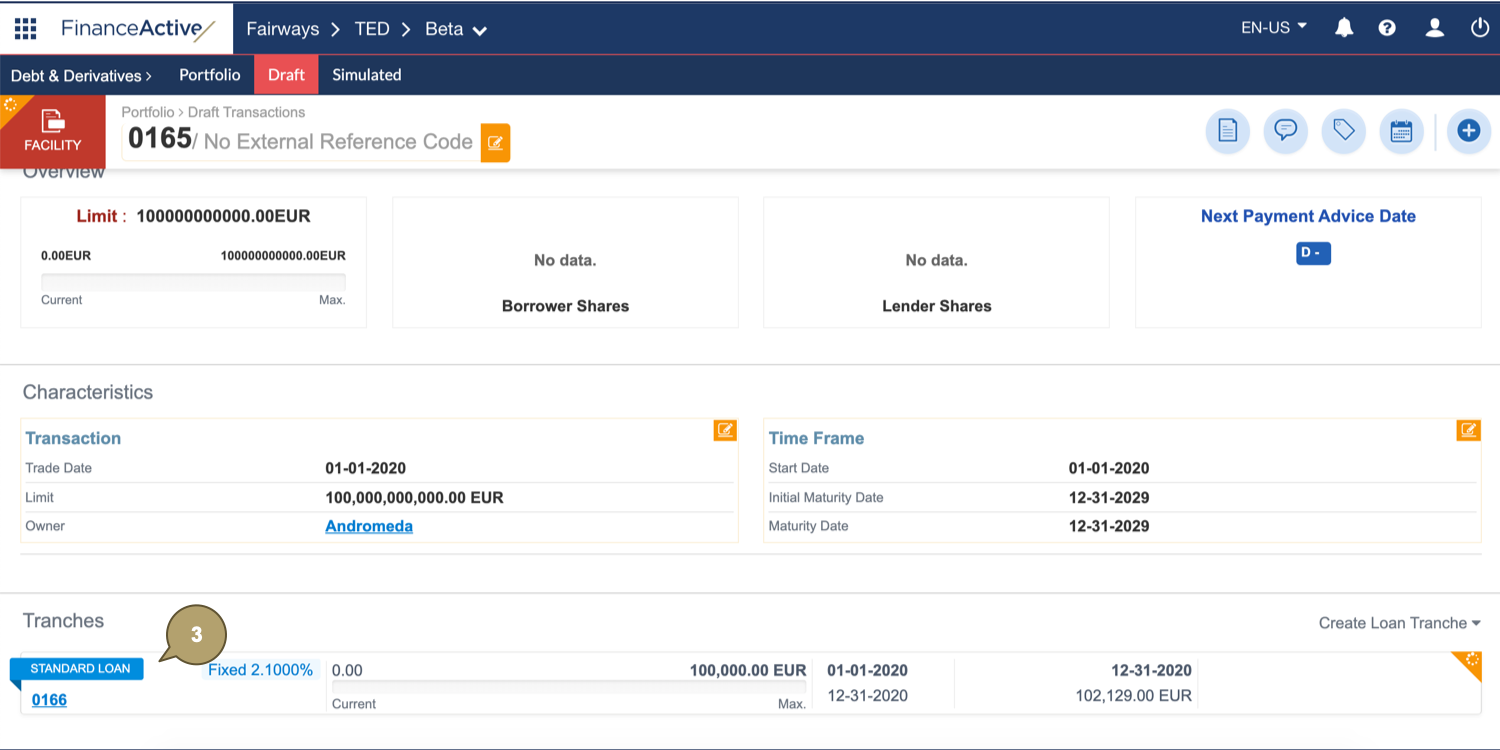

- Click the relevant facility agreement to open its profile.

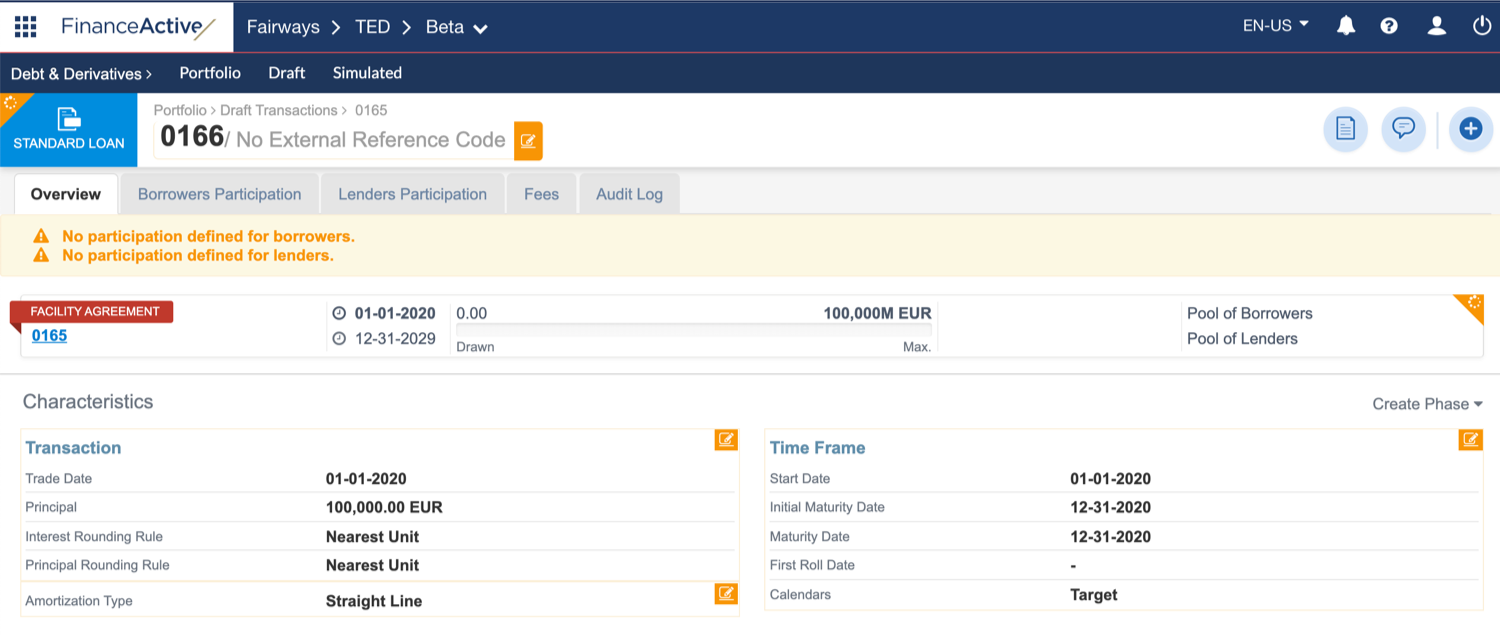

- Click the relevant tranche to open its profile.

The tranche profile displays.

Create a Standard Phase in a Facility Agreement Tranche

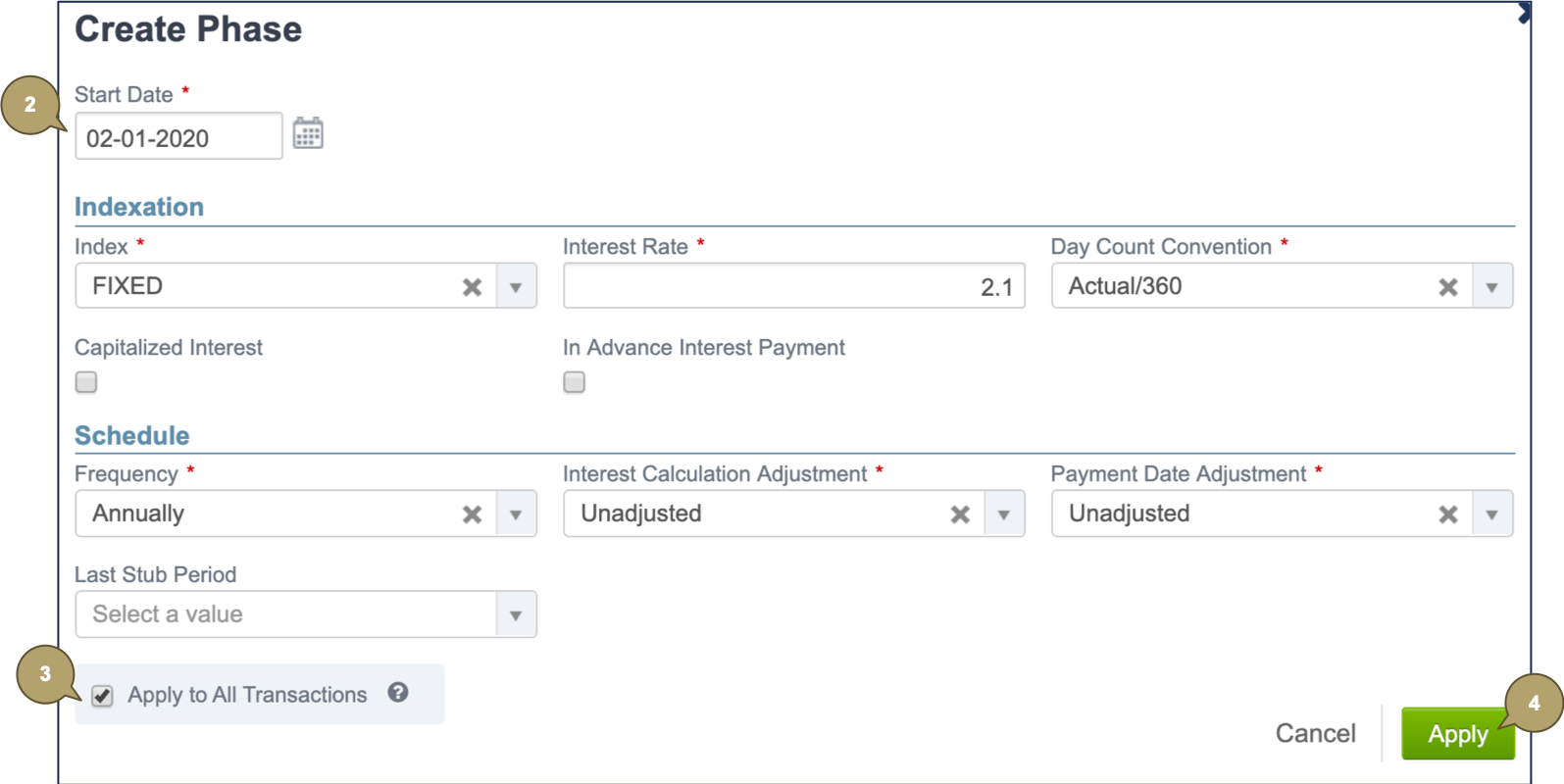

- Click Create Phase > Create Phase.

- Complete the form with all relevant details.

Notes:

- Fields marked with an asterisk * are mandatory.

- The tranche characteristics apply by default.

|

Field |

Description |

|---|---|

|

Start Date |

Unadjusted start date of the phase. |

|

Field |

Description |

|---|---|

|

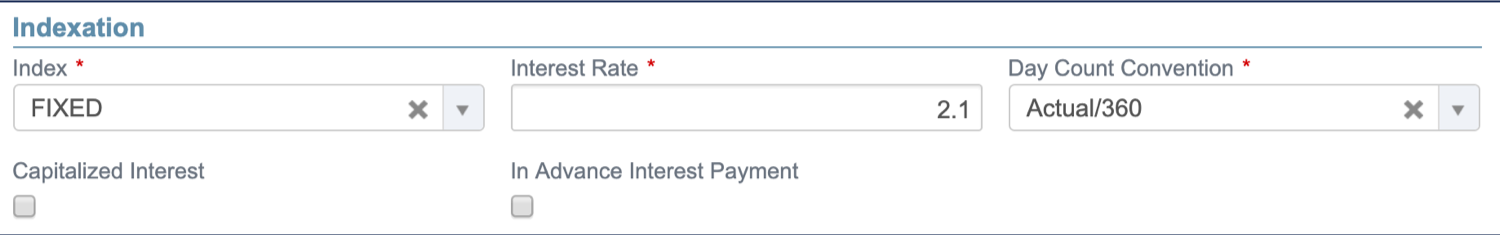

Index |

Name of the index used to calculate the rate value, e.g. FIXED for a fixed rate. Note: The field beside displays depending on the index selected. |

|

Interest Rate |

Fixed rate value in percentage. Note: This field displays depending on the index selected. |

|

Initial Interest Rate |

Initial rate of the custom index. Note: This field displays depending on the index selected. |

|

Spread |

Spread (or margin) value in percentage. Note: This field displays depending on the index selected. |

|

Day Count Convention |

Computes the day fraction of an interest accrual period. |

|

Capitalized Interest |

Defines whether the interest amount should be paid at the payment date, or added to the principal (and included in the outstanding balance for the following periods). |

|

In Advance Interest Payment |

Defines whether the interest amount should be paid at the start of the period. |

|

Field |

Description |

|---|---|

|

Frequency |

Frequency of the payments. |

|

Adjustment mode for the interest calculation. The nominal start and end dates of the accrual period will be adjusted accordingly before computing the interest amount. |

|

|

Adjustment mode for the payment date. |

|

|

Last Stub Period |

Defines whether the last period should be a short or long stub when it does not match the selected frequency:

Note: If neither stub is selected, the short stub applies by default. |

- Enable Apply to All Transactions to apply these characteristics to all transactions of the phase.

- Click Apply.

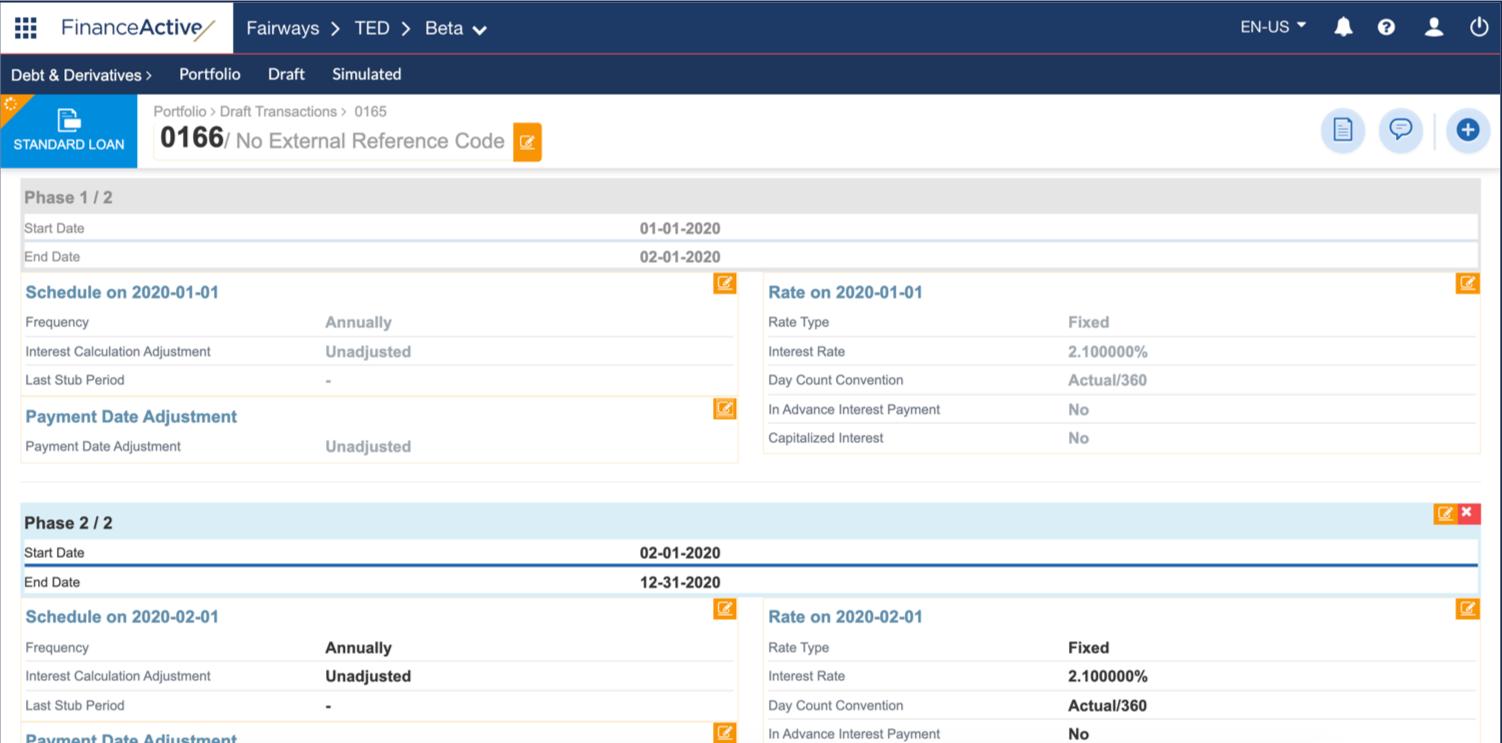

The new phase(s) display(s) in the tranche.

Adjustment

Adjustment modes define how the system rolls dates in case of holidays in the calendar.

|

Field |

Description |

|---|---|

|

Unadjusted |

Not rolled. |

|

Preceding |

Rolled to the previous business day. |

|

Following |

Rolled to the next business day. |

|

Modified Preceding |

Rolled to the previous business day, only if that day occurs in the same month. Otherwise, rolled to the next business day. |

|

Modified Following |

Rolled to the next business day, only if that day occurs in the same month. Otherwise, rolled to the previous business day. |

|

End of Month (unadjusted) |

Rolled to the last day of the month. |

|

End of Month (preceding) |

Rolled to the last day of the month, then adjusted to the previous business day. |

|

Modified Following (year) |

Rolled to the next business day, only if that day occurs in the same year. Otherwise, rolled to the previous business day. |