For pricing constant maturity swaps (CMS), swaps and caps, and especially how convexity adjustment is managed, Finance Active uses the method developed by Patrick Hagan in his article Convexity Conundrums: Pricing CMS Swaps, Caps and Floors.

In our notation, today is always t = 0.

|

Property |

Description |

|---|---|

|

Z(t;T) |

Value at date t of a zero-coupon bond with maturity T. |

|

D(T) |

Today's discount factor for maturity T. |

Let's consider:

- A CMS swap leg paying the N year swap rate.

- j = 1, 2, …, m

|

Property |

Description |

|---|---|

|

|

Dates of the CMS leg specified in the contract. |

|

|

Year fraction of interval j. |

|

|

N year swap rate. |

For each period j, the CMS leg pays:

paid at

paid at

|

Property |

Description |

|---|---|

|

|

Reference rate, par rate for a standard swap that starts at date |

|

|

Payment dates of the swap fixed legs. |

|

|

Fraction of a year for each fixed leg period j. |

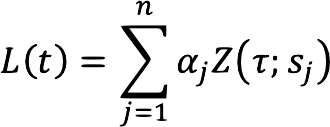

The level of the swap is defined as:

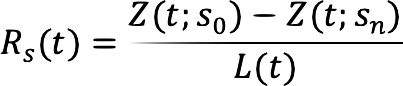

The forward swap rate is:

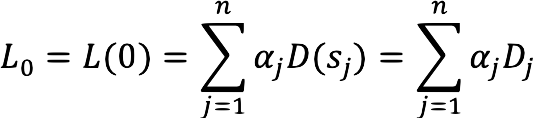

In particular, today’s level is:

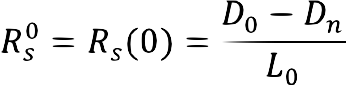

And today’s swap rate is:

We begin with the pricing of a CMS caplet. The payoff of a CMS caplet with a fixing date τ is:

![]()

paid at

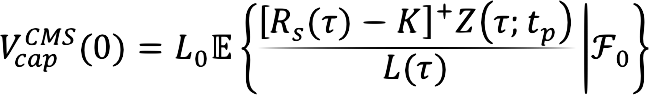

From the fundamental formula of the pricing, today’s value of the caplet is (under the level numeraire):

The ratio Z(τ; )/L(τ) is a martingale under the level numeraire, so its average value is today’s value:

)/L(τ) is a martingale under the level numeraire, so its average value is today’s value:

![]()

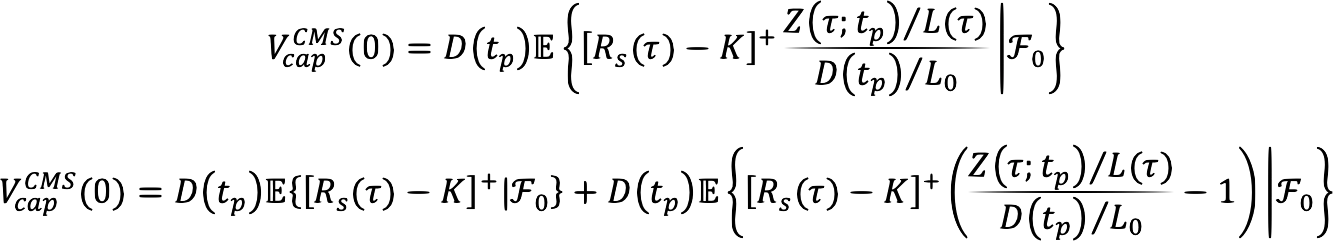

By dividing Z(τ; )⁄L(τ) by its mean, we get:

)⁄L(τ) by its mean, we get:

The first term is the price of a European swaption with the notional D( )⁄

)⁄ . The last term is the convexity correction.

. The last term is the convexity correction.

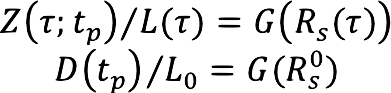

There are two steps in evaluating the convexity correction. The first step is to model the yield curve movement in a way that allows us to rewrite the level L(τ) and the zero-coupon bond Z(τ; ) in terms of the swap rate

) in terms of the swap rate  . Then we can write:

. Then we can write:

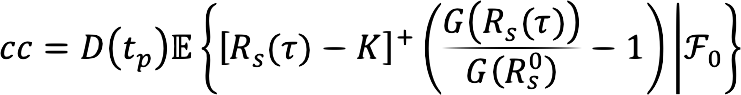

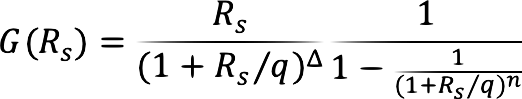

For some G( ) functions, the convexity correction is just the expected value:

) functions, the convexity correction is just the expected value:

|

Property |

Description |

|---|---|

|

q |

Count of periods per year:

|

|

|

Fraction of a period between the swap start date |

The function we use is called standard model (or street-standard model) in Hagan's article:

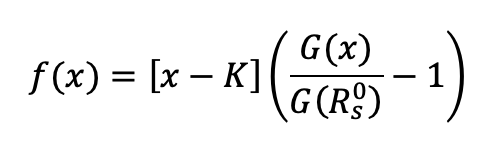

The second step is to replicate the payoff in terms of payer swaptions. For any smooth functions f( ) with f(K)=0, we can write:

) with f(K)=0, we can write:

![]()

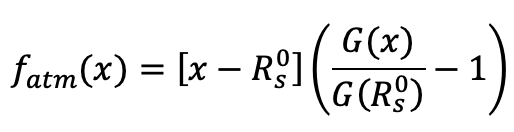

Choosing:

We get:

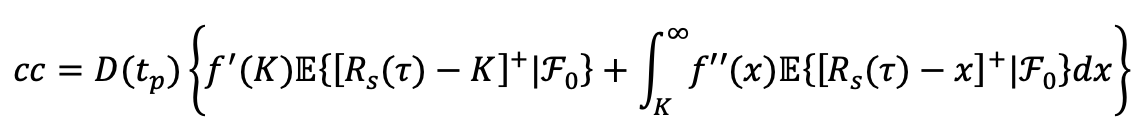

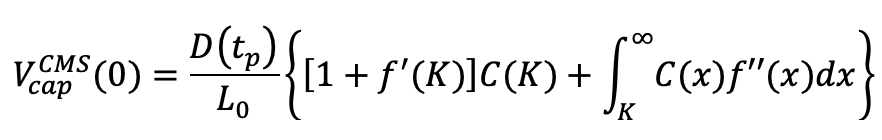

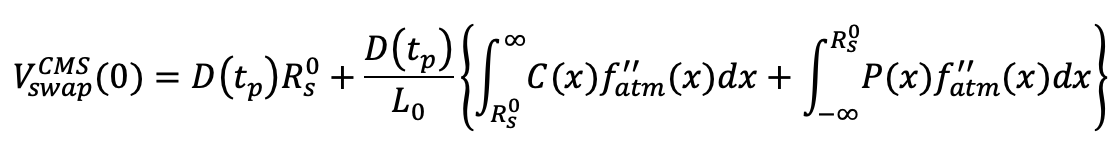

So we get for the value of the CMS caplet:

With the value of a payer swaption with strike x:

![]()

With similar arguments, we get the value of a CMS floorlet:

With the same as f(x) with the strike K replaced by the swap rate  :

:

The values C(x) and P(x) are computed with our internal swaption volatility surfaces, built when supposing the forward swap rate is following the SABR model.

,

,  , …,

, …,

and ends N years later at

and ends N years later at  .

. ,

,  , ...,

, ...,