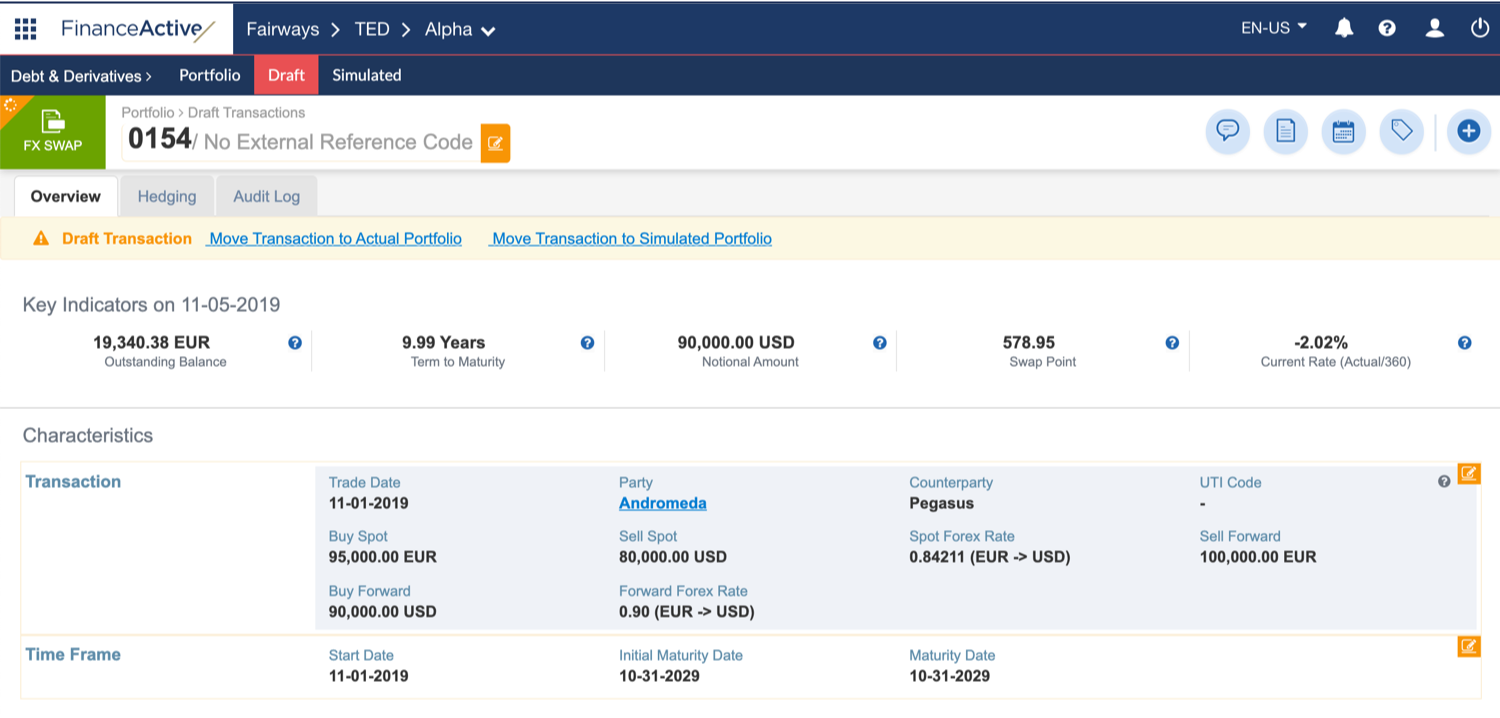

A foreign exchange swap (FX swap) in Fairways Debt is a simultaneous purchase and sale of amounts of one currency for another with two different value dates and may use foreign exchange derivatives.

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Debt & Derivatives.

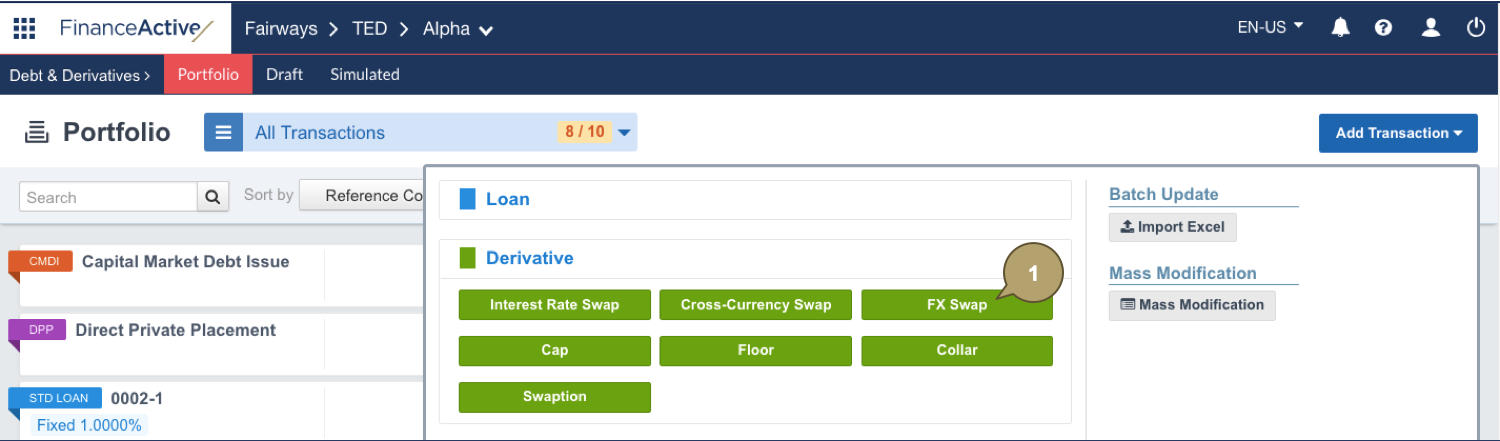

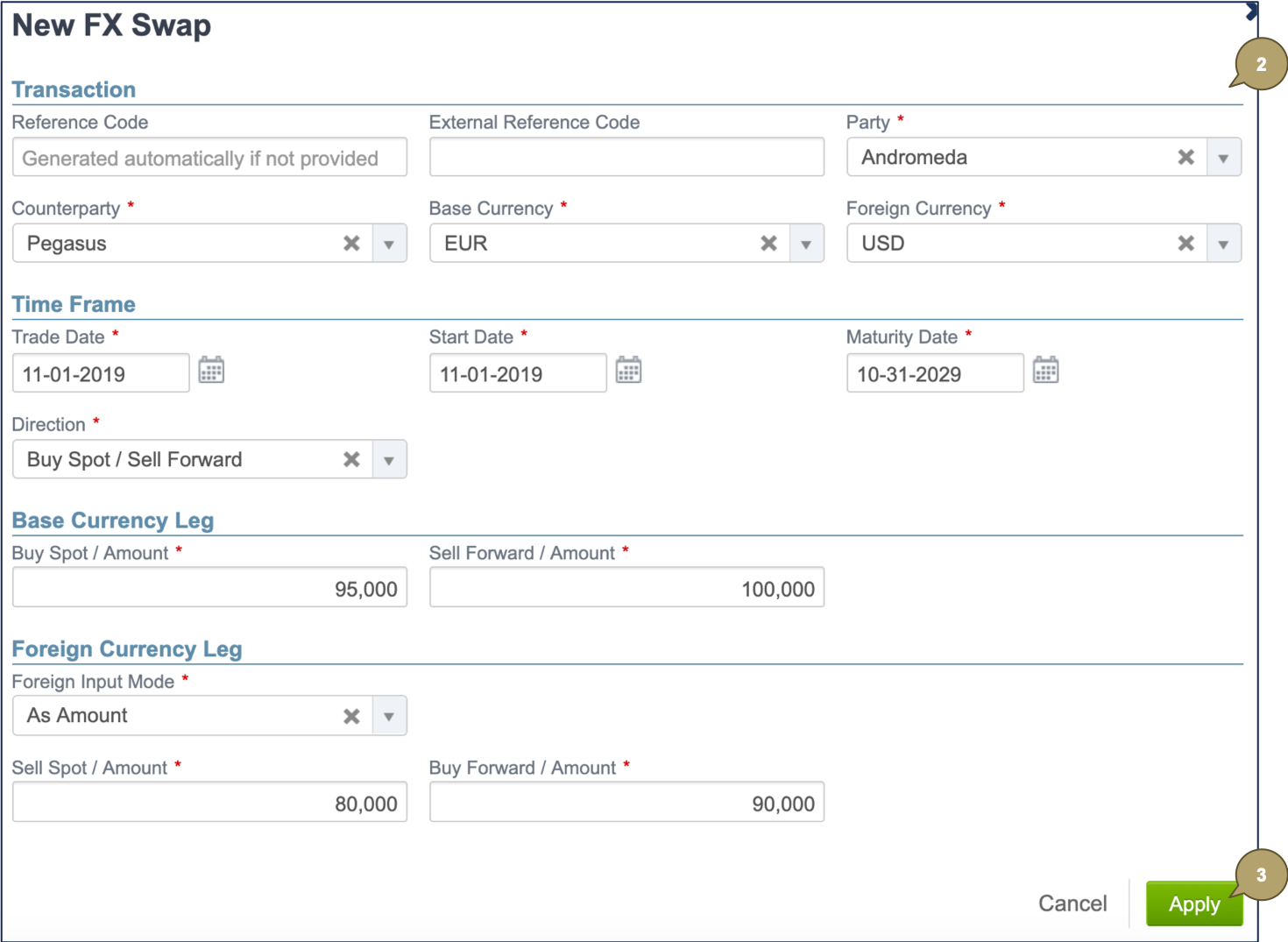

Create an FX Swap

- Click Add Transaction > Derivative > FX Swap.

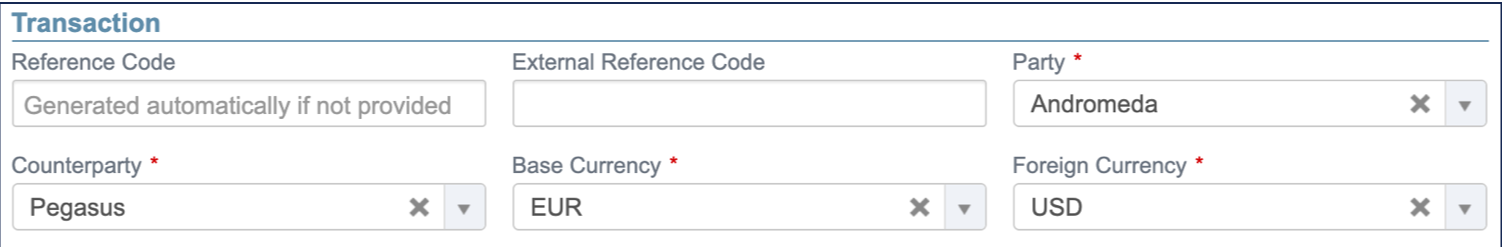

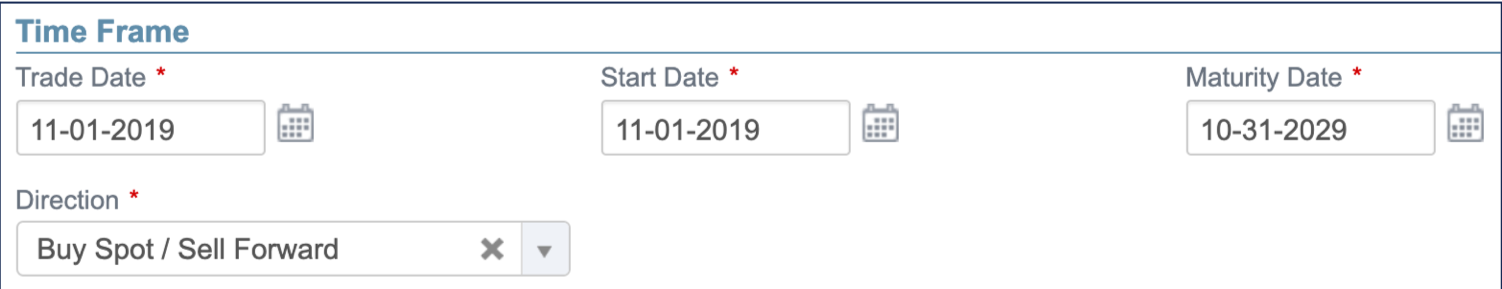

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

Reference Code |

Unique reference of the transaction. Identifies the transaction in the portfolio. Note: The reference must be unique among all the entities managed in the account. |

|

External Reference Code |

Used by external systems to identify the transaction. Used when transactions are imported from or exported to another system. |

|

Party |

Entity in the system involved in the transaction. |

|

Counterparty |

Can be either internal (an entity in the system) or external (a commercial bank). |

|

Base Currency |

Note: The currencies must be different from each other. |

|

Foreign Currency |

|

Field |

Description |

|---|---|

|

Trade Date |

Date at which the transaction has been traded. From that date, the system takes the transaction into account as an item of the portfolio. |

|

Start Date |

Unadjusted start date of the transaction. |

|

Maturity Date |

Unadjusted maturity date of the transaction. |

|

Direction |

Indicates whether the base currency is bought or sold at spot. Note: The Base and Foreign Currency Leg fields update depending on the selected direction. |

|

Field |

Description |

|---|---|

|

Buy Spot / Amount |

Contract amount in the base currency exchanged at spot. Note: This field updates depending on the selected direction. |

|

Sell Spot / Amount |

|

|

Sell Forward / Amount |

Future amount in the base currency exchanged at forward. Note: This field updates depending on the selected direction. |

|

Buy Forward / Amount |

|

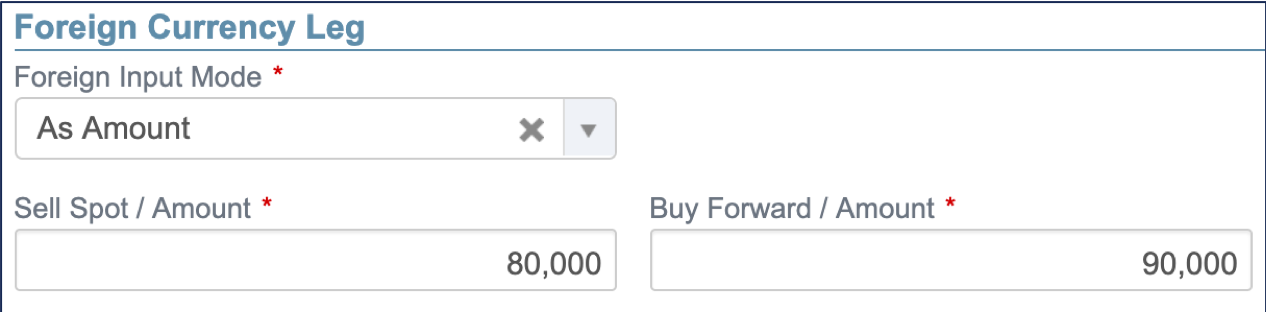

Field |

Description |

|---|---|

|

Foreign Input Mode |

Exchange mode of the foreign currency. |

|

Sell Spot / Amount |

Contract amount or rate in the foreign currency exchanged at spot against the base currency. Note: This field updates depending on the selected direction and the foreign input mode. |

|

Sell Spot / Forex Rate |

|

|

Buy Spot / Amount |

|

|

Buy Spot / Forex Rate |

|

|

Buy Forward / Amount |

Future amount or rate in the foreign currency exchanged at forward against the base currency. Note: This field updates depending on the selected direction and the foreign input mode. |

|

Buy Forward / Forex Rate |

|

|

Sell Forward / Amount |

|

|

Sell Forward / Forex Rate |

Enter the required custom attributes, if any.

- Click Apply to create the FX swap.

The new FX swap displays in the draft portfolio.