Loan servicing refers to the administrative aspects of a loan from the time the processes are dispersed until the loan is paid off. Loan servicers send overpayment statements (payment advices), collect payments, maintain records of payments and balances, follow up on delinquencies.

This task can be carried out by a bank or a financial institution, a non-bank entity that is specializing in loan servicing, or a subservicer that operates as a third-party vendor for the lending institution.

All accounts in Fairways Debt are configured in the borrower mode by default. To enable the loan servicing activities in Fairways Debt, e.g. viewing reports as a borrower or a lender, update the account to the owner mode.

Note: Only account administrators can manage the facility agreement portfolio mode.

Prerequisite

- Enable the Advanced Funding module (contact your Finance Active consultant)

Navigate to the Account Administration

- Log in to your Fairways Debt account.

- Select a customer account.

- Click Applications > Account Administration.

Edit the Facility Agreement Portfolio Mode

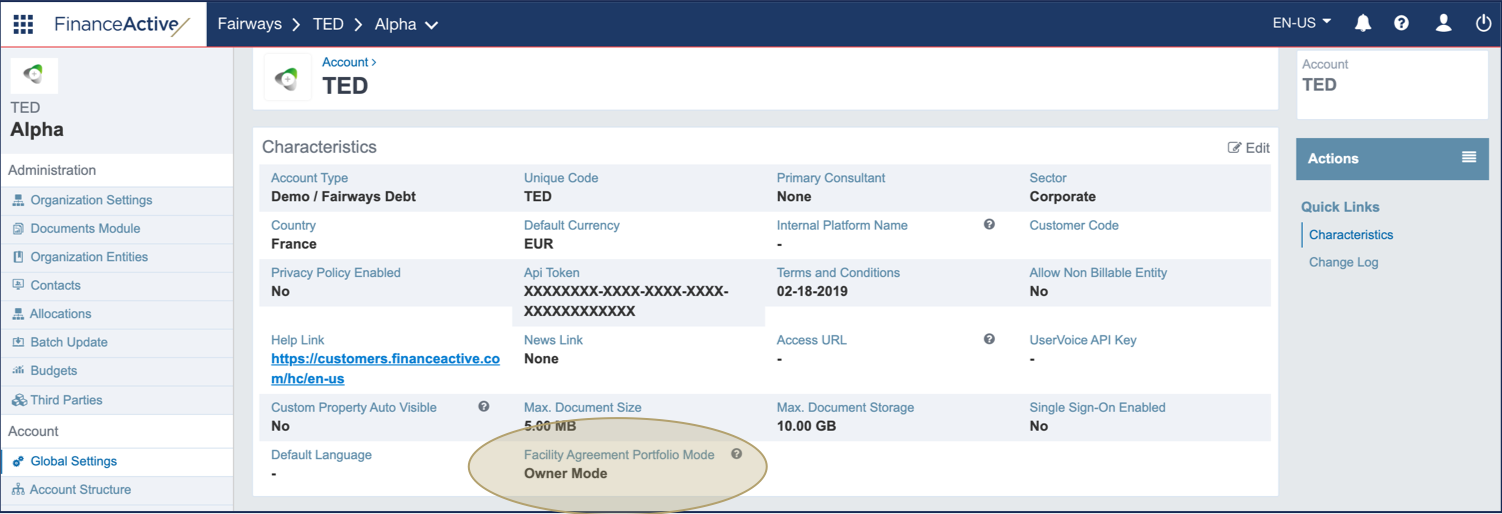

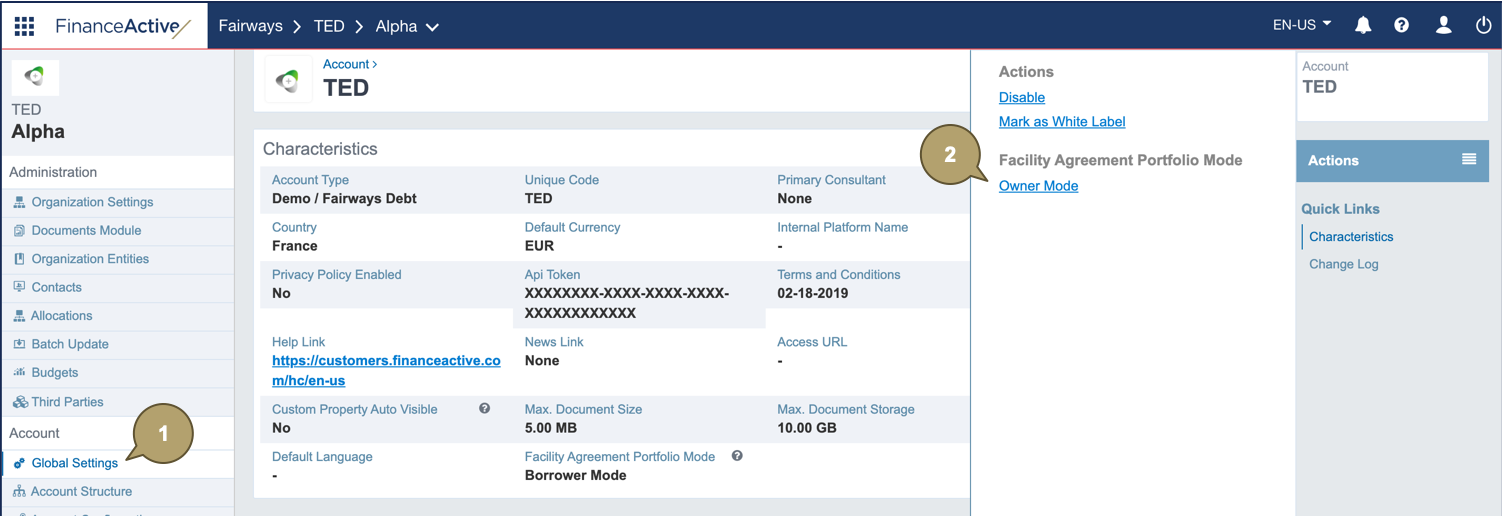

- Navigate to Account > Global Settings.

- Click Actions:

- Owner Mode to enable the loan servicing mode.

- Borrower Mode to disable the loan servicing mode.

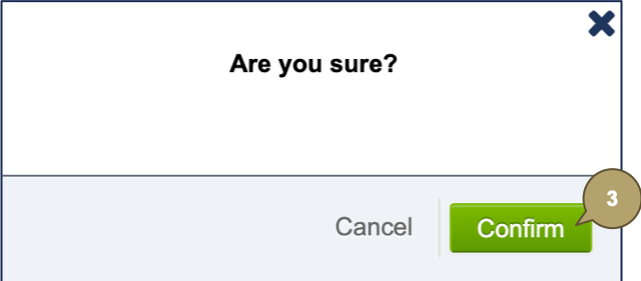

- Click Confirm.

The facility agreement portfolio mode updates.