Periodic / Single Period Reports

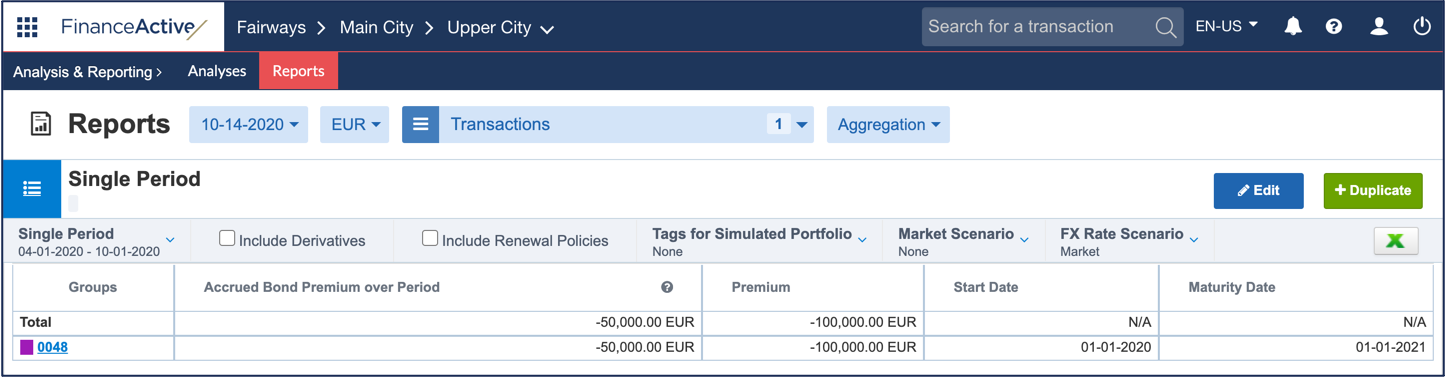

Accrued Bond Premium over Period

Prorated issuing price:

Premium / Number of days in the bond life * Number of days in the report period

For example, the accrued premium of 0048 over the period is:

= Premium / Number of days in the bond life * Number of days in the report period

= -100 000 / 366 * 183

= -50 000

- The bond lives for 366 days, from 1 January 2020 to 1 January 2021.

- The report includes 183 days, from 1 April to 1 October 2021.

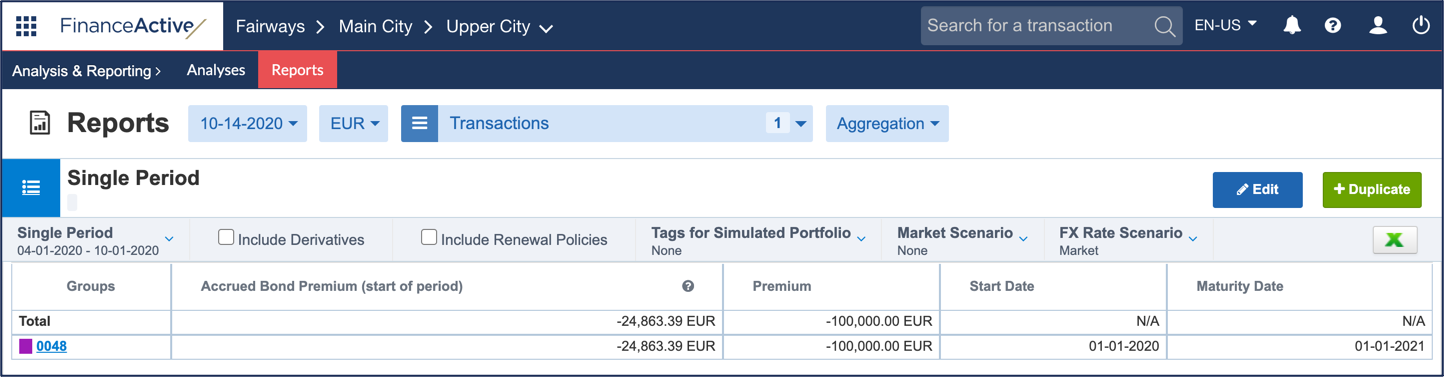

Accrued Bond Premium (start of period)

Accrued premium of the bond on the start of the start date of the period, in the currency applied to the report:

Premium / Number of days in the bond life * Number of days between the start date of the bond and the start date of the report period

For example, the accrued premium of 0048 on the start date of the period is:

= Premium / Number of days in the bond life * Number of days between the start date of the bond and the start date of the report period

= -100 000,00 / 366 * 91

= -24 863,39

- The bond lives for 366 days, from 1 January 2020 to 1 January 2021.

- There are 91 days between 1 January and 1 April 2020.

Accrued Bond Premium (end of period)

Accrued premium of the bond on the start of the end date of the period, in the currency applied to the report:

Premium / Number of days in the bond life * Number of days between the start date of the bond and the end date of the report period

For example, the accrued premium of 0048 on the end date of the period is:

= Premium / Number of days in the bond life * Number of days between the start date of the bond and the end date of the report period

= -100 000,00 / 366 * 274

= -74 863,39

- The bond lives for 366 days, from 1 January 2020 to 1 January 2021.

- There are 274 days between 1 January and 1 October 2020.