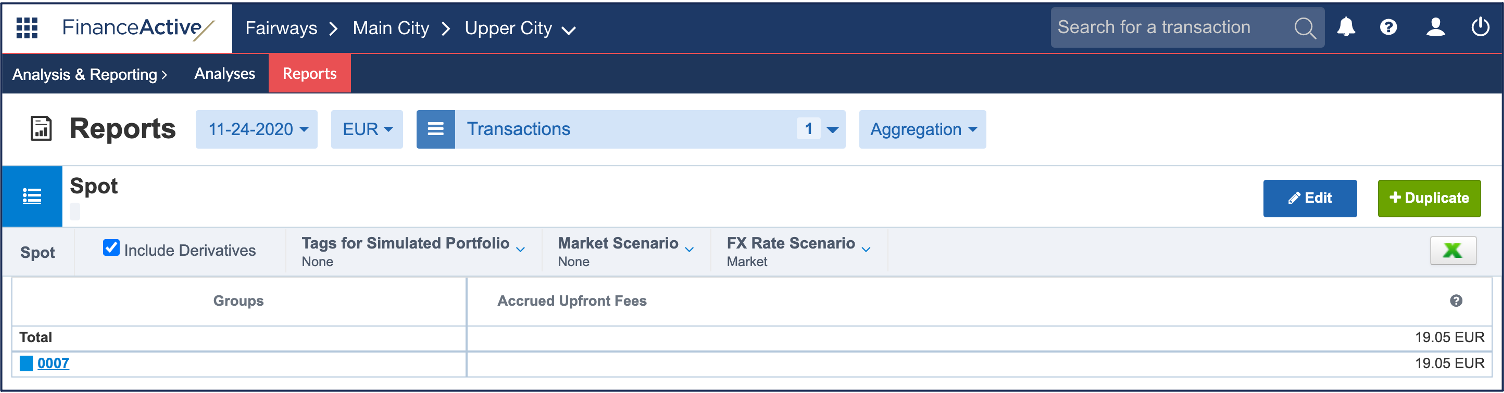

Spot Reports

Accrued Upfront Fees

Aggregated amount of upfront fees to pay on the report date, in the currency applied to the report:

Upfront Fees / Count of days from the fee payment date to the transaction maturity date * Count of days from the fee payment date to the report date

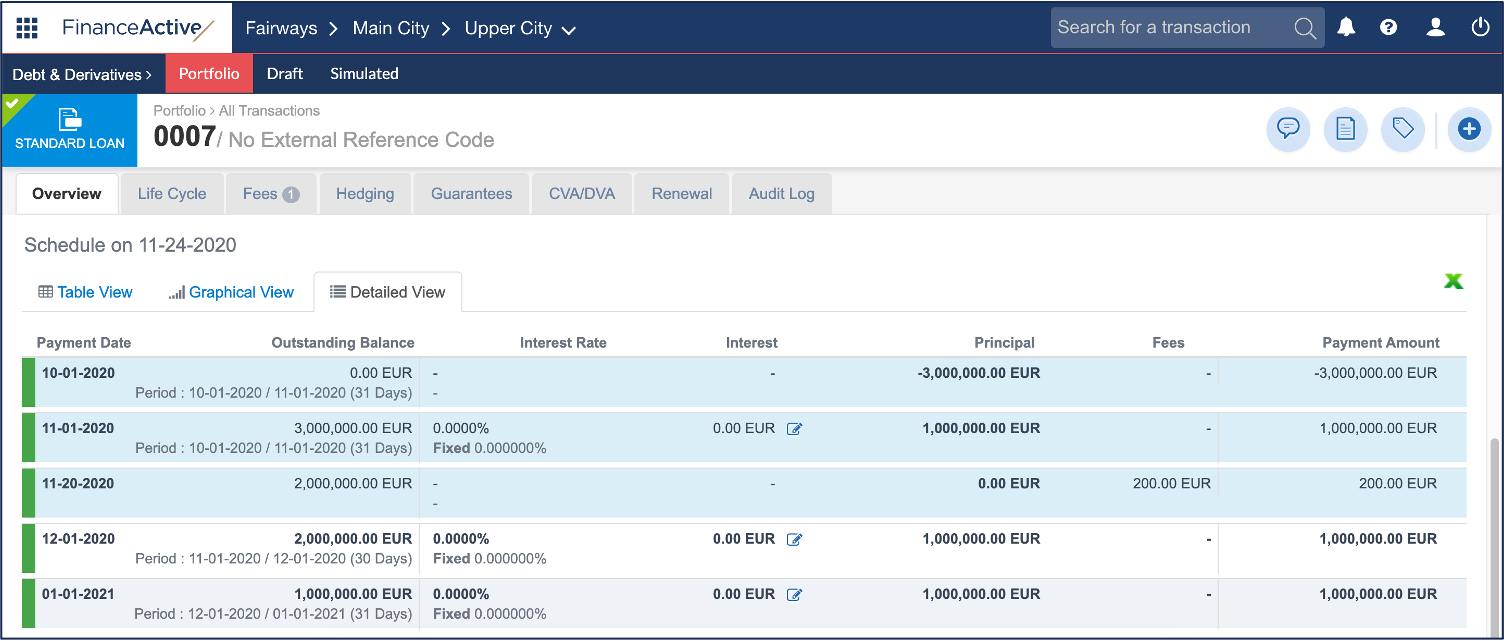

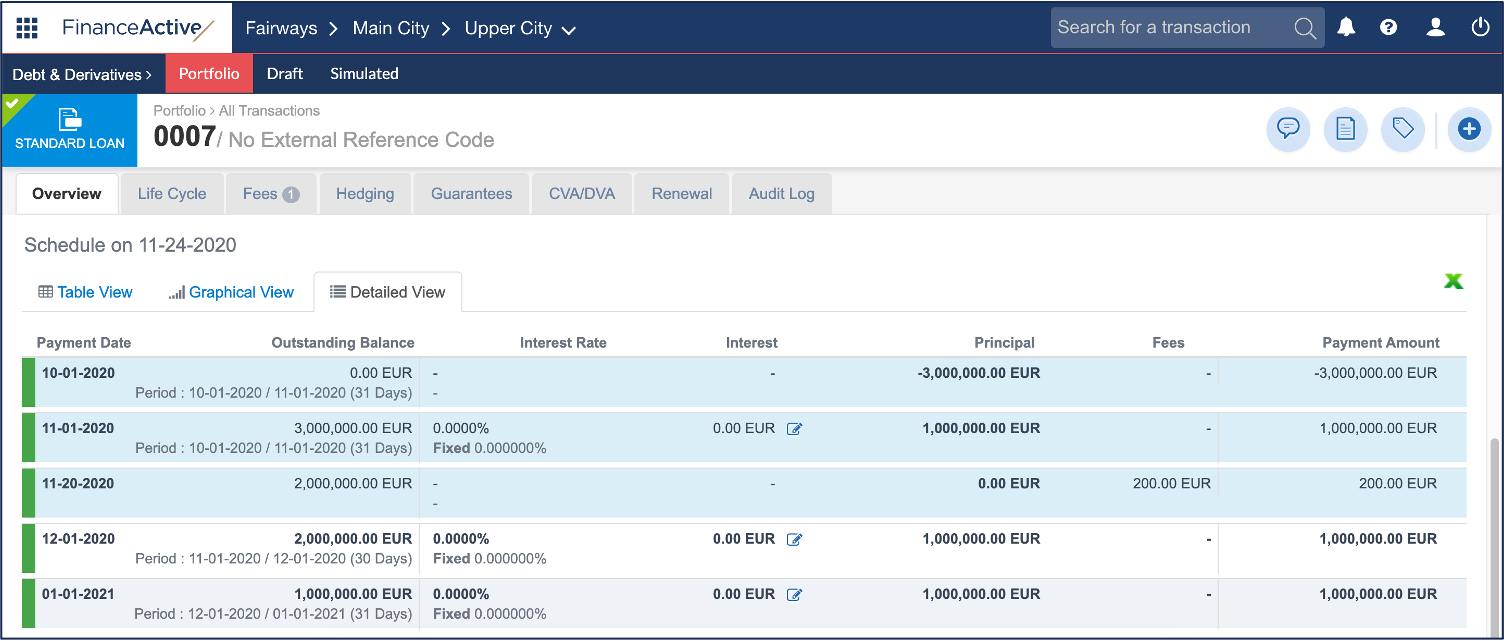

For example, on 24 November 2020, the accrued upfront fees of 0007 are:

= Upfront Fees / Count of days from the fee payment date to the transaction maturity date * Count of days from the fee payment date to the report date

= 200 / 42 * 4

= 19,05

- The transaction includes an upfront fee of EUR 200.

- There are 42 days between the fee payment date on 20 November 2020 and the transaction maturity date on 1 January 2021.

- There are 4 days between the fee payment date on 20 November 2020 and the report date on 24 November 2020.

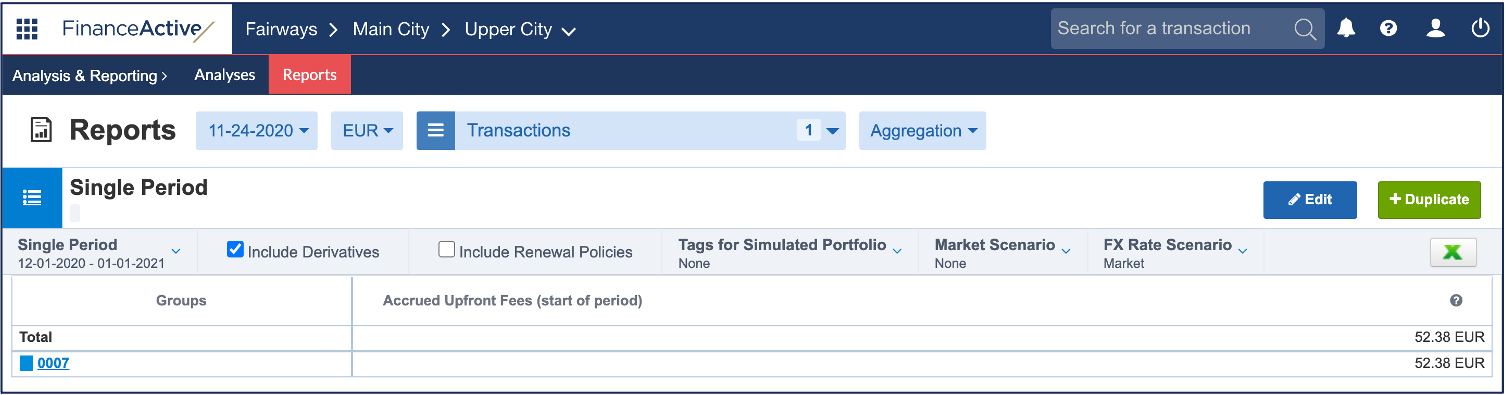

Periodic / Single Period Reports

Accrued Upfront Fees (start of period)

Aggregated amount of upfront fees to pay on the report start date, in the currency applied to the report:

Upfront Fees / Count of days from the fee payment date to the transaction maturity date * Count of days from the fee payment date to the report start date

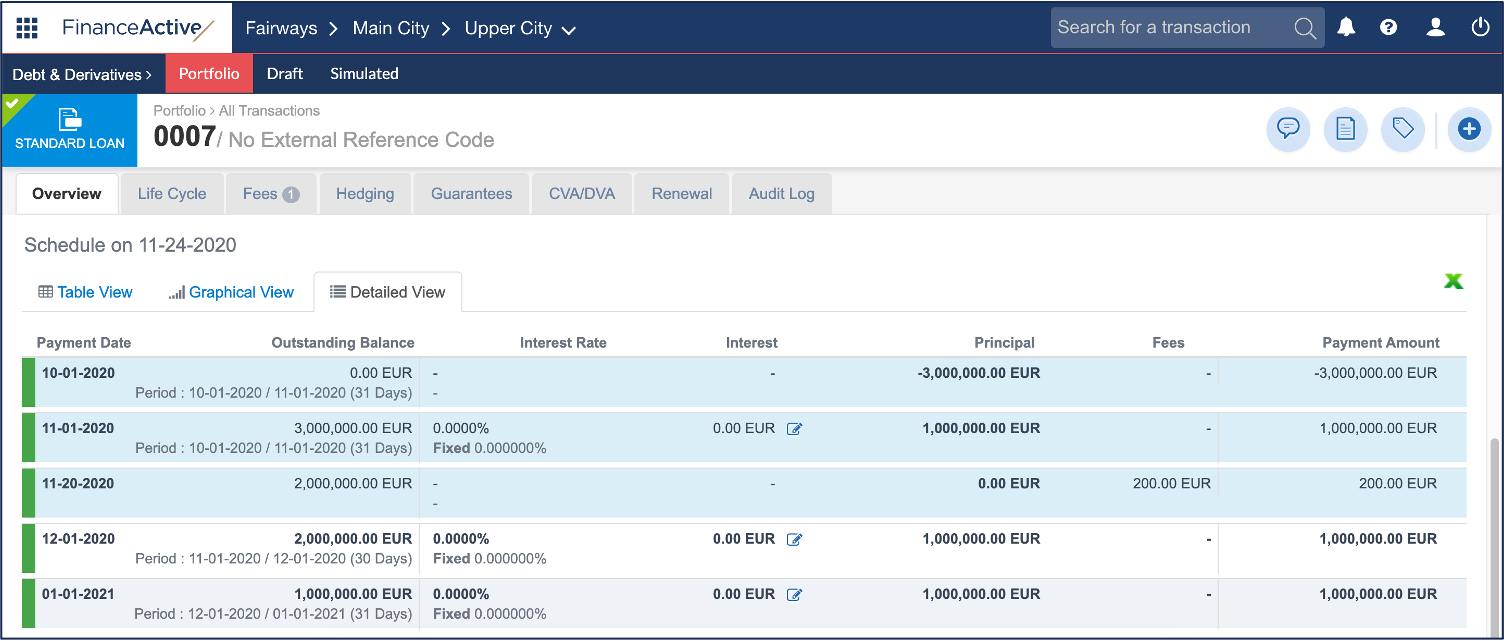

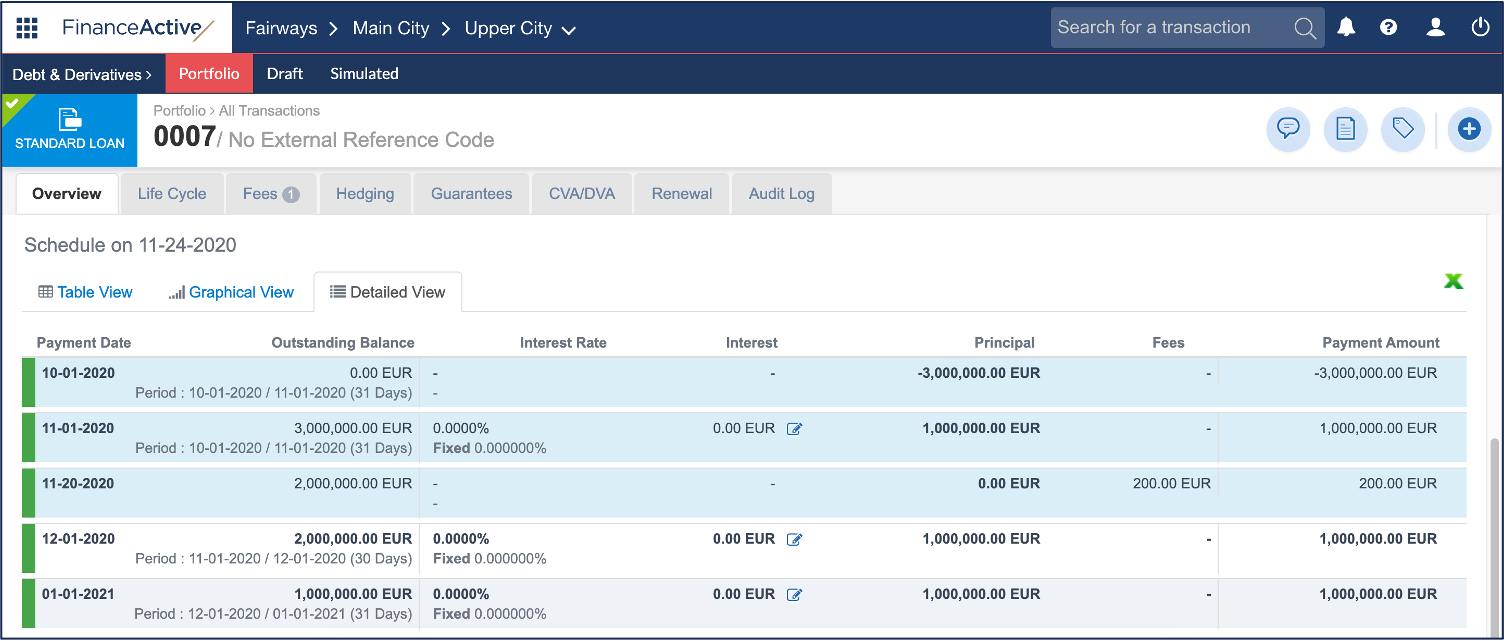

For example, on 1 December 2020, the accrued upfront fees of 0007 are:

= Upfront Fees / Count of days from the fee payment date to the transaction maturity date * Count of days from the fee payment date to the report start date

= 200 / 42 * 11

= 52,38

- The transaction includes an upfront fee of EUR 200.

- There are 42 days between the fee payment date on 20 November 2020 and the transaction maturity date on 1 January 2021.

- There are 11 days between the fee payment date on 20 November 2020 and the report start date on 1 December 2020.

Accrued Upfront Fees (end of period)

Aggregated amount of upfront fees to pay on the report end date, in the currency applied to the report:

Upfront Fees / Count of days from the fee payment date to the transaction maturity date * Count of days from the fee payment date to the report end date

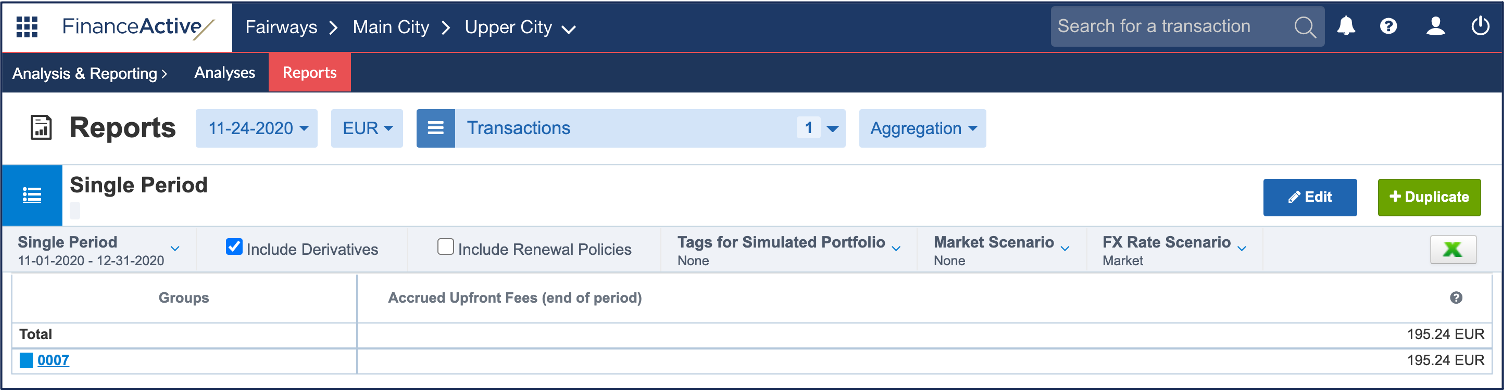

For example, on 31 December 2020, the accrued upfront fees of 0007 are:

= Upfront Fees / Count of days from the fee payment date to the transaction maturity date * Count of days from the fee payment date to the report end date

= 200 / 42 * 41

= 195,24

- The transaction includes an upfront fee of EUR 200.

- There are 42 days between the fee payment date on 20 November 2020 and the transaction maturity date on 1 January 2021.

- There are 41 days between the fee payment date on 20 November 2020 and the report end date on 31 December 2020.

Accrued Upfront Fees over Period

Aggregated amount of upfront fees to pay during the report period, in the currency applied to the report:

Upfront Fees / Count of days from the fee payment date to the transaction maturity date * Count of days from the report start date to the report end date

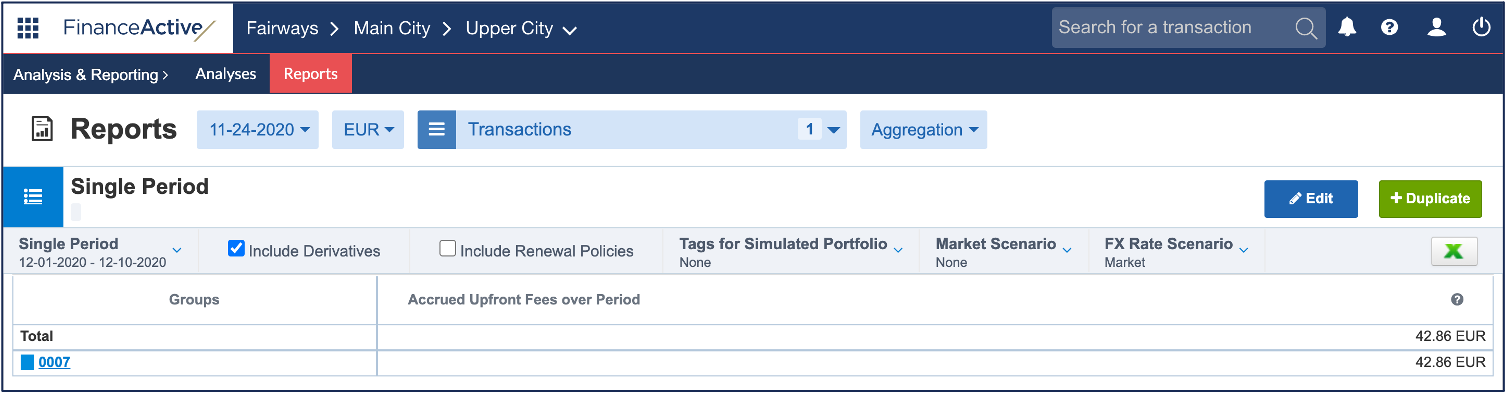

For example, from 1 to 10 December 2020, the accrued upfront fees of 0007 are:

= Upfront Fees / Count of days from the fee payment date to the transaction maturity date * Count of days from the report start date to the report end date

= 200 / 42 * 9

= 42,86

- The transaction includes an upfront fee of EUR 200.

- There are 42 days between the fee payment date on 20 November 2020 and the transaction maturity date on 1 January 2021.

- There are 9 days between the report start date on 1 December 2020 and the report end date on 10 December 2020.