Upfront fees in Fairways Debt can be paid on a specific date during the transaction life.

<loan>

<fees>

<upfrontFee>

<reference>...</reference>

<amount>...</amount>

<currency>...</currency>

<paymentDate>...</paymentDate>

</upfrontFee>

</fees>

</loan>

|

Tag |

Item |

Description |

|

|---|---|---|---|

|

upfrontFee |

Mandatory |

Main |

Characteristics to apply to the fee. |

|

reference |

Optional |

Secondary |

Unique reference of the fee. |

|

amount |

Mandatory |

Secondary |

Amount to pay. |

|

currency |

Mandatory |

Secondary |

Currency of the fee. |

|

paymentDate |

Optional |

Secondary |

Date on which the fee must be paid. Notes:

|

To add an upfront fee to a transaction, e.g. a standard transaction:

- Add the <fees> tags in the <standardLoan> tags of the transaction.

<standardLoan>

<fees>

</fees>

</standardLoan>

- Add the <upfrontFee> tags in the <fees> tags.

<standardLoan>

<fees>

<upfrontFee>

</upfrontFee>

</fees>

</standardLoan>

- If needed, add the <reference> tags in the <upfrontFee> tags.

<standardLoan>

<fees>

<upfrontFee>

<reference></reference>

</upfrontFee>

</fees>

</standardLoan>

- Enter the fee reference.

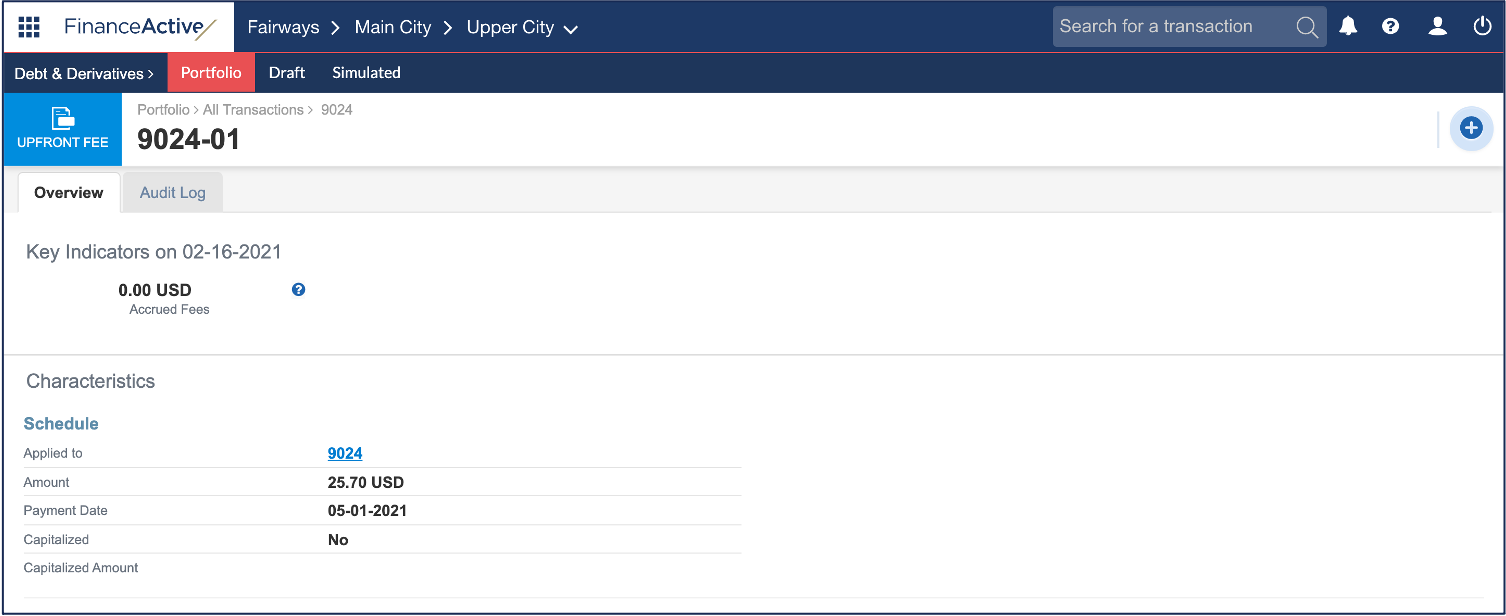

In this example, we enter 9024-01.

<standardLoan>

<fees>

<upfrontFee>

<reference>9024-01</reference>

</upfrontFee>

</fees>

</standardLoan>

- Add the <amount> tags in the <upfrontFee> tags.

<standardLoan>

<fees>

<upfrontFee>

<reference>9024-01</reference>

<amount></amount>

</upfrontFee>

</fees>

</standardLoan>

- Enter the fee amount.

Note: Use a full stop . for decimals.

In this example, we enter 25.7.

<standardLoan>

<fees>

<upfrontFee>

<reference>9024-01</reference>

<amount>25.7</amount>

</upfrontFee>

</fees>

</standardLoan>

- Add the <currency> tags in the <upfrontFee> tags.

<standardLoan>

<fees>

<upfrontFee>

<reference>9024-01</reference>

<amount>25.7</amount>

<currency></currency>

</upfrontFee>

</fees>

</standardLoan>

- Enter the fee currency.

In this example, we enter USD for the American dollar.

<standardLoan>

<fees>

<upfrontFee>

<reference>9024-01</reference>

<amount>25.7</amount>

<currency>USD</currency>

</upfrontFee>

</fees>

</standardLoan>

If the fee payment date is different from the transaction start date:

- Add the <paymentDate> tags in the <upfrontFee> tags.

<standardLoan>

<fees>

<upfrontFee>

<reference>9024-01</reference>

<amount>25.7</amount>

<currency>USD</currency>

<paymentDate></paymentDate>

</upfrontFee>

</fees>

</standardLoan>

- Enter the fee payment date in the year-month-day format, i.e. YYYY-MM-DD.

In this example, we enter 2021-05-01 for 1 May 2021.

<standardLoan>

<fees>

<upfrontFee>

<reference>9024-01</reference>

<amount>25.7</amount>

<currency>USD</currency>

<paymentDate>2021-05-01</paymentDate>

</upfrontFee>

</fees>

</standardLoan>