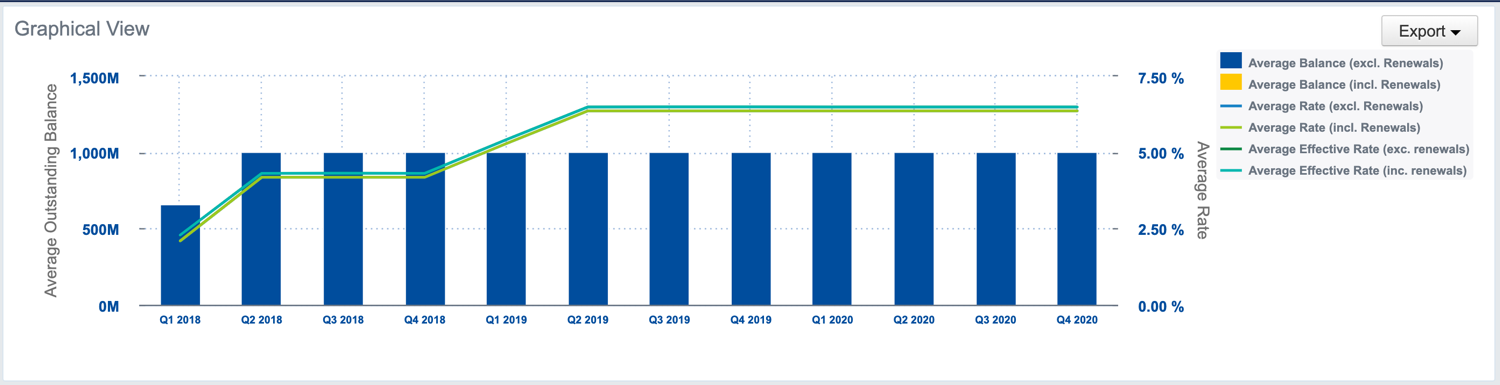

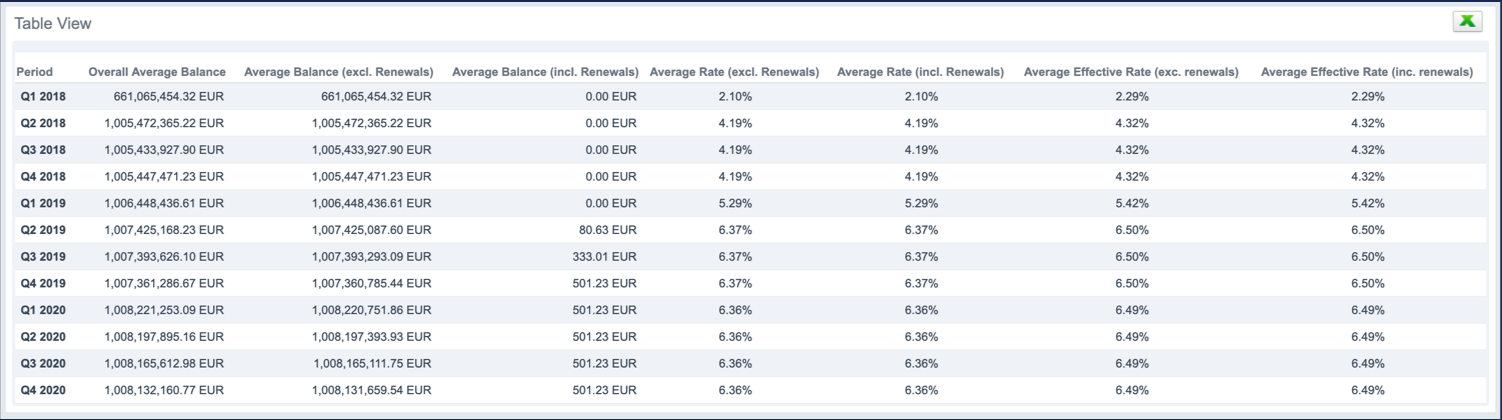

The Debt Maturity Profile shows how the average outstanding balance and average rate evolve over time, including actual debt and renewed transactions.

Prerequisite

- Contact your Finance Active consultant to enable the Debt Maturity Profile analysis in your customer account

Navigate to the Analysis & Reporting Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Analysis & Reporting.

Generate a Debt Maturity Profile Analysis

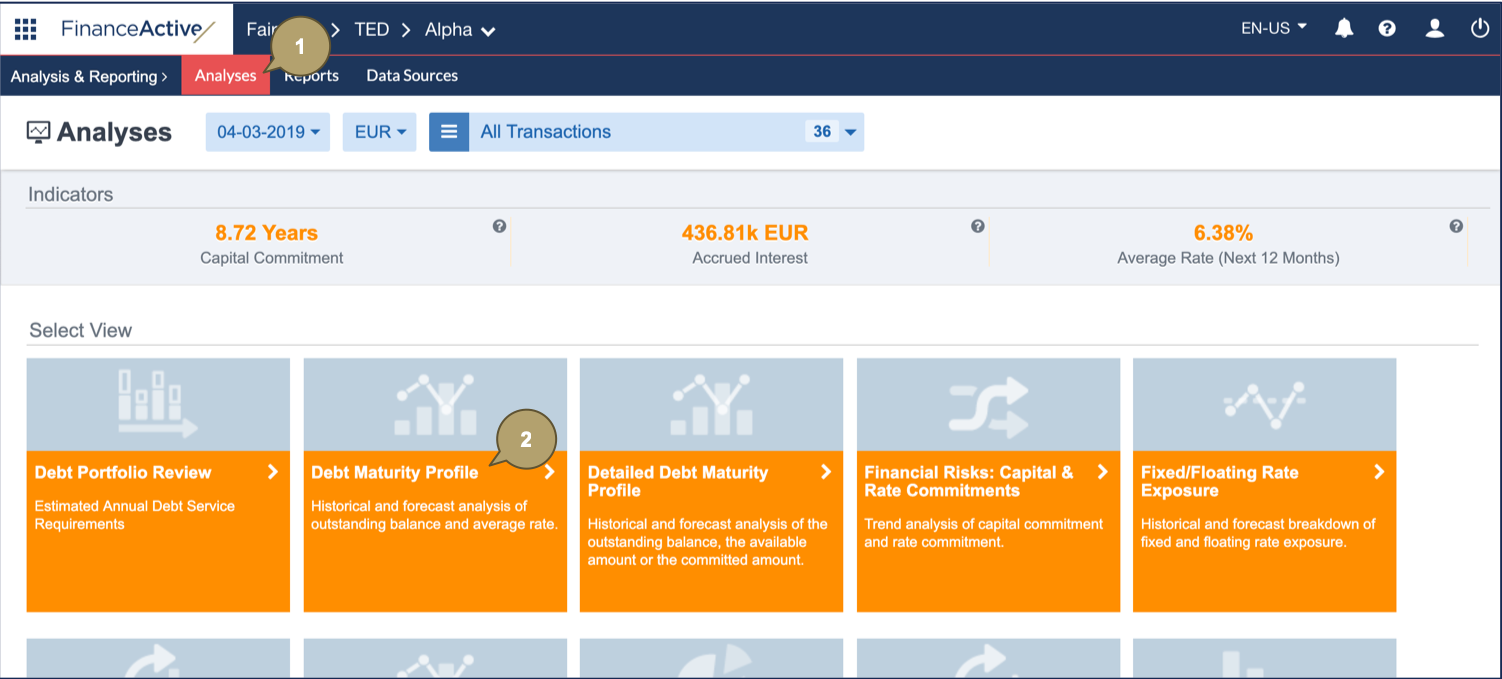

- Navigate to Analyses.

- Click Debt Maturity Profile.

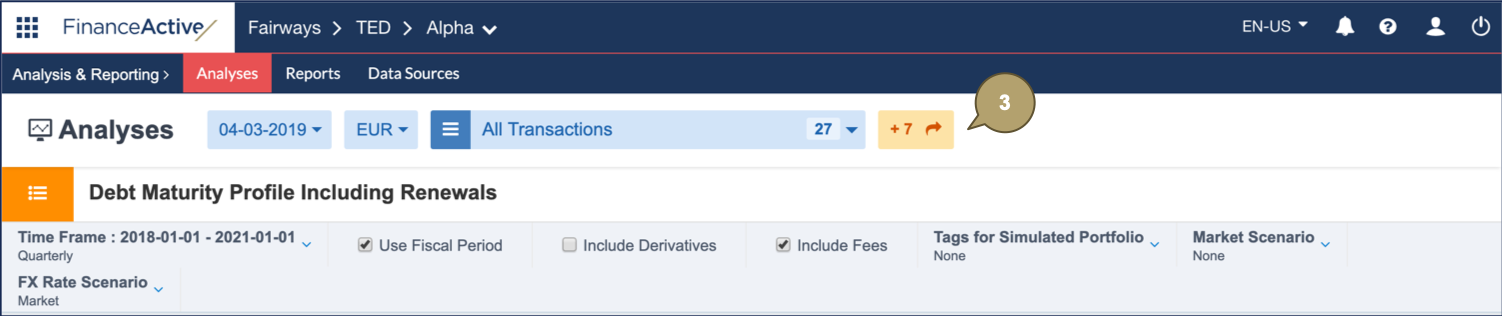

- Configure the analysis settings.

|

Field |

Description |

|---|---|

|

Market Date |

Analysis date. |

|

Currency |

Currency in which the analysis data displays. |

|

Filter |

Refine to include relevant data in the analysis. |

|

Display data following a period, start and end dates included. |

|

|

Fiscal Period |

Include/Exclude the fiscal period. |

|

Derivatives |

Include/Exclude derivative transactions. |

|

Fees |

Include/Exclude fee amounts. |

|

Tags for Simulated Portfolio |

Filter by tag(s) applied to the simulated portfolio. |

|

Simulate how data would look based on different values. |

|

|

FX Rate Scenario |

Apply a simulation using custom Forex rates. |

The Debt Maturity Profile analysis updates following the selected settings.

Time Display

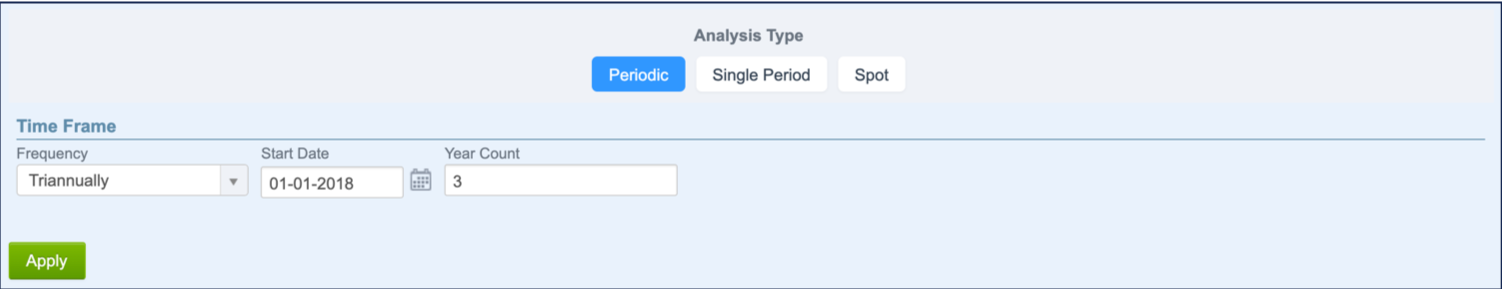

- Select an analysis type:

- Periodic: Data of each period for a defined time frame.

|

Field |

Description |

|---|---|

|

Frequency |

Period frequency. |

|

Start Date |

Start date of the period. |

|

Year Count |

Period length. |

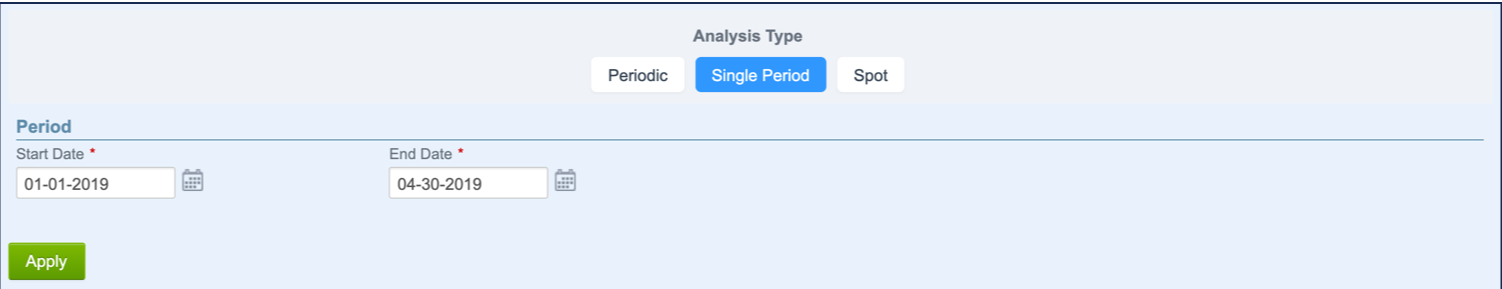

- Single Period: Data summary of the selected period.

| Field | Description |

|---|---|

| Start Date | Start date (included) of the period. |

| End Date | End date (included) of the period. |

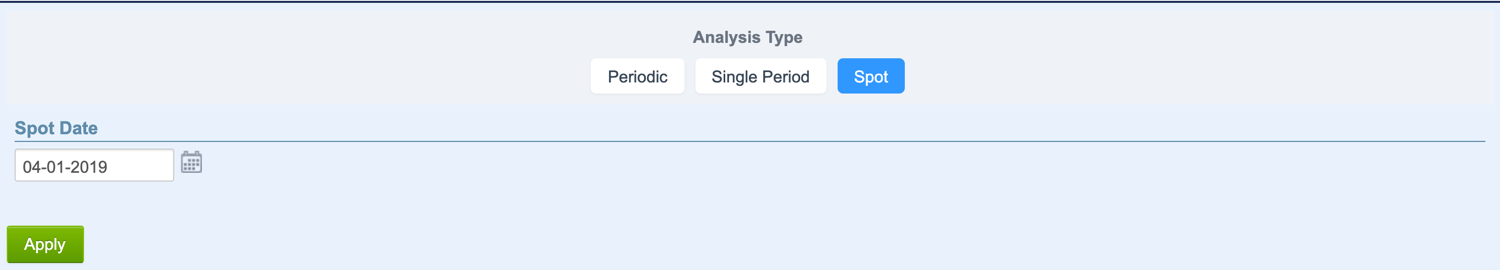

- Spot: Data at a specific date.

| Field | Description |

|---|---|

| Spot Date | Specific date. |

- Click Apply to update the analysis.