A cross-currency swap in Fairways Debt is an agreement between two parties providing for the exchange of principal and interest payments in loans denominated in two different currencies: one counterparty makes payments in one currency, the other makes payments in a different currency. In a cross-currency swap, the principal and interest payments of a loan can be exchanged for an equally valued loan and interest payments in a different currency.

A cross-currency swap can be used to hedge a debt in a foreign currency.

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications

> Debt & Derivatives.

> Debt & Derivatives.

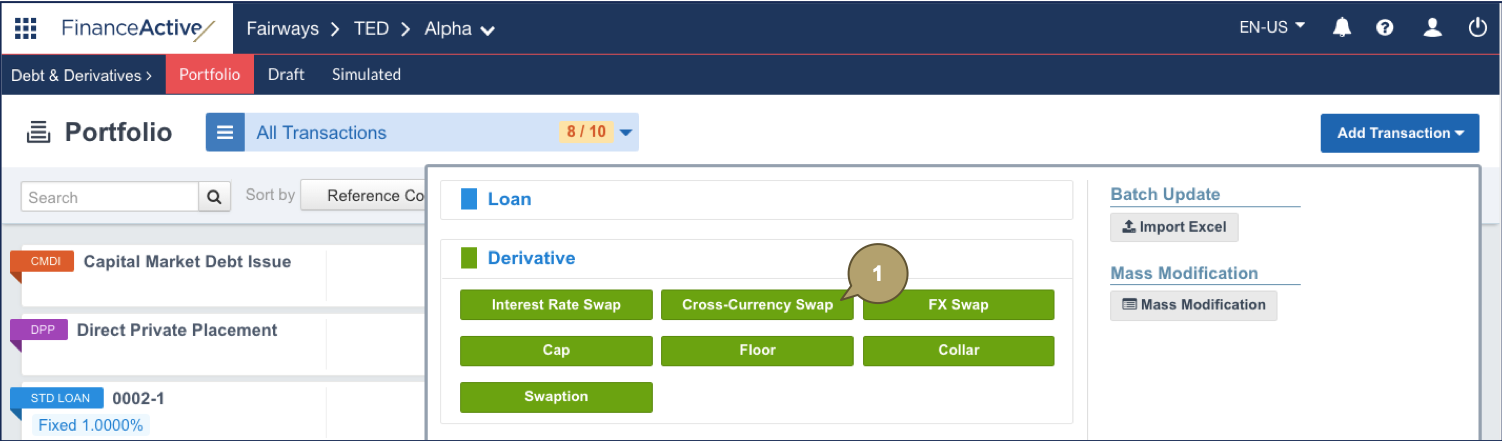

Create a Cross-Currency Swap

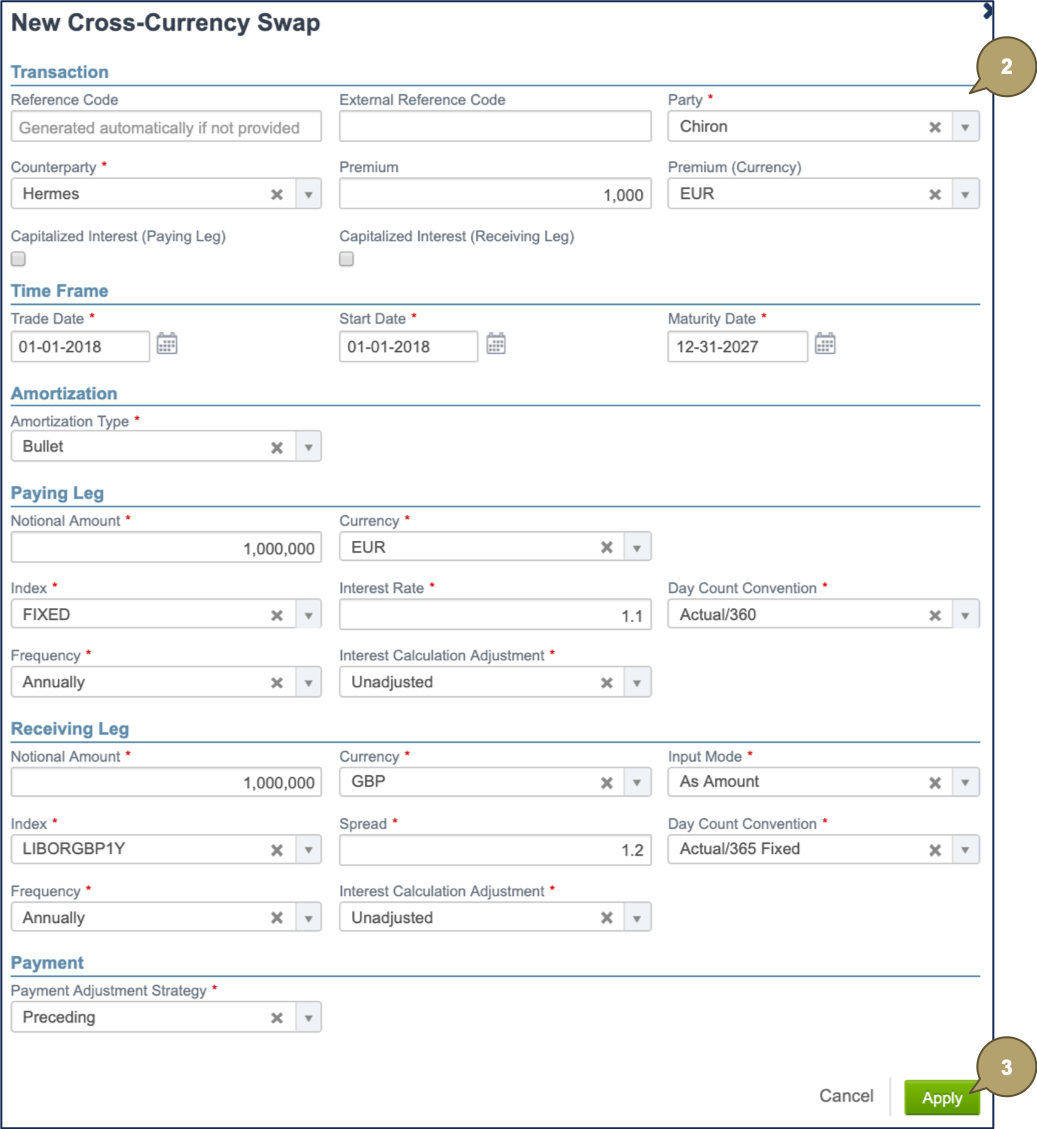

- Click Add Transaction > Derivative > Cross-Currency Swap.

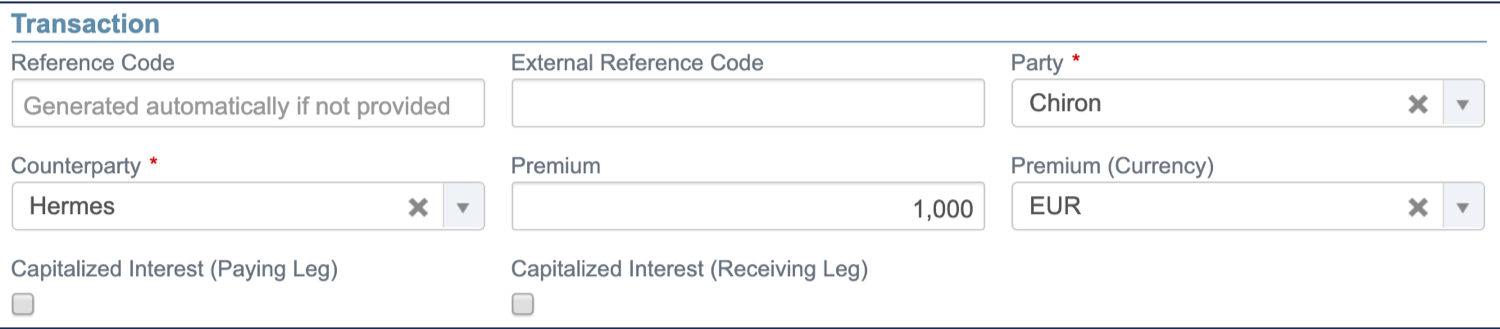

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

|

Field |

Description |

|---|---|

|

Reference Code |

Unique reference of the transaction. Identifies the transaction in the portfolio. The reference must be unique among all the entities managed in the account. |

|

External Reference Code |

Used by external systems to identify the transaction. Used when transactions are imported from or exported to another system. |

|

Party |

Entity in the system involved in the transaction. |

|

Counterparty |

Can be either internal (an entity in the system) or external (a commercial bank). |

|

Premium |

Premium paid at the start date of the cross-currency swap. |

|

Premium (Currency) |

Note: Must be in the same currency as one of the swap legs. |

|

Capitalized Interest (Paying Leg) |

Defines whether the interest amount should be paid at the payment date, or added to the principal (and included into the outstanding balance for the following periods). |

|

Capitalized Interest (Receiving Leg) |

|

Field |

Description |

|---|---|

|

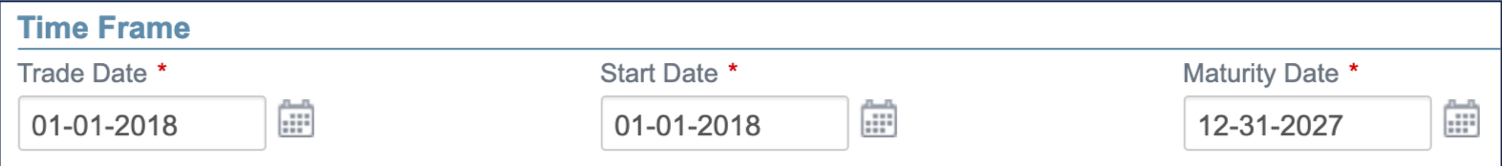

Trade Date |

Date at which the transaction has been traded. From that date, the system takes the transaction into account as an item of the portfolio. |

|

Start Date |

Unadjusted start date of the transaction, initial date of the first payment period. |

|

Maturity Date |

Unadjusted maturity date of the transaction. |

|

Field |

Description |

|---|---|

|

Notional depreciation over the life of the transaction. |

|

Field |

Description |

|---|---|

|

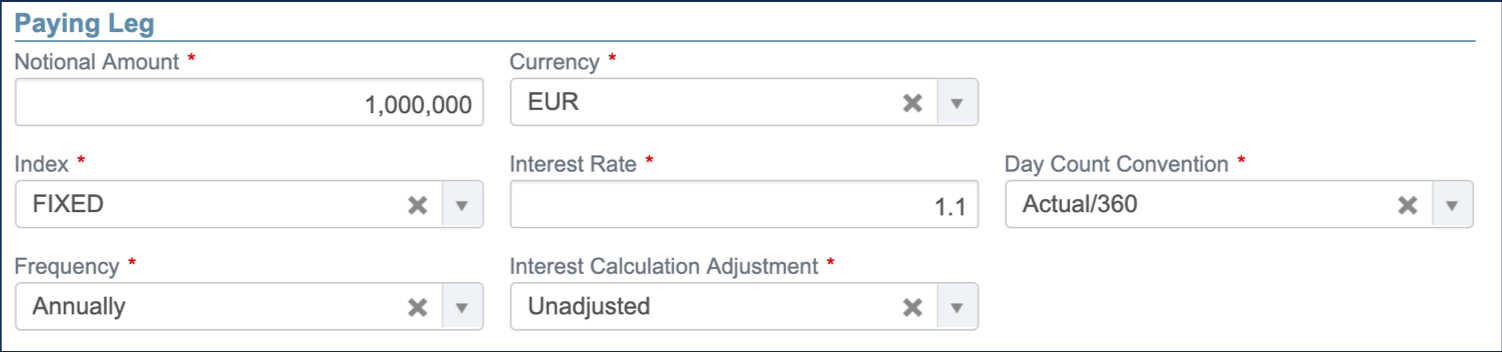

Notional Amount |

Notional amount used to calculate the payments of the leg. |

|

Currency |

Currency of the paying leg. |

|

Index |

Name of the index used to calculate the rate value. Note: The field beside displays depending on the index selected. |

|

Interest Rate |

Fixed rate value in percentage. Note: This field displays depending on the index selected. |

|

Initial Interest Rate |

Initial rate of the custom index. Note: This field displays depending on the index selected. |

|

Spread |

Spread (or margin) value in percentage. Note: This field displays depending on the index selected. |

|

Day Count Convention |

Used to compute the day fraction of an interest accrual period. |

|

Frequency |

Frequency of the payments. |

|

Adjustment mode for the interest calculation. The nominal start and end dates of the accrual period will be adjusted accordingly before computing the interest amount. |

|

Field |

Description |

|---|---|

|

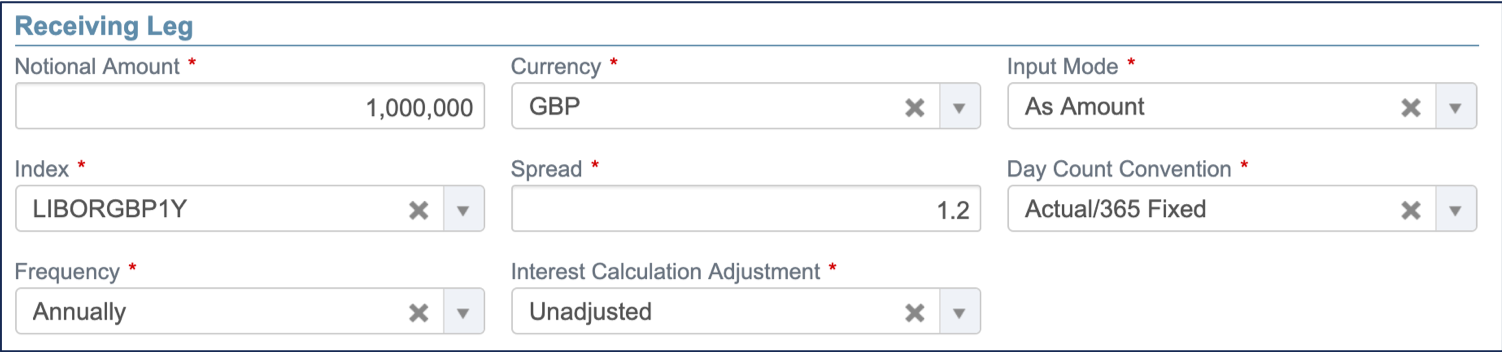

Notional Amount |

Note: This field displays depending on the input mode selected. Notional amount used to calculate the payments of the leg. |

|

Forex Rate |

Note: This field displays depending on the input mode selected. Forex rate of the receiving leg. |

|

Currency |

Currency of the receiving leg. |

|

Input Mode |

|

|

Index |

Name of the index used to calculate the rate value. Note: The field beside displays depending on the index selected. |

|

Interest Rate |

Fixed rate value in percentage. Note: This field displays depending on the index selected. |

|

Initial Interest Rate |

Initial rate of the custom index. Note: This field displays depending on the index selected. |

|

Spread |

Spread (or margin) value in percentage. Note: This field displays depending on the index selected. |

|

Day Count Convention |

Used to compute the day fraction of an interest accrual period. |

|

Frequency |

Frequency of the payments. |

|

Adjustment mode for the interest calculation. The nominal start and end dates of the accrual period will be adjusted accordingly before computing the interest amount. |

|

Field |

Description |

|---|---|

|

Adjustment mode for the payment date, applicable to both legs. |

Enter the required custom attributes, if any.

- Click Apply to create the cross-currency swap.

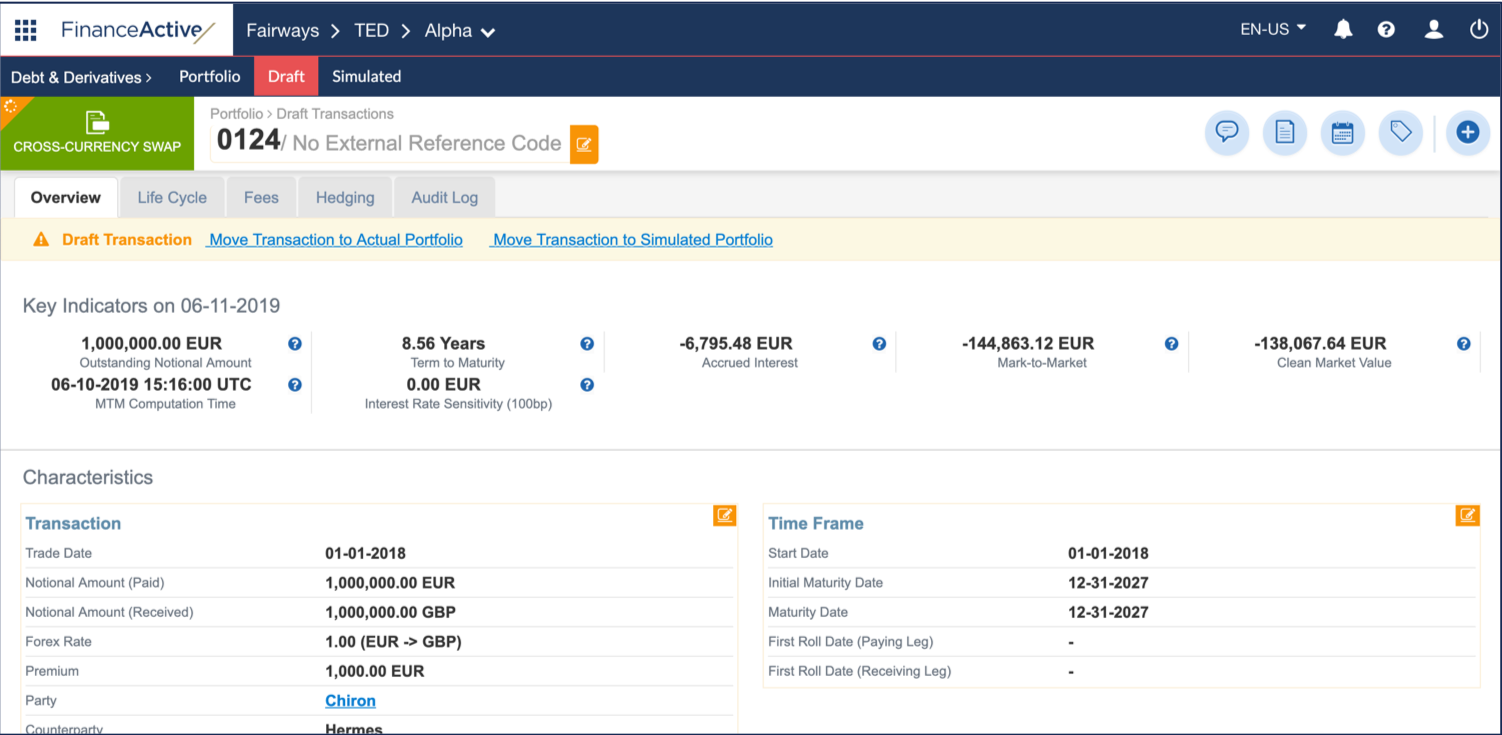

The new cross-currency swap displays in the draft portfolio.

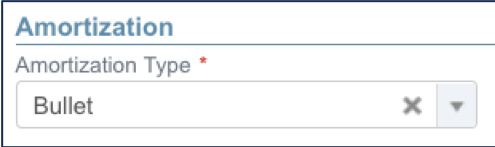

Amortization

|

Mode |

Description |

|---|---|

|

Bullet |

No depreciation during the lifetime of the transaction. Cumulative depreciations are counted at the end of the transaction term. |

|

Linear |

Constant depreciation. |

Adjustment

Adjustment modes define how the system rolls dates in case of holidays in the calendar.

| Field | Description |

|---|---|

| Unadjusted | Not rolled. |

| Preceding | Rolled to the previous business day. |

| Following | Rolled to the next business day. |

| Modified Preceding | Rolled to the previous business day, only if that day occurs in the same month. Otherwise, rolled to the next business day. |

| Modified Following | Rolled to the next business day, only if that day occurs in the same month. Otherwise, rolled to the previous business day. |

| End of Month (unadjusted) | Rolled to the last day of the month. |

| End of Month (preceding) | Rolled to the last day of the month, then adjusted to the previous business day. |

| Modified Following (year) |

Rolled to the next business day, only if that day occurs in the same year. Otherwise, rolled to the previous business day. |