Hedging in Fairways Debt presents the relationship of the actual debt and the risk hedging transactions.

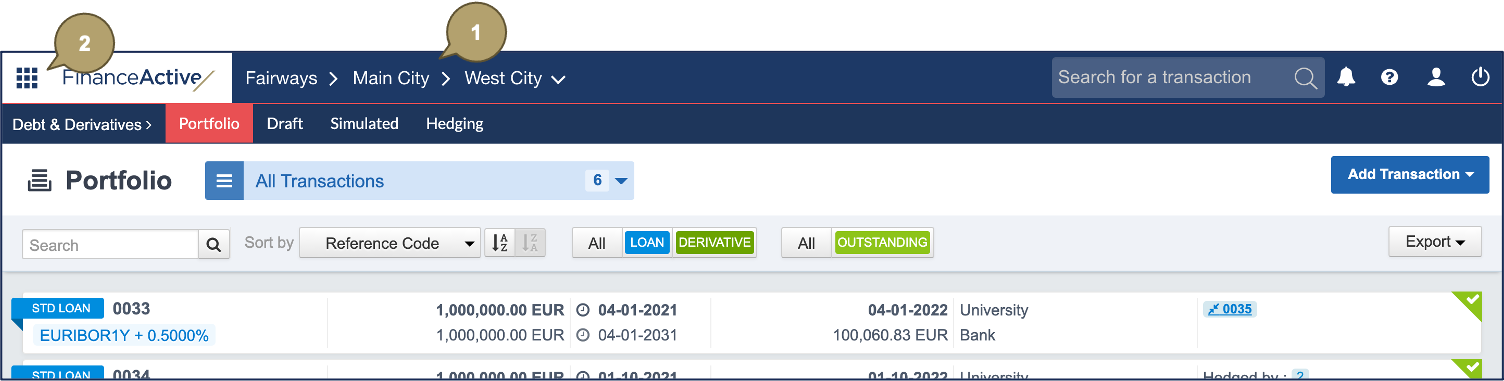

- Log in to your Fairways Debt account and select a customer account, if relevant.

In this example, we log in to the Main City account.

- Navigate to Applications

> Debt & Derivatives > Hedging.

> Debt & Derivatives > Hedging.

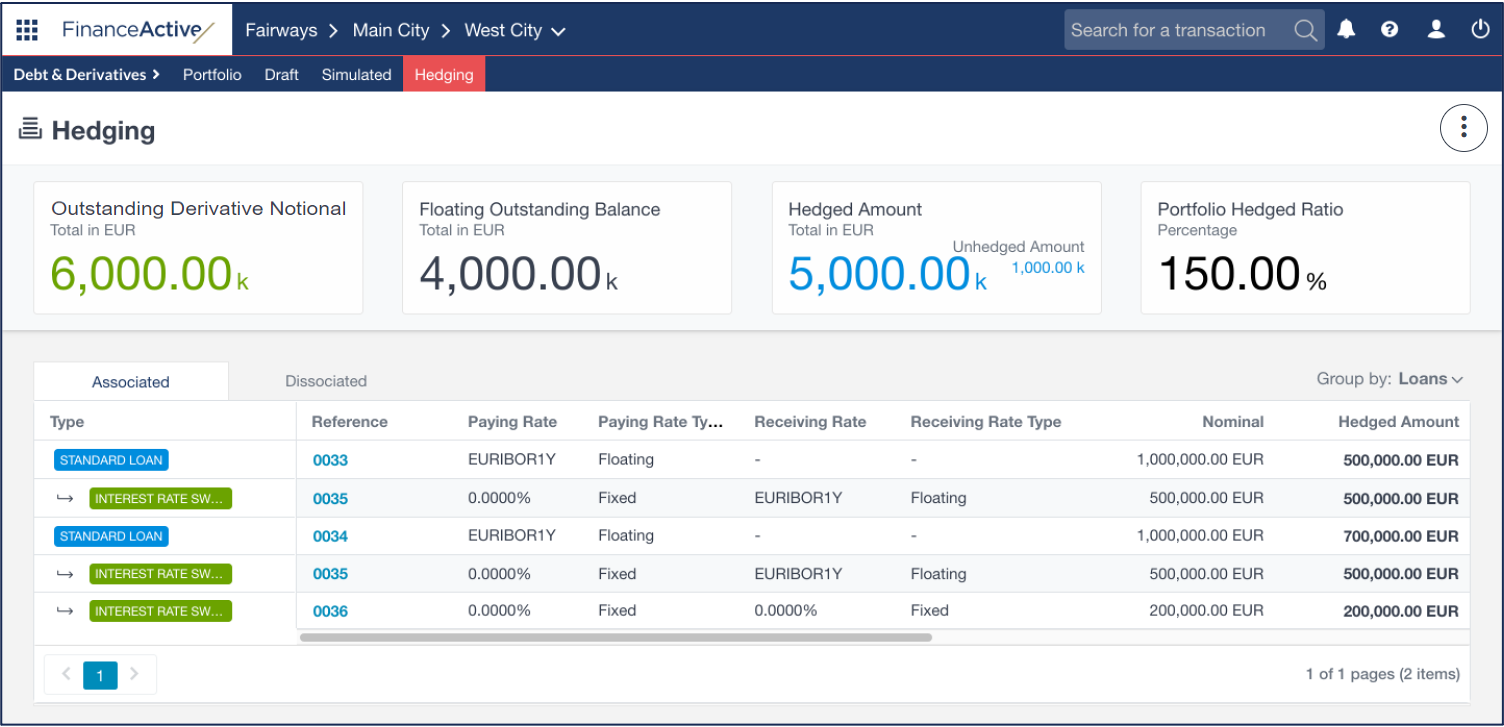

The hedging overview displays.

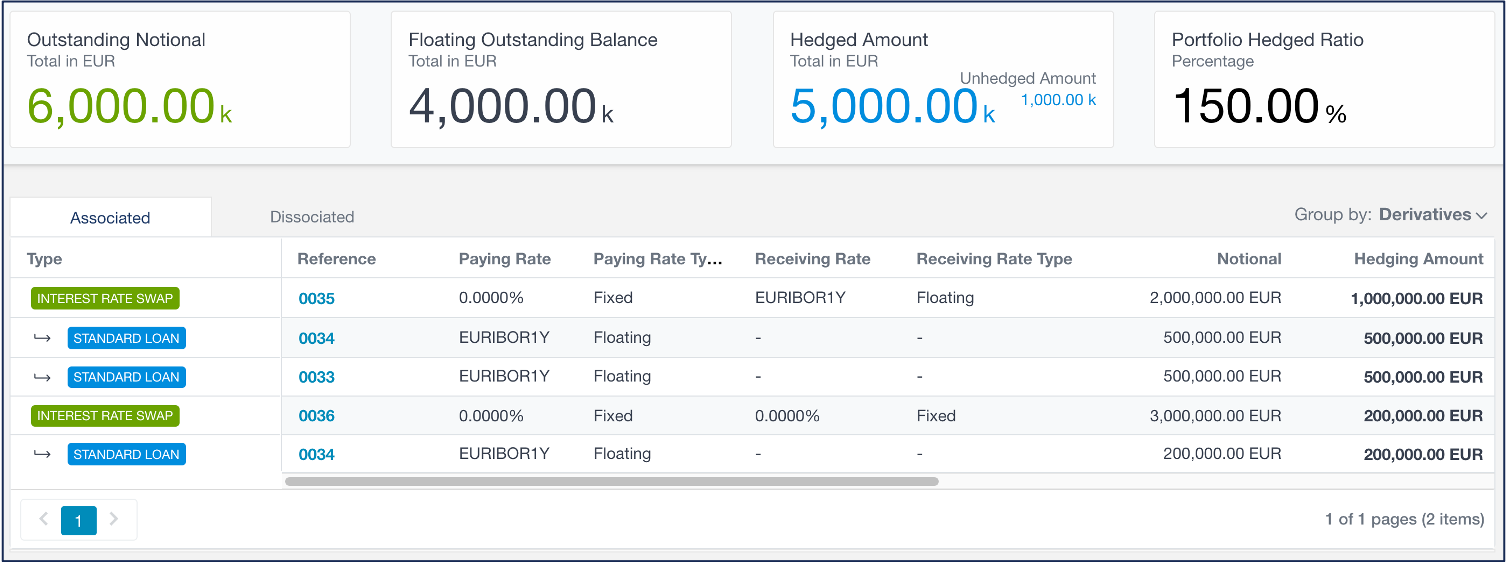

|

Indicator |

Description |

|---|---|

|

Outstanding Derivative Notional |

Total notional amount of all the outstanding derivatives in the actual portfolio. |

|

Floating Outstanding Balance |

Total balance amount of all the outstanding floating-rate transactions in the actual portfolio. |

|

Hedged Amount |

Total notional amount of the derivatives associated with at least one hedged transaction. In this example, the hedged amount is EUR 5 000 000. We add up the notionals of all derivatives displayed in the Associated list: 2 000 000 + 3 000 000 = 5 000 000

|

|

Unhedged Amount |

Total notional amount of the derivatives associated with no hedged transaction: Outstanding Derivative Notional - Hedged Amount

In this example, the unhedged amount is EUR 1 000 000. Outstanding Derivative Notional - Hedged Amount = 6 000 000 - 5 000 000 = 1 000 000

|

|

Portfolio Hedged Ratio |

Ratio between hedgeable amount (notional) and amount to hedge (balance): Outstanding Derivative Notional / Floating Outstanding Balance * 100

In this example, the portfolio hedged ratio is 150%. Outstanding Derivative Notional / Floating Outstanding Balance * 100 = 6 000 000 / 4 000 000 * 100 = 150%

|

|

# |

Description |

Options |

|---|---|---|

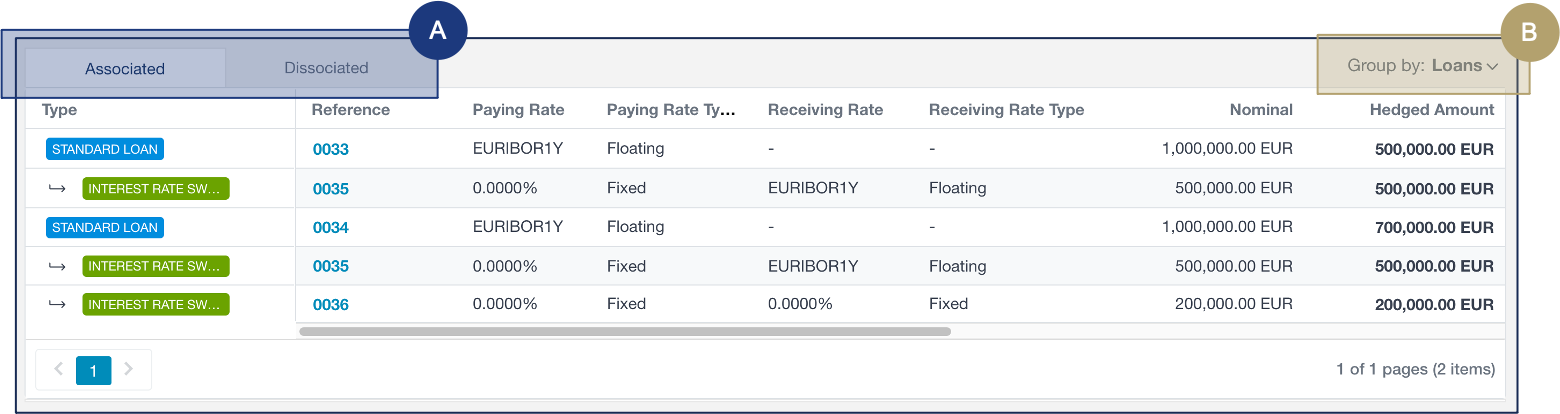

|

A |

Display:

|

|

|

B |

Group transactions to sort them in the list. |

|