After creating a transaction in Fairways Debt, you can further adjust the payment date of that transaction, as long as it is still a draft. This feature enables you to define more accurate payment dates.

Note: You can adjust the payment date of these transaction types:

- Loans: CDC, construction, ongoing, PIK, standard, subsidy

- Derivatives: cross-currency swap, interest rate swap

- Leases

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Debt & Derivatives.

Adjust the Payment Date of a Transaction

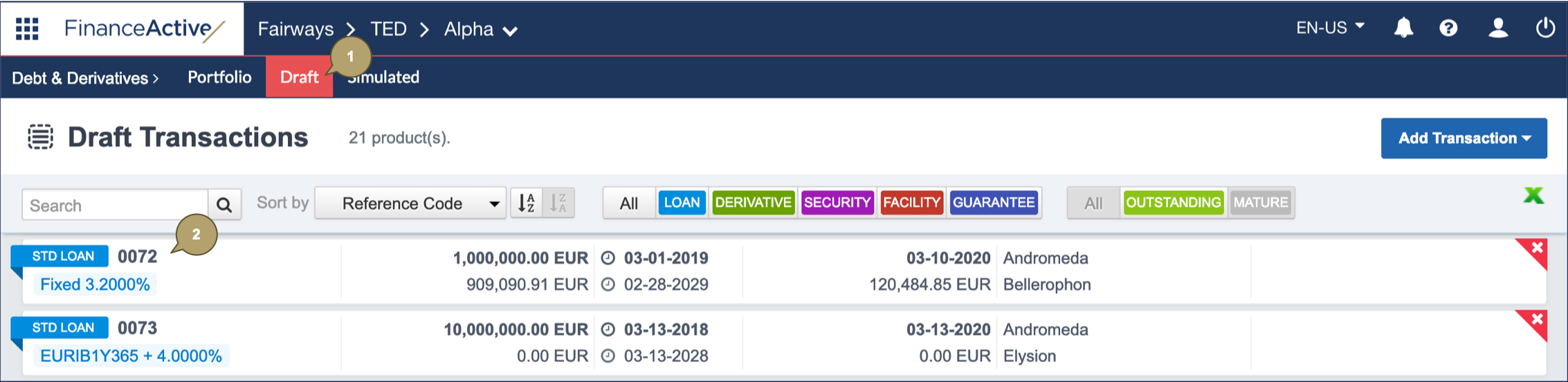

- Navigate to Draft.

- Click a transaction to display its profile.

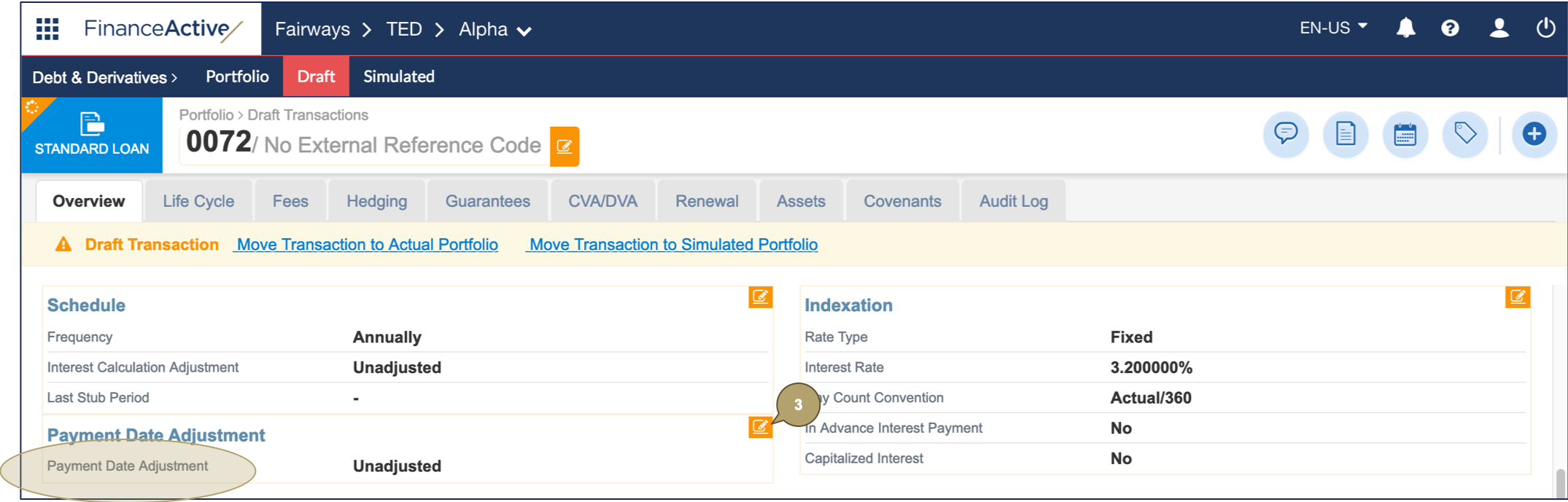

- Click Edit in the panel where the payment date adjustment is located.

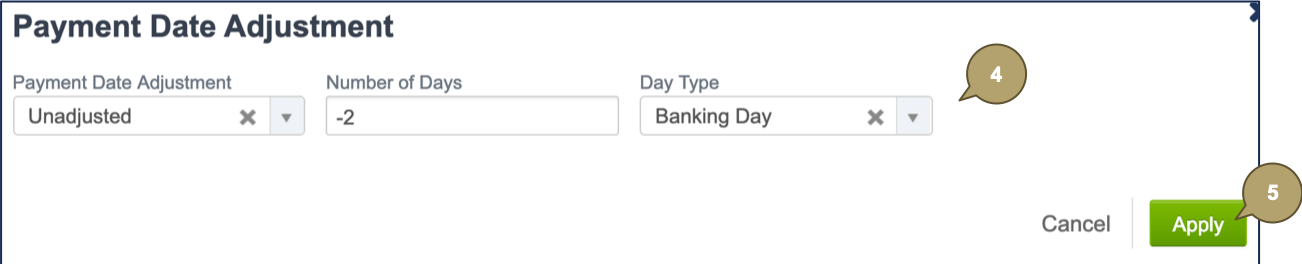

- Complete the form with all relevant details.

| Field | Description |

|---|---|

| Payment Date Adjustment | Adjustment mode for the payment date. |

| Number of Days |

Note: The number of days applies before the payment date adjustment. Number of days to move from the payment date mode selected, can be earlier or later, e.g.:

|

| Day Type |

|

- Click Apply to update the schedule.

Example

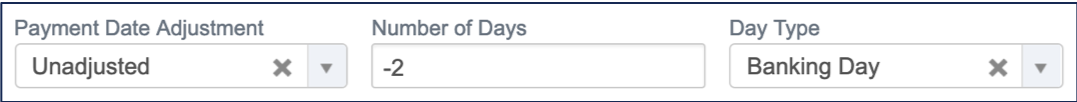

This transaction has an unadjusted payment date, occurring every 16 July.

We adjust the payment date to -2 banking days.

All payment dates are moved to the 2nd banking day earlier than the unadjusted payment date, i.e. every 14 July or earlier.

In 2019, 16 July is a Tuesday. The 1st banking day earlier is Monday 15 July. 13 and 14 July are Saturday and Sunday. That brings us to 12 July as the 2nd banking day earlier.