After creating a transaction in Fairways Debt, you can apply an amortization frequency to your transaction, especially if it differs from the payment frequency.

Note: You can only apply an amortization frequency to:

- Transactions associated with the straight line amortization type.

- These specific transaction types:

- Standard loans

- Subsidy loans

- Inflated linked bonds

- Credit facility drawings

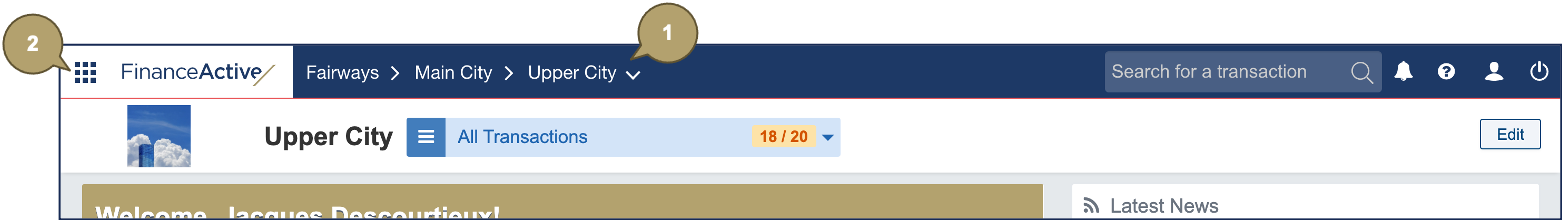

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account and select a customer account/organization, if relevant.

- Navigate to Applications

> Debt & Derivatives.

> Debt & Derivatives.

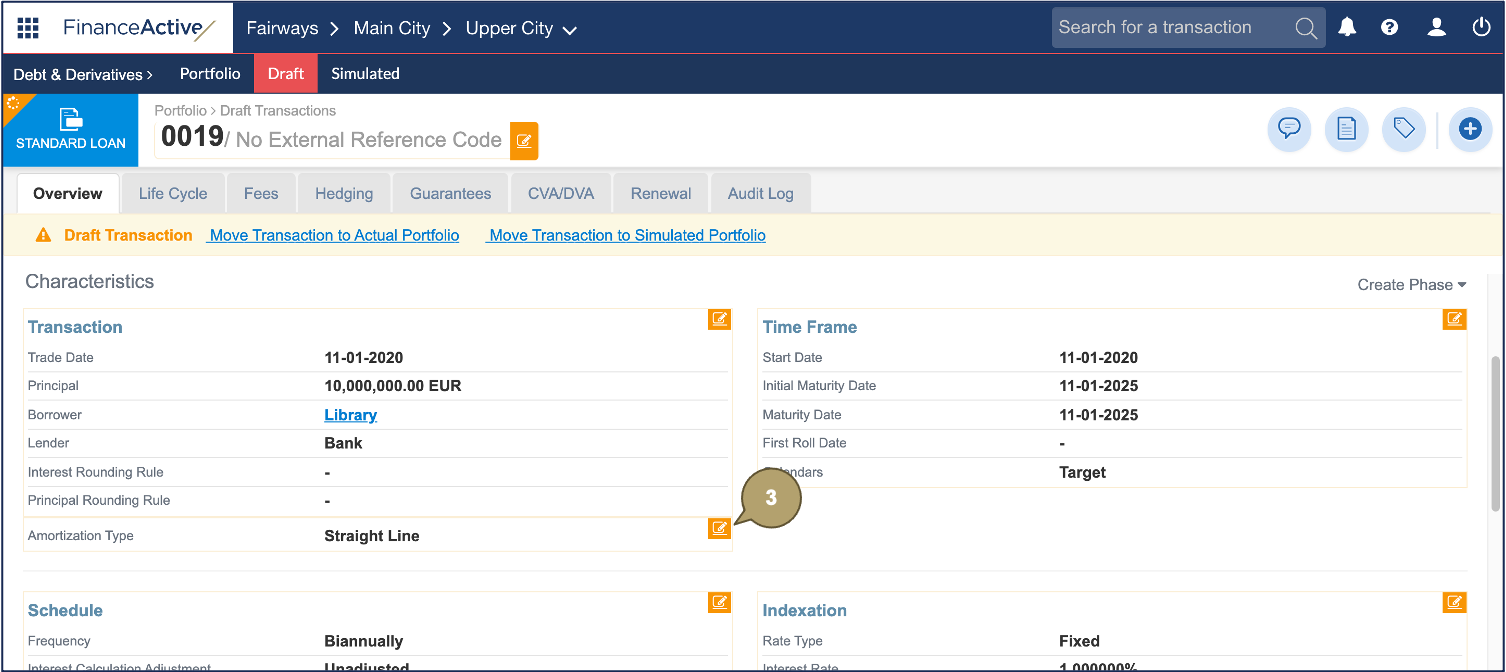

Apply an Amortization Frequency to a Transaction

- Navigate to Draft.

- Click a relevant straight line transaction to open its profile.

- Click Edit in the Amortization Type panel.

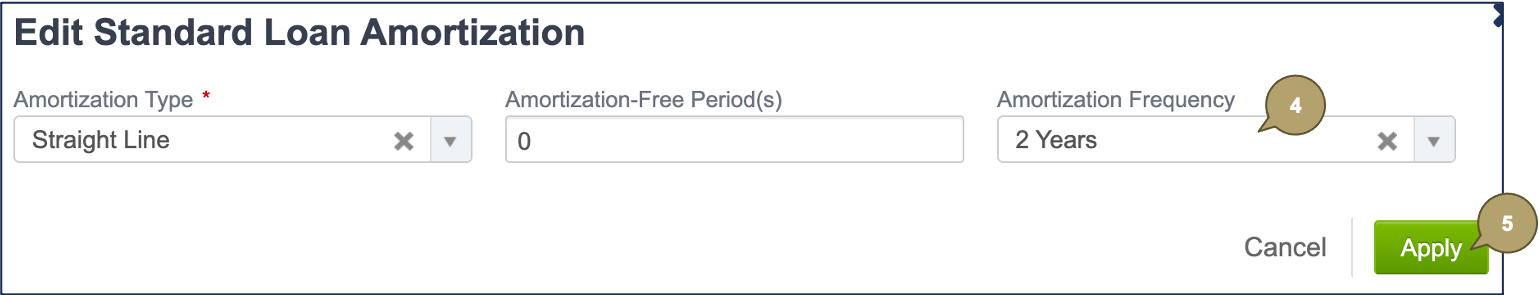

- Select an amortization frequency.

Notes:

- The amortization frequency must be equal to or greater than the payment frequency.

- The amortization frequency must be compatible with the payment frequency, i.e. the amortization dates must match the existing payment dates.

Example

If the payment frequency is quarterly, the amortization frequency cannot be triannual, but it can be biannual.

|

Month |

Quarterly Payment |

Triannual Amortization |

Biannual Amortization |

|---|---|---|---|

|

January |

|||

|

February |

|||

|

March |

✓ |

||

|

April |

✗ |

||

|

May |

|||

|

June |

✓ |

✓ |

|

|

July |

|||

|

August |

✗ |

||

|

September |

✓ |

||

|

October |

|||

|

November |

|||

|

December |

✓ |

✓ |

✓ |

- Click Apply.

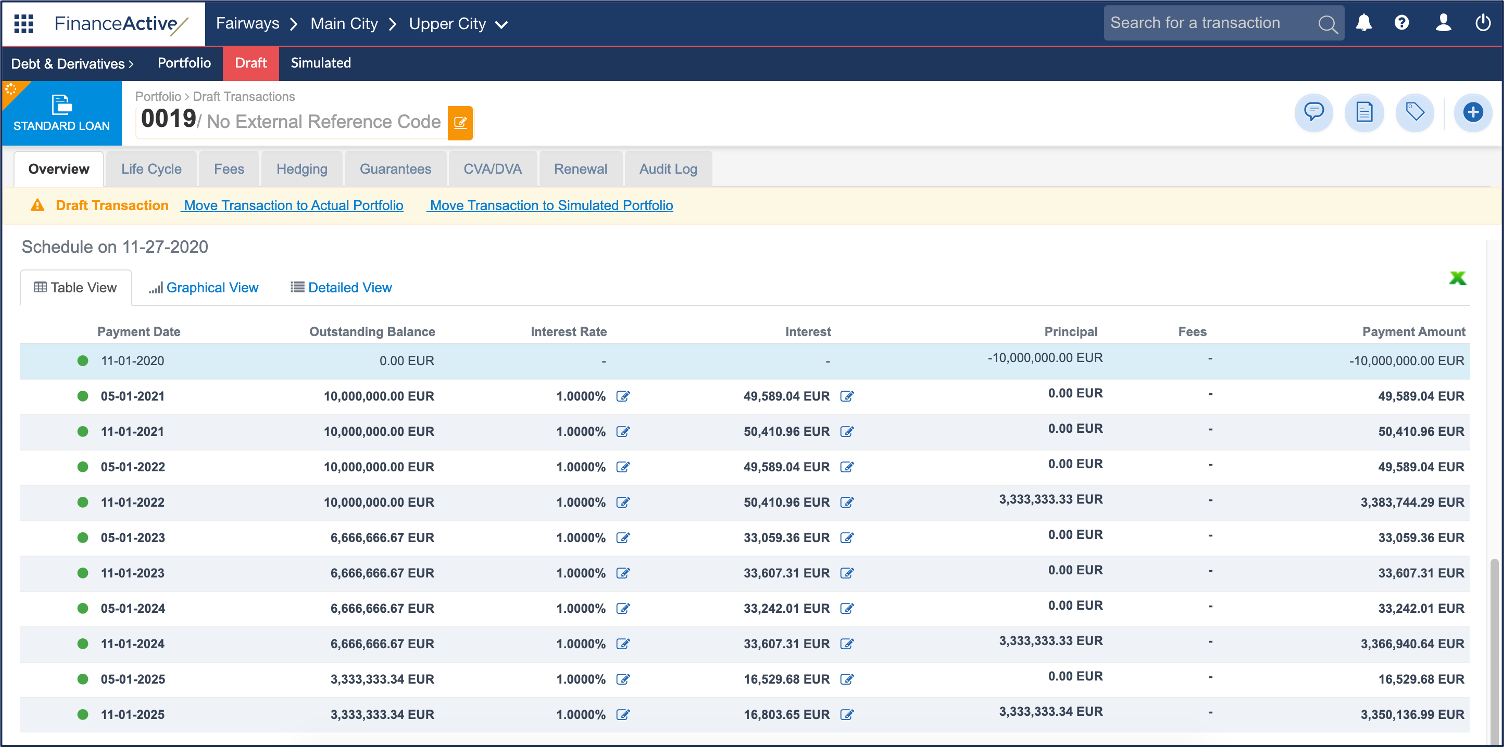

The amortization frequency applies to the transaction schedule.