In Fairways Debt, you can refinance a transaction: fully repay the original transaction, which will be refinanced with a new one, for example with a better rate.

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Debt & Derivatives.

Refinance a Transaction

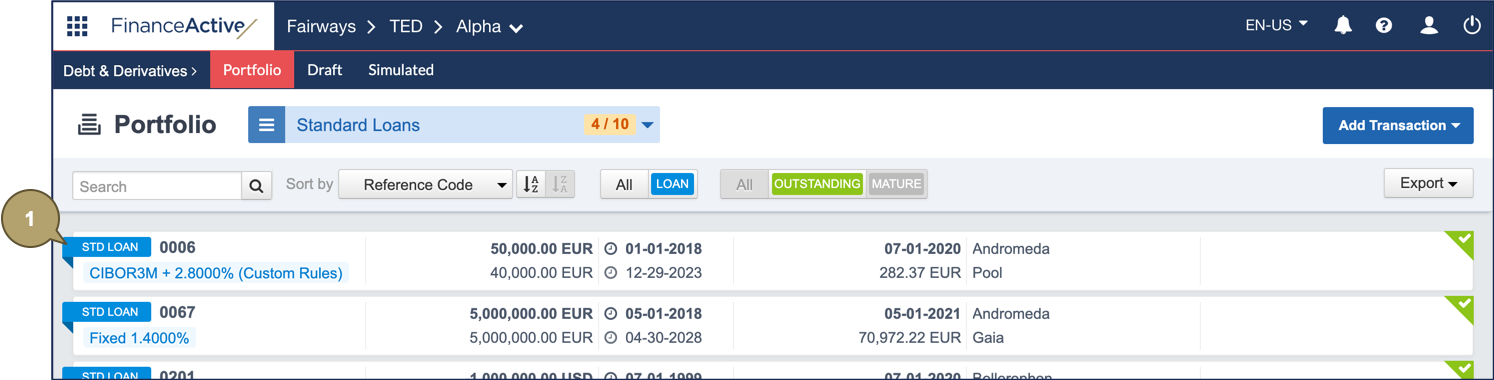

- Open a standard or a CDC loan.

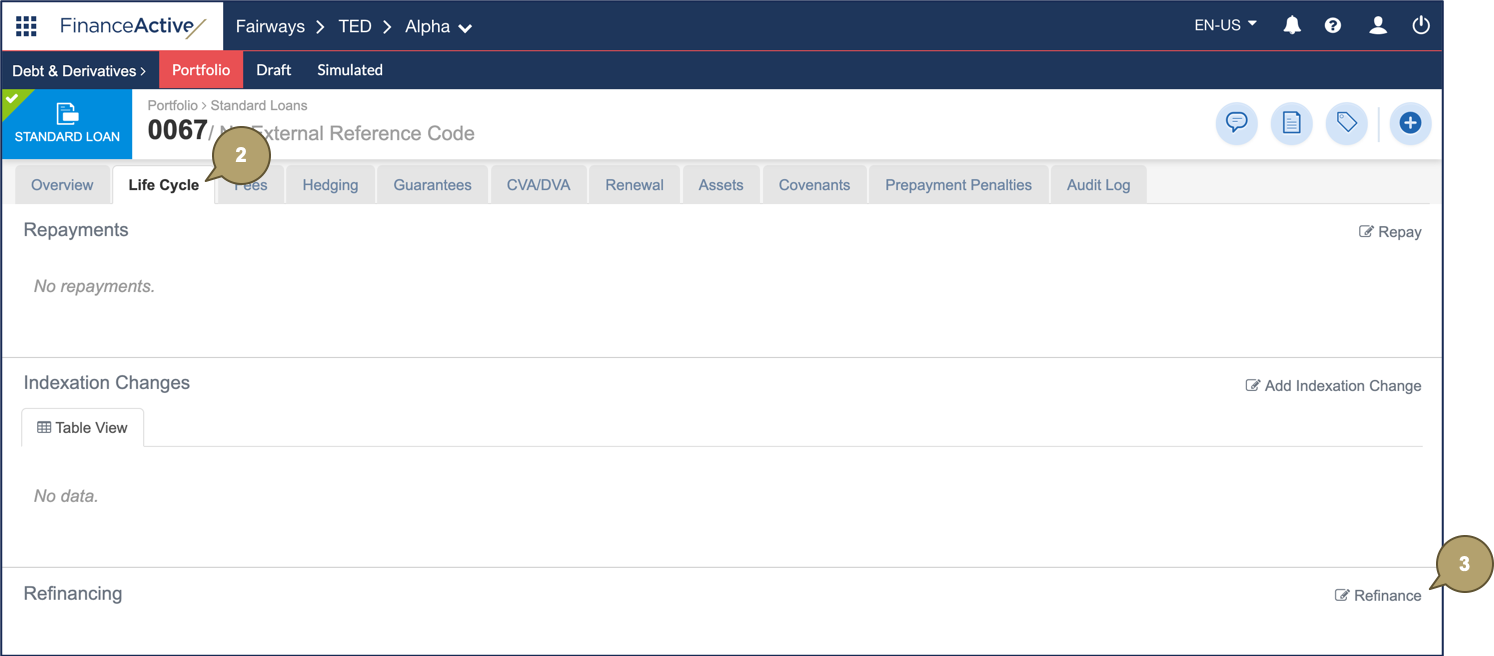

- Navigate to Life Cycle.

- Click Refinance.

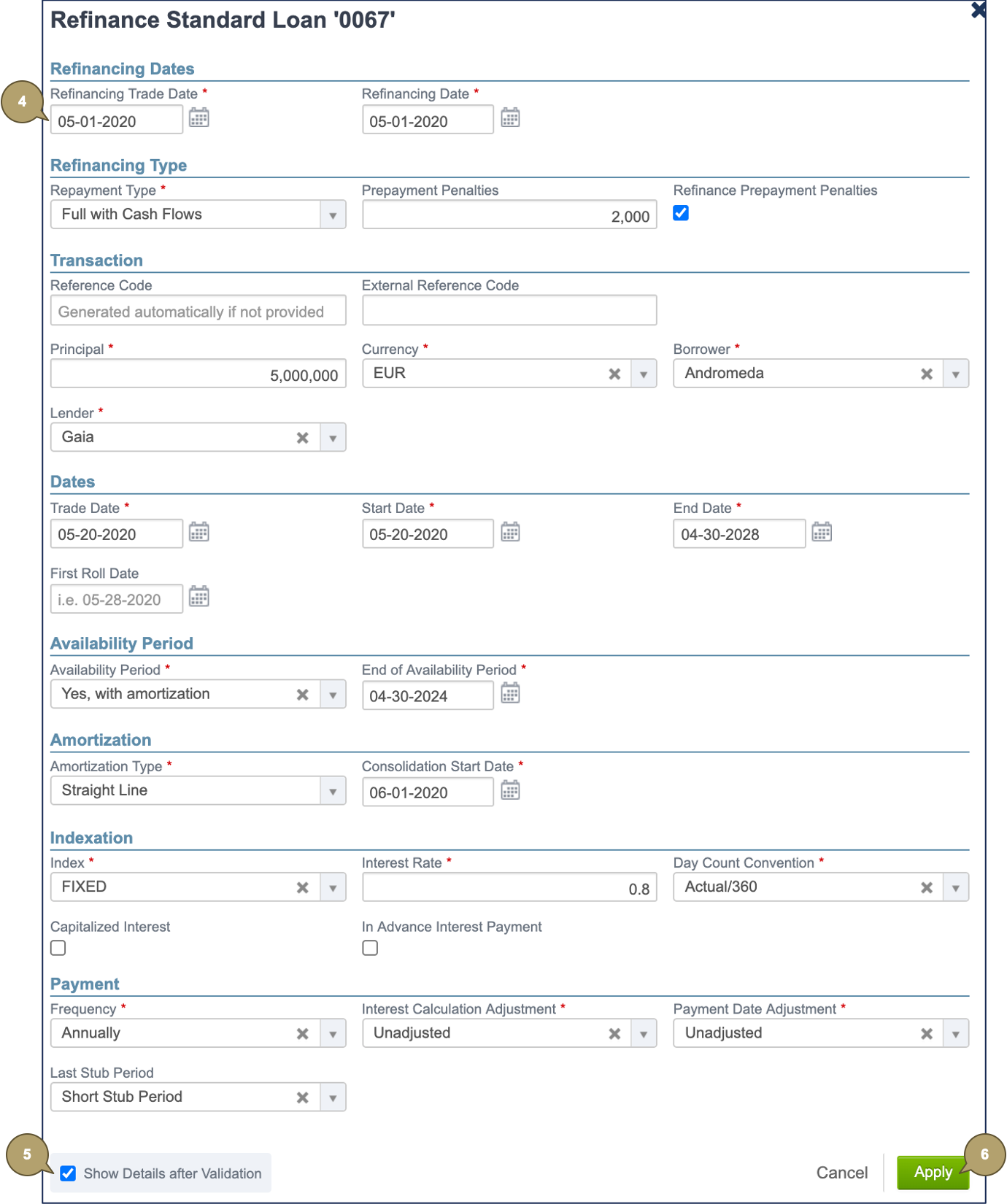

- Complete the form with all relevant details.

Notes:

- Fields marked with an asterisk * are mandatory.

- Some fields automatically fill out with the data of the transaction to refinance, but remain editable.

|

Field |

Description |

|---|---|

|

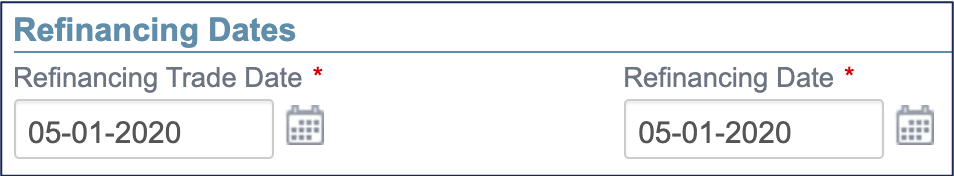

Refinancing Trade Date |

Date at which the transaction has been agreed for refinancing. Note: The refinancing trade date must be equal or later than the original transaction trade date. |

|

Refinancing Date |

Unadjusted repayment date of the refinanced transaction. Note: The refinancing date must be equal or later than the refinancing trade date. |

|

Field |

Description |

|---|---|

|

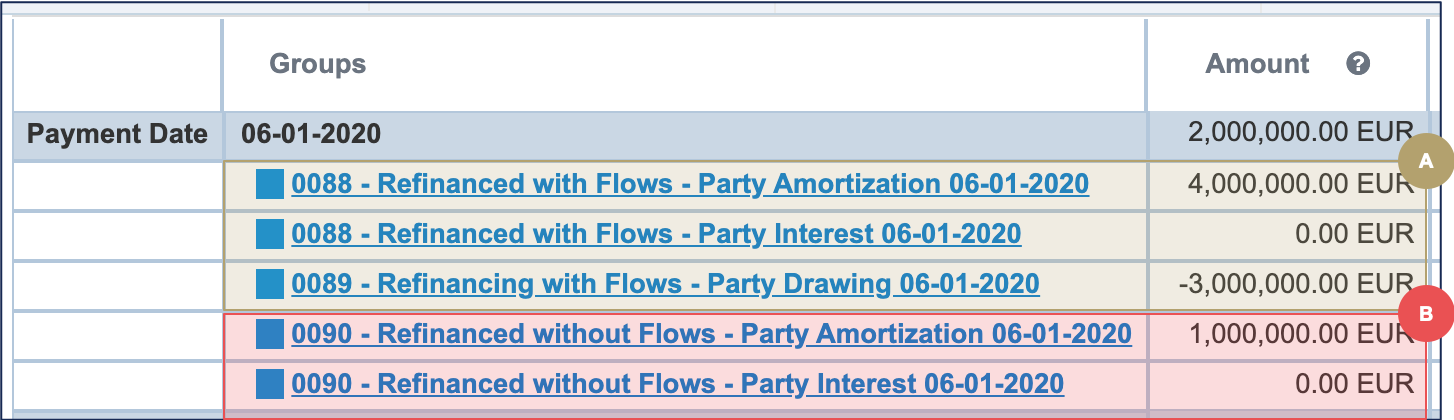

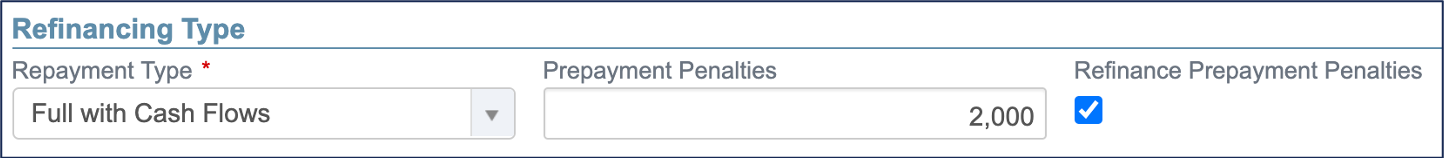

Repayment Type |

Impacts how cash flow reports display:

|

|

Prepayment Penalties |

Amount of the fees paid for the repayment. |

|

Refinance Prepayment Penalties |

Include/Exclude the penalties in/from the refinancing transaction. Note: If the penalties are included in the refinancing transaction, then the penalty fee drawing displays in the cash flow reports, even for the type without cash flows. |

|

Field |

Description |

|---|---|

|

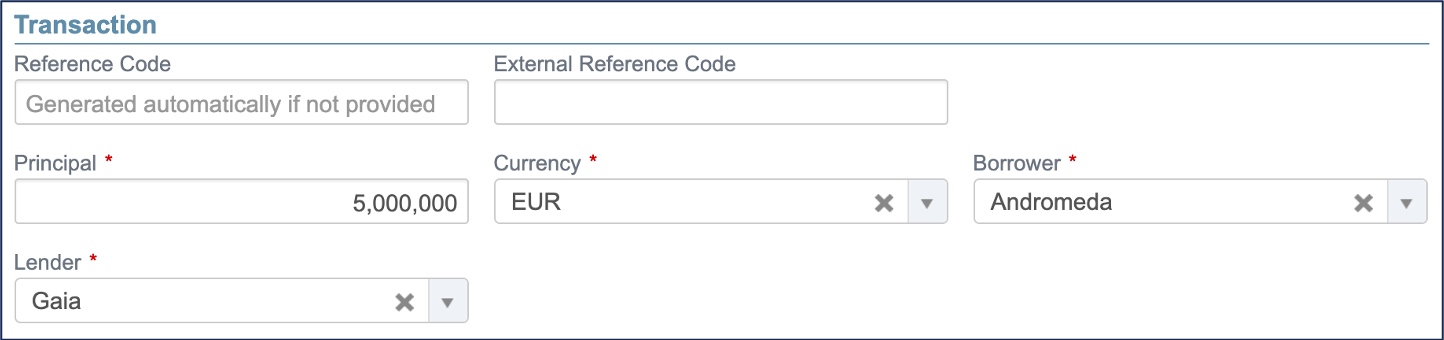

Reference Code |

Unique reference of the transaction. Identifies the transaction in the portfolio. Note: The reference must be unique among all the entities managed in the account. |

|

External Reference Code |

Used by external systems to identify the transaction. Used when transactions are imported from or exported to another system. |

|

Principal |

Principal amount of the loan. |

|

Currency |

Currency of the principal amount. |

|

Borrower |

Borrowing entity in the system. |

|

Lender |

Can be either internal (an entity in the system) or external (a commercial bank). |

|

Field |

Description |

|---|---|

|

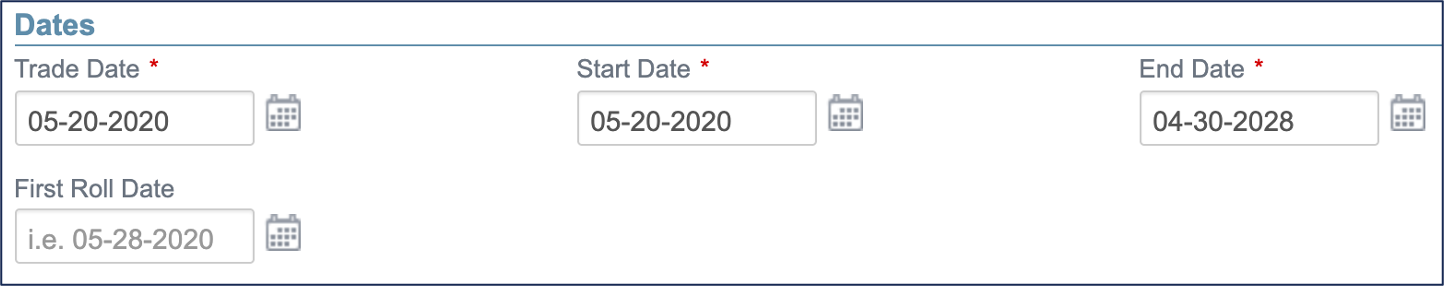

Trade Date |

Date at which the transaction has been traded. From that date, the system takes the transaction into account as an item of the portfolio. Note: Inherits from the refinancing trade date, by default. The trade date must be equal or later than the refinancing trade date. |

|

Start Date |

Unadjusted start date of the transaction. Note: Inherits from the refinancing date, by default. The start date must be equal or later than the trade date. |

|

End/Maturity Date |

Unadjusted end/maturity date of the transaction. Note: Inherits from the end date of the refinanced loan, by default. The end date must be later than the start date. |

|

First Roll Date |

Unadjusted date of the first payment (useful when the first period is a long or short stub). Note: The first roll date must be later than the start date and earlier than the end date. |

|

Field |

Description |

|---|---|

|

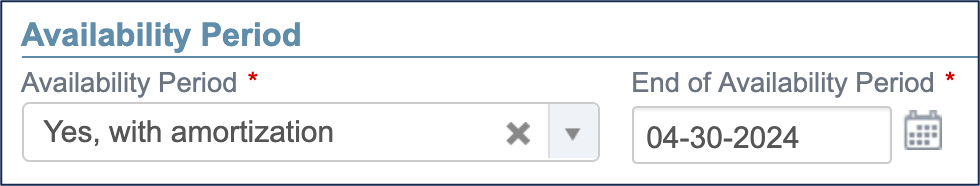

Availability Period |

Note: This field only displays for standard loans. Indicates if the loan includes drawings and amortization:

Notes:

|

|

End of Availability Period |

Note: This field only displays for refinancing standard loans. Indicates the last date at which drawings can be made. |

|

Field |

Description |

|---|---|

|

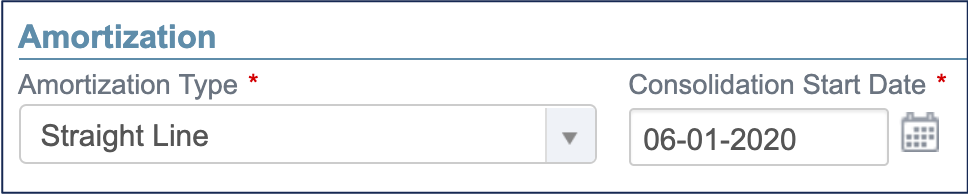

Principal depreciation over the life of the transaction. |

|

|

Consolidation Start Date |

Note: This field is only available for standard loans including drawings with amortization. Indicates the date at which the amortization can start. |

| Initial Progression |

Note: This field only displays for CDC loans. |

|

Construction Rate |

Note: This field only displays for CDC loans with the DA amortization type. |

|

Progress Type |

Note: This field only displays for CDC loans with the DA amortization type. |

|

Revision Type |

Note: This field only displays for CDC loans with the ID, ICO, and IP amortization types. |

|

Revision Floor |

Note: This field only displays for the Double Limited revision type. |

|

Stock Amount |

Note: This field only displays for CDC loans with the Double and Double Limited revision types. |

|

Amortization Progression |

Note: This field only displays for CDC loans with the ICO amortization type. |

|

Field |

Description |

|---|---|

|

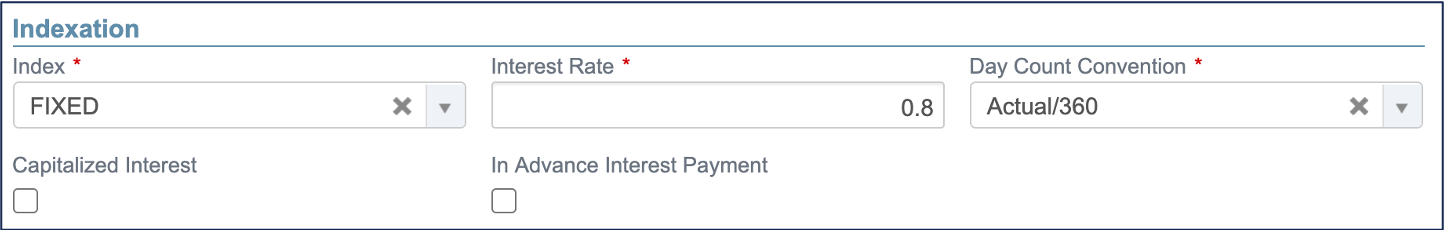

Index |

Name of the index used to calculate the rate value, e.g. FIXED for a fixed rate. Note: The field beside displays depending on the index selected. |

|

Interest Rate |

Fixed rate value in percentage. Note: This field displays depending on the index selected. |

|

Initial Interest Rate |

Initial rate of the custom index. Note: This field displays depending on the index selected. |

|

Spread |

Spread (or margin) value in percentage. Note: This field displays depending on the index selected. |

|

Used to compute the day fraction of an interest accrual period. |

|

|

Capitalized Interest |

Note: This field only displays for standard loans. Defines whether the interest amount should be paid at the payment date, or added to the principal (and included in the outstanding balance for the following periods). |

|

In Advance Interest Payment |

Note: This field only displays for standard loans. Defines whether the interest amount should be paid at the start of the period. If enabled:

If disabled:

|

|

Field |

Description |

|---|---|

|

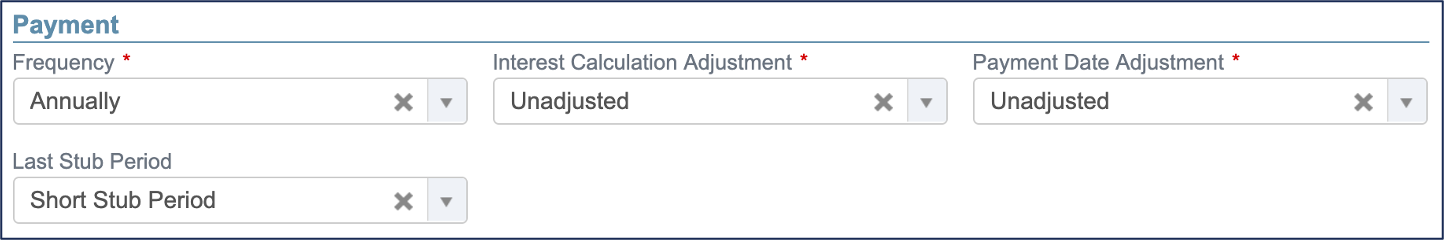

Frequency |

Frequency of the payments. |

|

Adjustment mode for the interest calculation. The nominal start and end dates of the accrual period will be adjusted accordingly before computing the interest amount. |

|

|

Adjustment mode for the payment date. |

|

|

Last Stub Period |

Defines whether the last period should be a short or long stub when it does not match the selected frequency:

Note: If neither stub is selected, the short stub applies by default. |

- Enable Show Details after Validation to automatically open the new transaction profile once created.

- Click Apply.

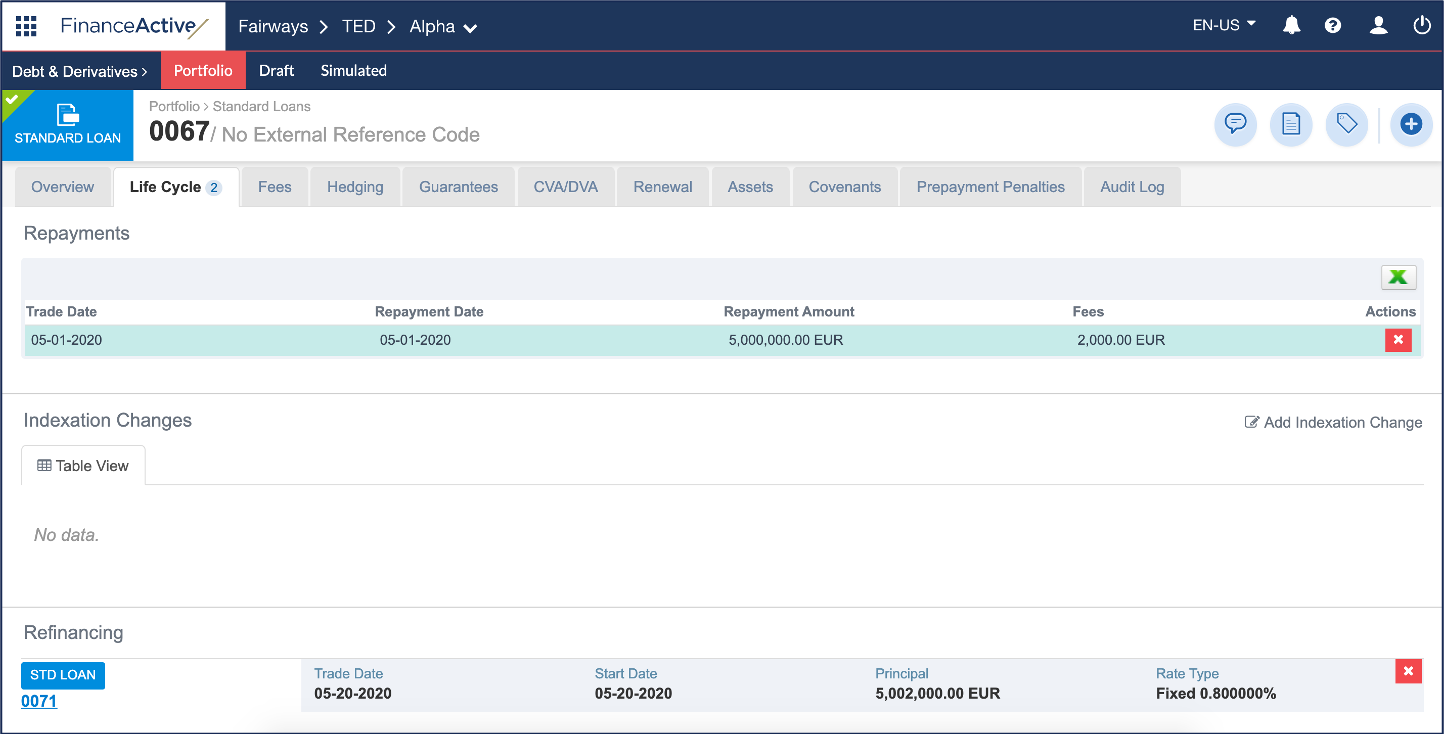

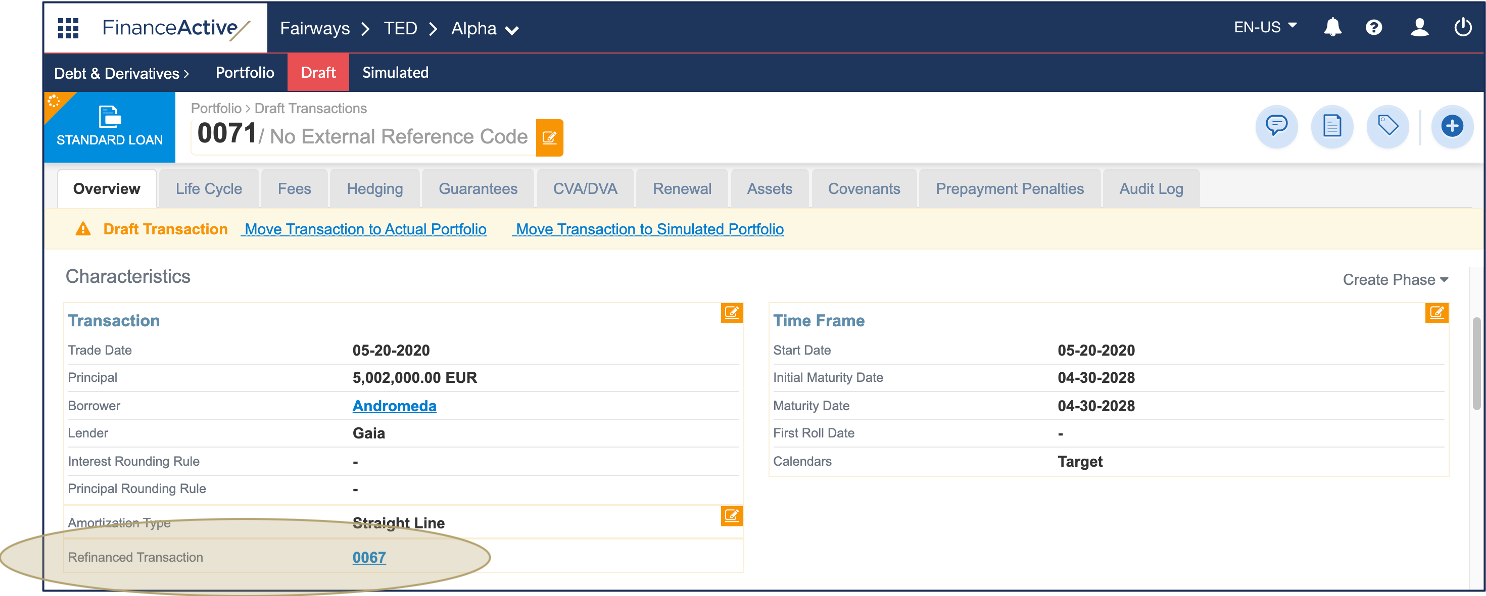

The refinancing transaction displays as a draft and remains associated with the refinanced transaction.

The refinanced transaction matures with two life events: the repayment and the refinancing.