In Fairways Debt, you can defer a transaction: postpone its payments and interest for a specific period.

Note: You can defer payments of:

- Standard loans

- Leases (with no downpayments)

Prerequisites

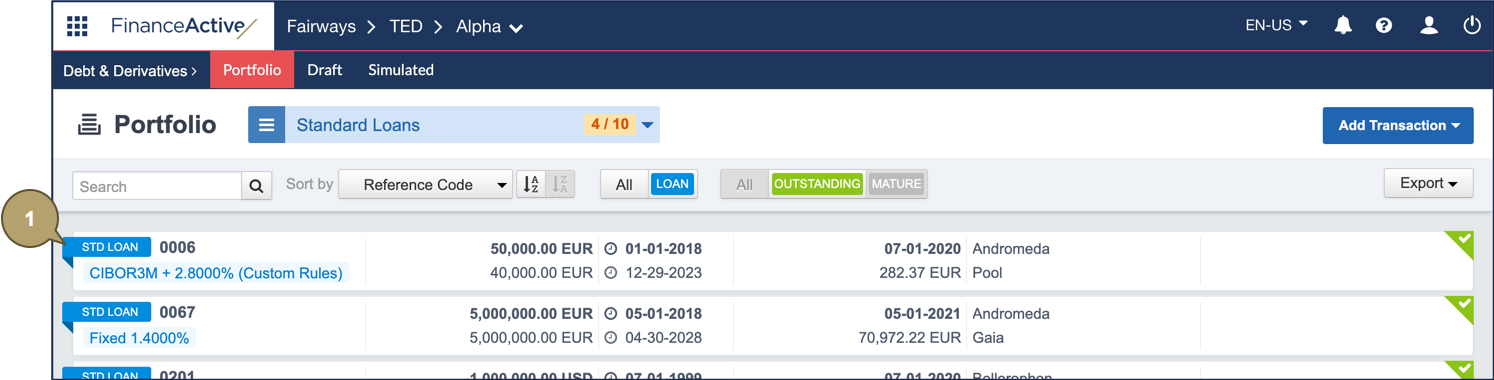

Navigate to the Debt & Derivatives Application

- Log in to your Fairways Debt account.

- Select a customer account.

- Navigate to Applications > Debt & Derivatives.

Defer a Transaction

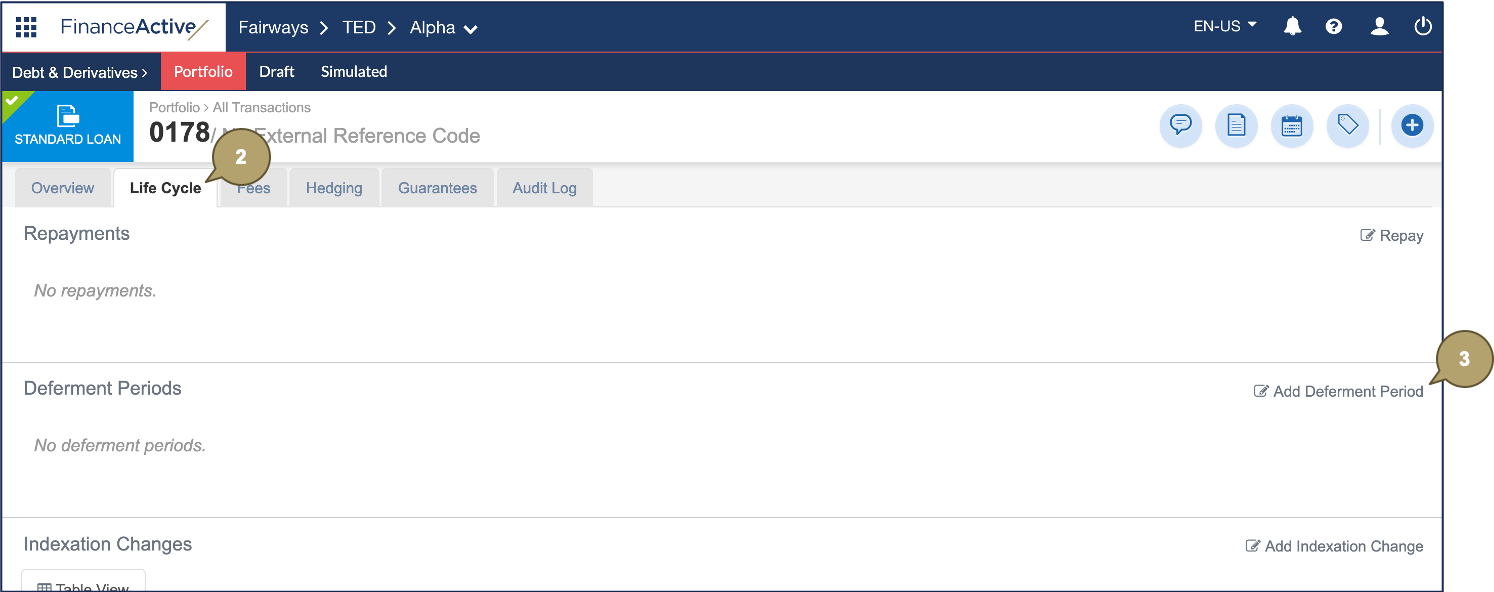

- Open a standard loan or a lease.

- Navigate to Life Cycle.

- Click Add Deferment Period.

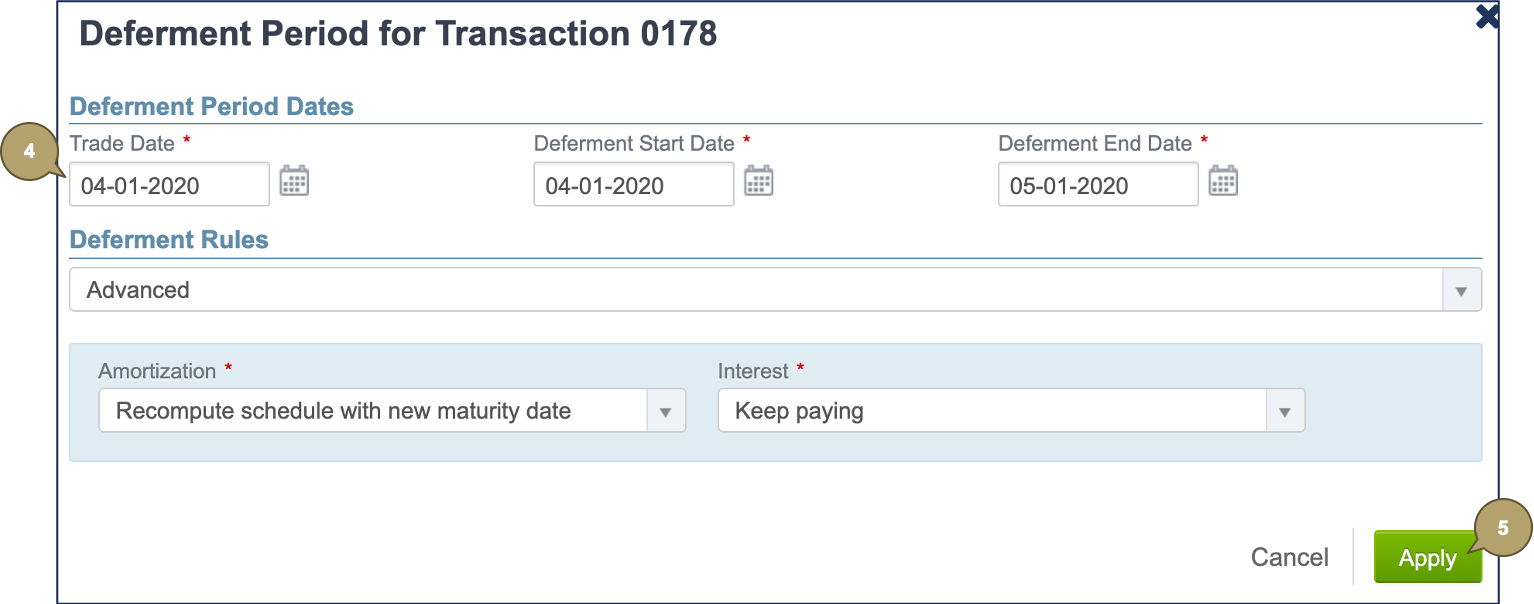

- Complete the form with all relevant details.

Note: Fields marked with an asterisk * are mandatory.

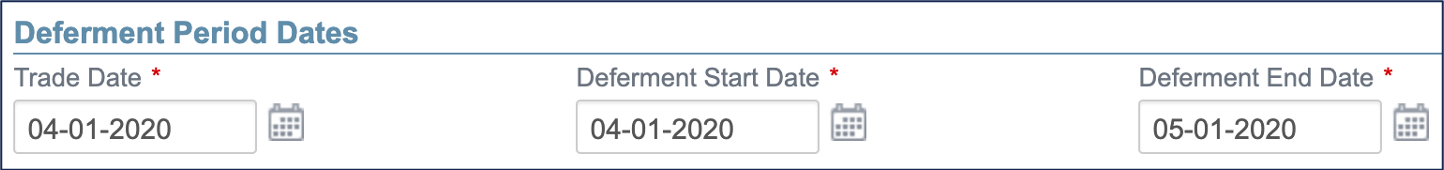

|

Field |

Description |

|---|---|

|

Trade Date |

Date at which the deferment has been agreed. Note: The deferment trade date must be equal or later than the original transaction trade date. |

|

Deferment Start Date |

Unadjusted start date of the deferment period. Note: The start date must be equal or later than the trade date. |

|

Deferment End Date |

Unadjusted end date of the deferment period. Note: The end date must be later than the start date. |

|

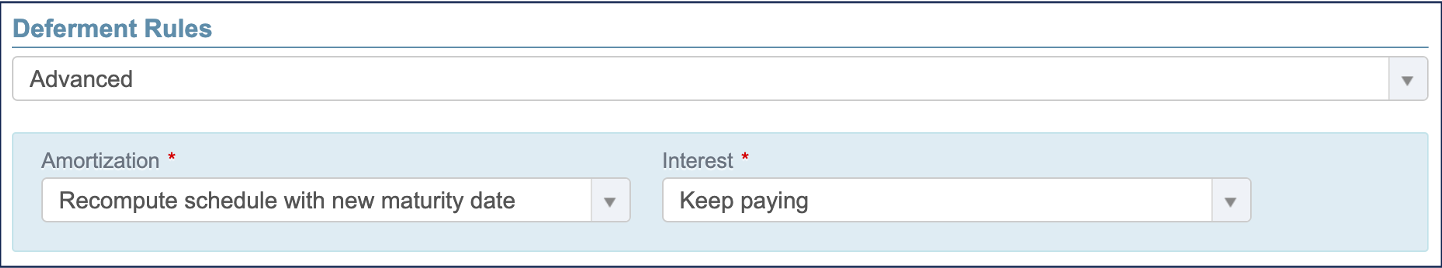

Field |

Description |

|---|---|

|

Rule Type |

Note: Different rule configurations display for different transaction types. For transactions with a bullet, straight-line, or custom amortization: Simple rules apply the current most popular amortization and interest choices. Select Advanced to configure other rules. |

|

Amortization |

Note: This field only displays for transactions with a bullet, straight-line, or custom amortization. Impacts the initial maturity date of the transaction:

|

|

Interest |

Note: This field only displays for transactions with a bullet, straight-line, or custom amortization with an advanced rule type. Impacts the payment amounts in the transaction schedule:

|

|

Index |

Note: This field only displays for standard loans with constant annuities. Name of the index used to calculate the rate value, e.g. FIXED for a fixed rate. |

|

Interest Rate |

Note: This field only displays for standard loans with constant annuities. Fixed rate value in percentage. |

|

Note: This field only displays for standard loans with constant annuities. Used to compute the day fraction of an interest accrual period. |

|

|

Rent |

Note: This field only displays for leases with constant annuities. Rent value. |

|

Last Rent |

Note: This field only displays for leases with constant annuities. Value of the last rent, if different from the rent value. |

- Click Apply.

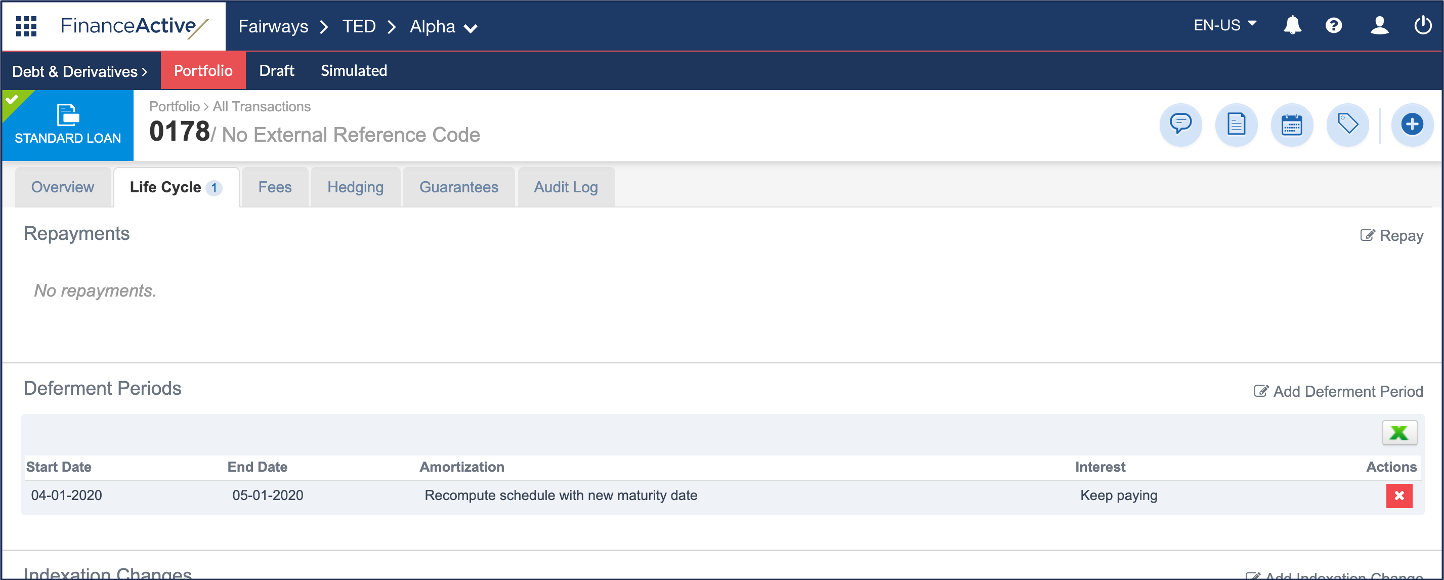

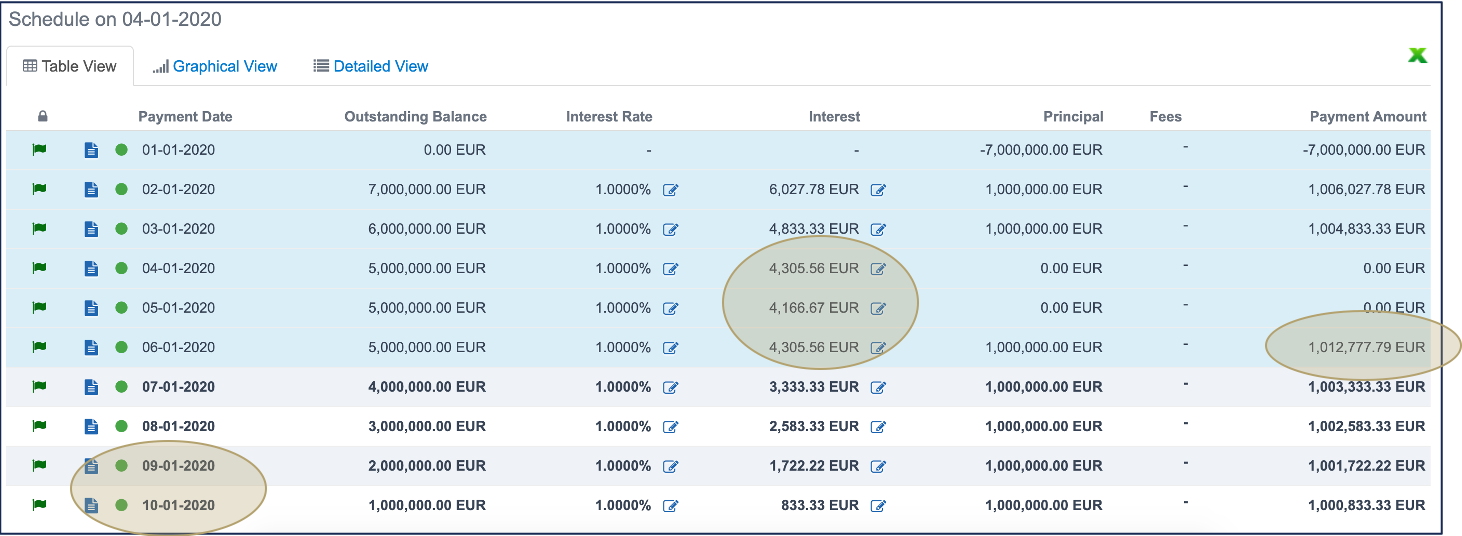

The deferment period is added to the transaction...

... and applies to the transaction schedule.

Note: You can add multiple deferment periods to a transaction, but these deferment periods cannot overlap one another.

Examples

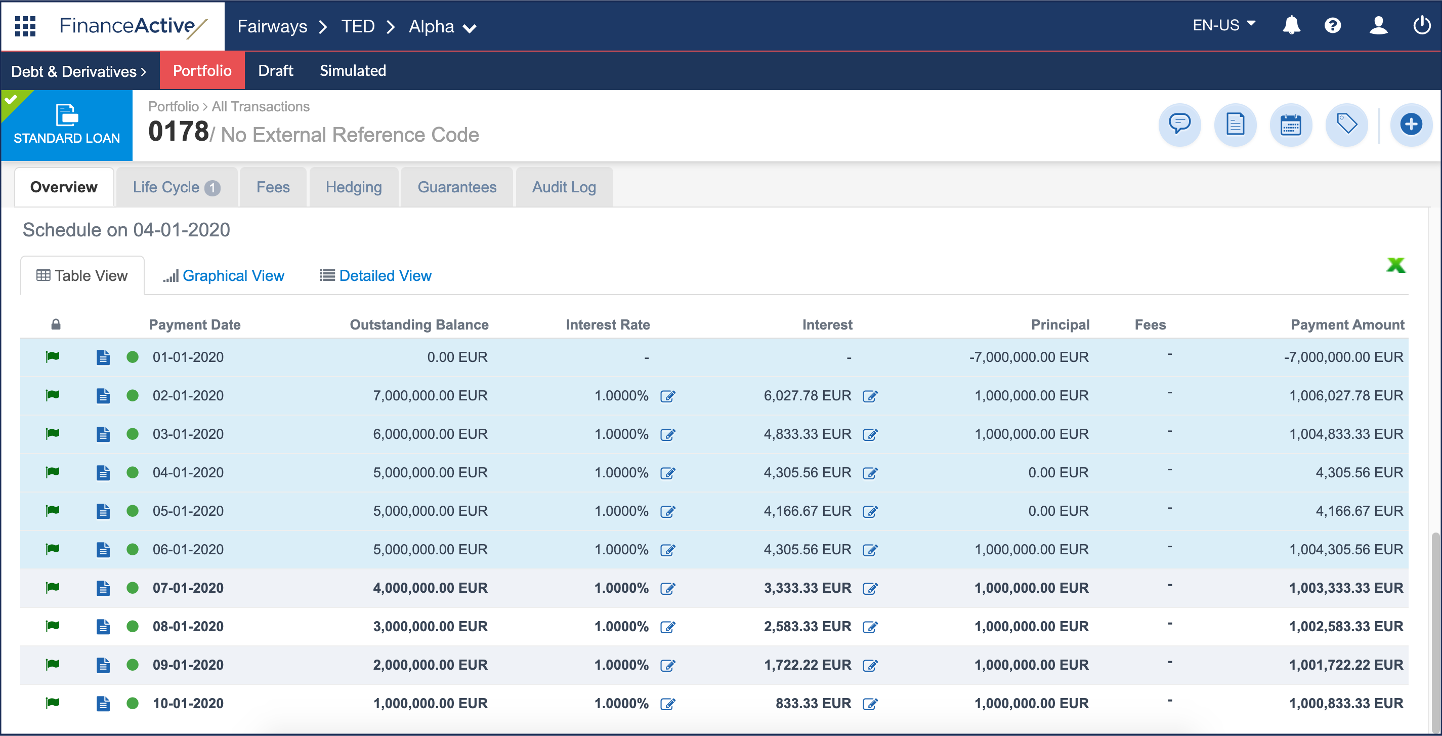

A standard loan with:

- Principal: 7 000 000 EUR

- Start date: 1 January 2020

- Maturity date: 1 August 2020

- Amortization type: Straight line

- Frequency: Monthly

Initial maturity date while keeping paying the interest:

- The maturity date does not change.

- The interest of April and May should still be paid.

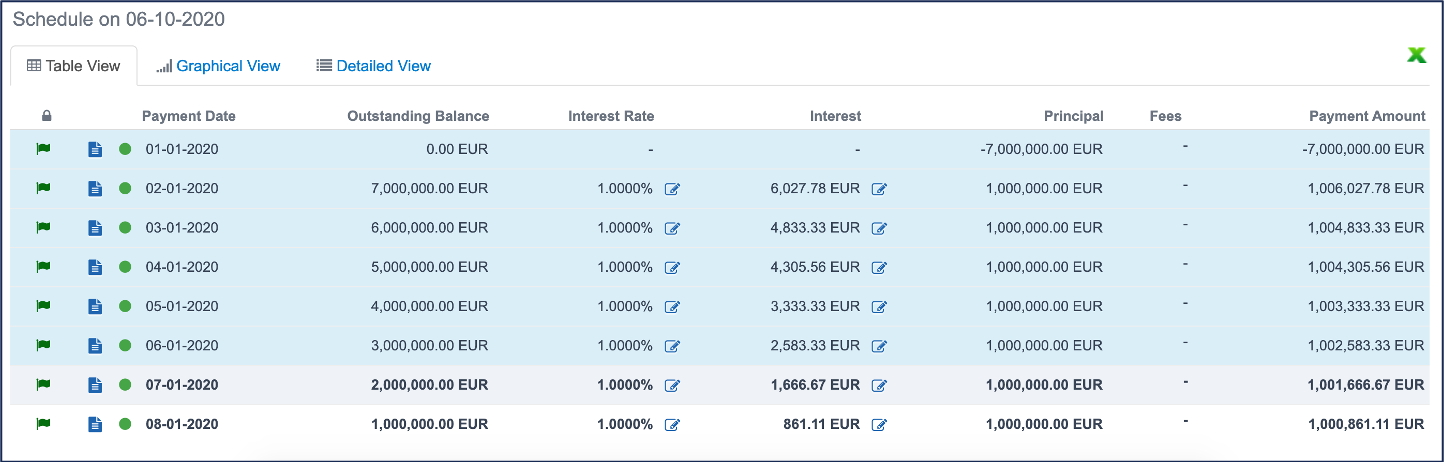

New maturity date while keeping paying the interest:

- As the deferment period lasts two months (April and May), two months are added to the initial maturity date, moving it from August to October.

- The interest of April and May should still be paid.

New maturity date with the accrued interest paid on the payment after the deferment period:

- As the deferment period lasts two months (April and May), two months are added to the initial maturity date, moving it from August to October.

- The interest of April and May is not paid during the deferment period but should be paid on the next payment date, June.

New maturity date while capitalizing the interest:

- As the deferment period lasts two months (April and May), two months are added to the initial maturity date, moving it from August to October.

- The interest of April and May is not paid during the deferment period but add up to the outstanding balance.